Was the listing of the ZRX token on the Coinbase crypto exchange done properly? A research by TheBlock revealed personnel entanglements between the teams of Coinbase, the Investvemnt company Scalar Capital and the 0x platform.

When the Bitcoin exchange Coinbase added ZRX, the 0x protocol token, to Coinbase Pro’s portfolio on October 11, the ZRX price responded with a respectable rise of 30 percent. On 16 October, the listing on Coinbase pushed the ZRX above the one US dollar mark. But was there a hidden game behind the listing? Research by TheBlock has revealed certain suspicions that an investment firm named Scalar Capital may have exerted influence on the ZRX listing.

What you'll learn 👉

Possible influence on listing rules

Scalar Capital is an investment firm specializing in the crypto sector. Co-founder of the company, Linda Xie, is a former product manager at Coinbase. Xie is also a member of the 0x project’s advisory team. Xie also apparently acted as a consultant for the Crypto Exchange as Scalar boss. In the guidelines for listing assets on Coinbase Pro, the Crypto Exchange thanks the two Scalar founders Xie and Jordan Clifford. However, it is unclear how big Xie’s influence on the creation of the rules really was.

The binding nature of the guidelines is also unclear. That’s what it says on the first page:

“We reserve the unlimited discretion to list, not list or sell assets for trading in the GDAX [Coinbae Pro], regardless of how the criteria within this framework apply to the asset.

Binding or not, scalability and governance are two key points in Coinbase’s listing rules. In an interview in September 2017, Xie cited the 0x protocol as an example of a project that is pursuing the right approaches to governance and scalability.

Coinbase programmer advises Scalar

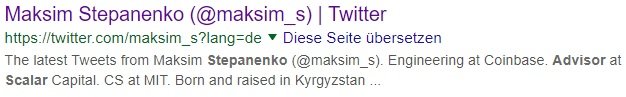

However, the entanglements between Scalar, Coinbase and 0x go beyond Personalie Xie. Maksim Stepanenko works as a programmer at the Crypto Exchange. He was also involved in the creation of the listing rules. Stepanenko also acted as a consultant to Scalar Capital – a reference that Stepanenko removed from his Twitter profile since the appearance of TheBlock. However, the information can still be found in the Google preview:

Charles Whitehead, law professor at Cornell’s elite university, drew a comparison on TheBlock to the traditional stock exchange business:

“If I’m an employee of the New York Stock Exchange and want to advise Goldman Sachs, the NYSE will have problems with it because of the appearance of conflict.

Evidence, no evidence

Scalar founders Xie and Clifford have definitely benefited from the listing of the 0x token – both have been invested in the ZRX since the token sale on August 15, 2017. ZRX price at that time: 0.048 US dollars. In addition, Xie is linked to 0x founder and CEO Will Warren.

Stepanenko’s attempt to disguise his consulting activities at Scalar retroactively also reinforces the suspicions that there might have been collusion between Coinbase and Scalar during the 0x listing. Finally, Scalar promised investors “asymmetric information” in a presentation.

Nevertheless, circumstantial evidence is circumstantial evidence and not evidence. However, Coinbase would do well to make the listing process more transparent in the future and to avoid any appearance of conflicts of interest – even if only for the credibility of the crypto industry.

So is this what XRP, XLM and others need to be listed on Coinbase?

If this story from TheBlock sounds plausible to you, it appears that teams with good connections with the leadership of the exchange get their tokens listed. Both XRP and XLM are notorious for having deep ties with highly influential figures in financial and political world so it is also very likely that they might know “a guy” on Coinbase that will speed up their listing.