Onchain data has shed light on a concerning pattern emerging in the cryptocurrency space – celebrities launching their own tokens and profiting substantially, often at the expense of unwitting traders. The recent cases of JENNER and DAVIDO tokens serve as cautionary tales for those considering investing in celebrity-backed cryptocurrencies.

What you'll learn 👉

The Jenner Token Saga

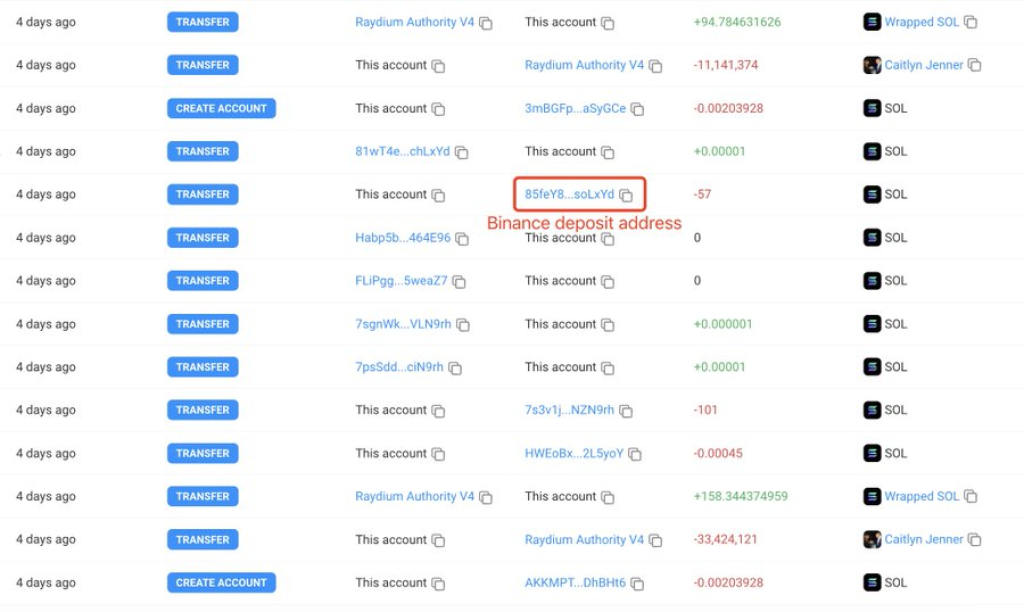

According to blockchain analysis firm Lookonchain, former Olympic athlete and reality TV star Caitlyn Jenner earned 2,381 SOL (approximately $405,000) by launching 12 meme coins on the Solana blockchain over the past four days. The firm’s on-chain investigation revealed that Jenner created numerous new addresses and used them to buy the tokens she had launched, only to sell them off for a substantial profit.

One of Jenner’s tokens, aptly named $JENNER, was particularly profitable. On May 27, Jenner spent just 1.3 SOL ($221) to purchase 44.56 million $JENNER tokens on the Pump.fun platform. She then promptly sold the entire stack for 253 SOL, netting a profit of 252 SOL (around $43,000).

Davido’s Debut Dash

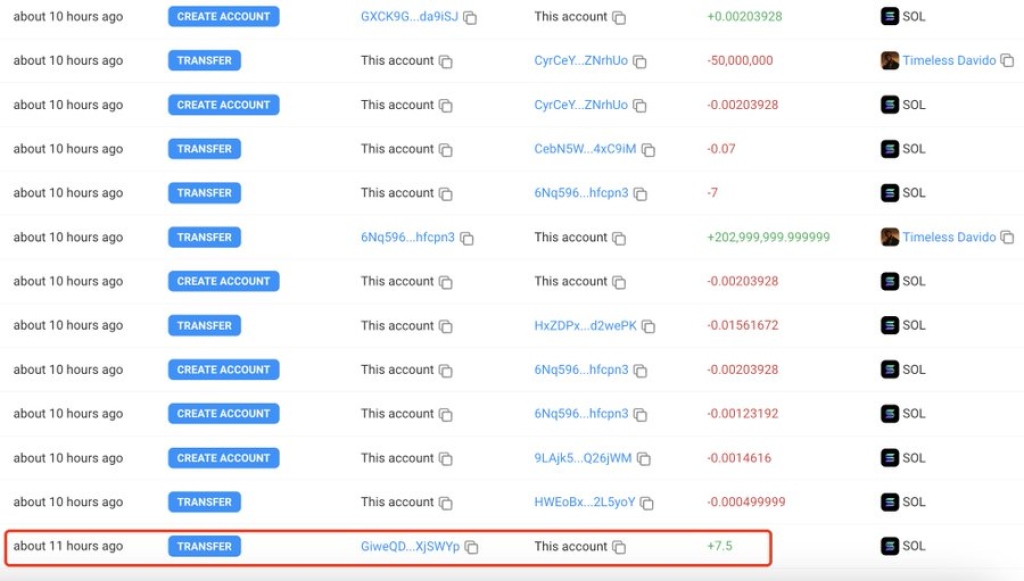

Renowned Nigerian musician Davido, boasting over 30 million Instagram followers, followed a similar path with his $DAVIDO token. According to Lookonchain, Davido received 7.5 SOL ($1,275) as start-up capital, which he used to create the $DAVIDO token and purchase 203 million tokens (20.3% of the total supply) for 7 SOL ($1,190) on Pump.fun.

Within just 11 hours, Davido had sold 121.88 million $DAVIDO tokens, raking in a profit of 2,783 SOL (approximately $473,000). Additionally, he still holds 61.12 million $DAVIDO tokens, representing an unrealized profit of around $207,000.

Trader Losses and Warnings

Lookonchain’s data also revealed that many traders lost substantial sums by trading the $JENNER token. One trader, who had previously made $3.7 million profit in just five days trading the $BOME token, lost 785 SOL (approximately $133,400) in a single day by buying and selling $JENNER.

Crypto analysts and industry experts have warned traders about the risks associated with celebrity-backed tokens, which often lack real-world utility and are primarily driven by hype and speculation.

Read Also: Why Is JasmyCoin (JASMY) Crypto Price Pumping? Top Analyst Predicts 225% Spike

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +As the trend of celebrity crypto launches continues to gain traction, regulatory bodies are taking notice. Several jurisdictions are exploring measures to protect investors from potential fraud and manipulation in the cryptocurrency markets, particularly in cases where influential figures leverage their fame to promote speculative assets.

While the crypto industry remains largely unregulated, the recent events surrounding JENNER and DAVIDO tokens have reignited calls for greater oversight and consumer protection measures.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.