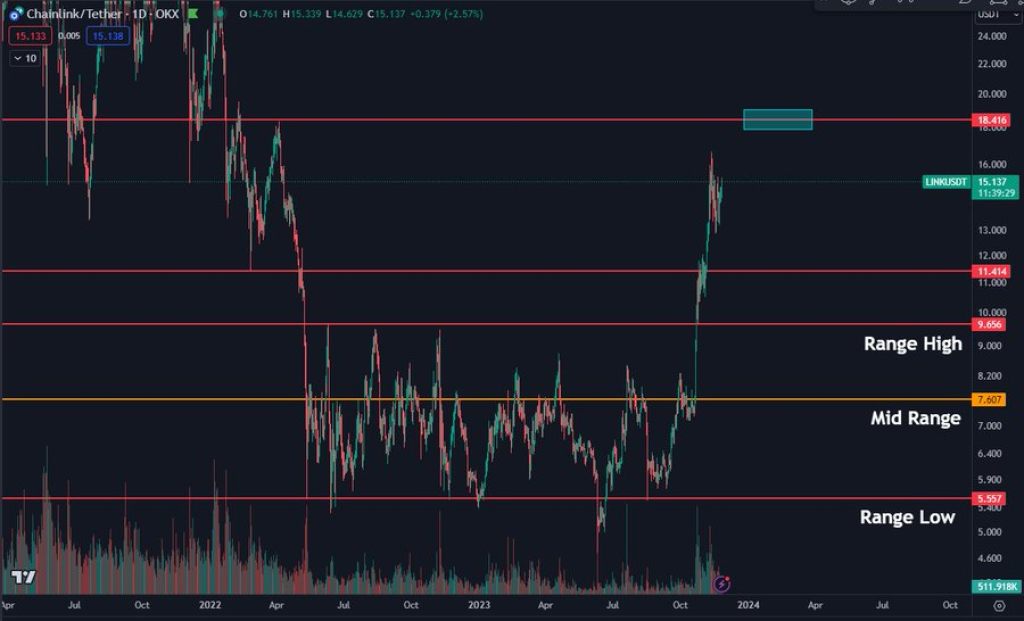

Crypto analyst Daan Crypto Trades remains steadfastly bullish on Chainlink (LINK) token prices despite some recent weakness over the last two weeks. In a recent tweet, he notes LINK is “still looking solid” after managing to break out from a grueling 500+ day long trading range it was stuck under. However, he cautions that the $18-19 level should be closely monitored as likely resistance to further upside.

Daan Crypto explains that LINK has good reason to keep seeing strength after finally breaching such a lengthy technical barrier between $6-15. Breaking free from heavy overhead supply zones frequently kicks off extended rallies, especially for fundamentally sound crypto assets like the Oracle network leader LINK.

And indeed, Chainlink did surge higher initially right after conquering the multi-year resistance zone – rocketing from around $6.50 up to a local high of $16 within a month. However, as Daan Crypto highlights, the last two weekly closes have printed red candles back under the breakout point. Selling has dropped LINK from $16 down to $14 over that time frame.

Yet Daan remains confident in the broader bullish outlook, calling LINK “solid” here and planning to hold his position for most of the market cycle still. But he is monitoring the $18-19 area closely for a potential ceiling that substantial selling pressure emerges at. This resistance ties closely with the 0.618 Fibonacci Retracement level when measured from the 2022 summer lows up to the September highs.

Read also:

- Chainlink’s LINK at the Crucial 2021 Zone That Triggered a Major Price Rally, but One Final Thing Remains

- Expert Reveals the ‘Only Bitcoin Chart You Will Ever Need’, Explains the 5 Phases of BTC Halving

- Javier Milei, a Bitcoin advocate, wins the Argentine Presidential Race; Investors Flock to this Emerging AI altcoin, InQubeta

In summary, top analyst Daan Crypto believes investors can remain confident in LINK’s post-breakout trajectory despite some choppy pullbacks recently. Unless the key $18-19 resistance area is breached, then Chainlink looks poised to establish support and gear up for its next leg higher toward retesting $20+ levels. But failing to overcome selling pressure near current highs could open the door for a deeper retracement back down toward the breakout point around $13.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.