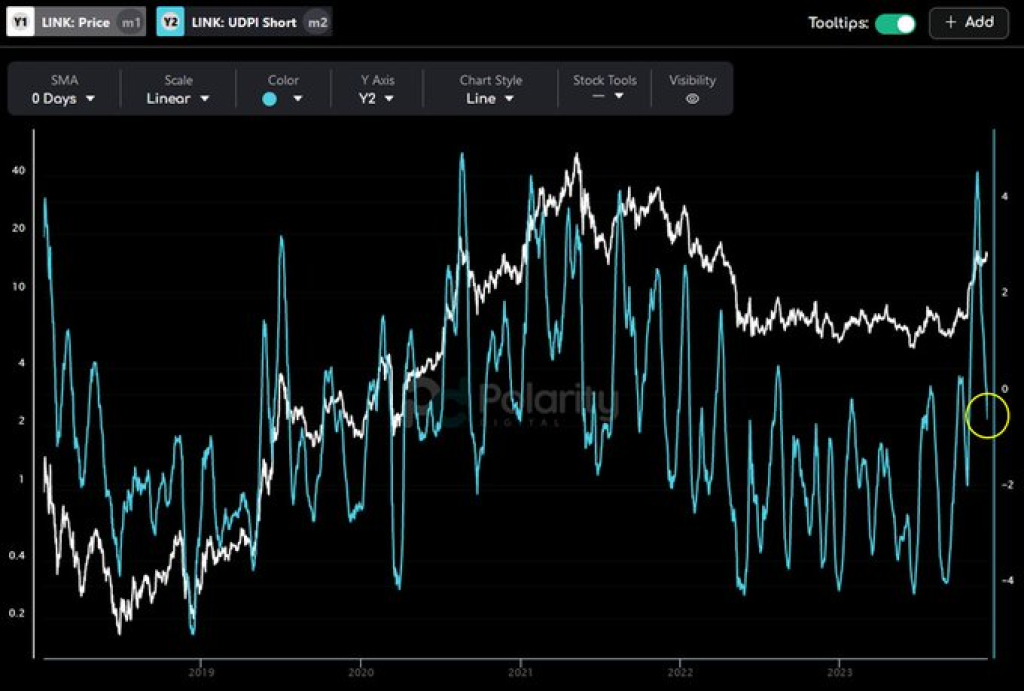

In the midst of Bitcoin’s surging momentum, Chainlink (LINK) is undergoing a consolidation phase, as highlighted by Upside Down Crypto Data. Contrary to viewing this as a setback, the consolidation is seen as a positive development. According to the short-term UDPI risk model, LINK’s short-term risk is gradually cooling off during this phase of consolidation.

As risk levels subside, the potential for upside movement in LINK increases, setting the stage for a more robust performance in its next rally. The strategic consolidation is deemed favorable, allowing the cryptocurrency to build resilience and gather momentum for future upward movements.

On-chain analyst David echoes the optimistic sentiment, citing a remarkable +243% surge in Chainlink’s value, propelling it to $16+ since his bottom call in June. Despite this substantial appreciation, David emphasizes that the LINK weekly chart remains bullish, projecting a further move into the $20s.

Dispelling notions of a potential dip below $8 as a psychological operation (Psyop), David underscores the robust position of Chainlink in the market. The analyst’s confidence in LINK’s weekly outlook reflects a bullish stance, anticipating sustained positive momentum in the coming weeks.

Read also:

- Analyst Unveils Weekly Crypto Watchlist As Bitcoin Surges: SOL, MATIC, and LUNC Take Center Stage

- Bitcoin (BTC) bubble or Bull Run? Interpreting the Mixed Crypto Market Signals

- Tornado Cash Dips 56% Post-Binance Delist; Investors Shift from Render to this New AI Altcoin

Investors and enthusiasts alike are closely monitoring Chainlink’s trajectory, with the cryptocurrency poised for potential gains as it consolidates amidst the broader market dynamics.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.