Cardano is showing price action that is similar to what it had during the last bull run. As noted by ‘Eilert’, before the last spike from $0.075 to $3.16, ADA found support at the bear market rally rejection point.

Now, after 1,400 days, the price is retesting this level again. The analyst thinks the support will hold and trigger a rally.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +The analyst mentions that history doesn’t repeat itself but often rhymes. This could mean that the price may not see such a wild spike, but this point could be an important reversal point for some bullish move.

Will ADA Price History Repeat?

It is yet to be known if history will repeat this time. However, one can consider various metrics to determine this.

Technical analysis is also built on the principle that ‘price never forgets’. That is why price will likely repeat a similar pattern at a point where it reacted in the past.

Thus, this ongoing price action is worth keeping a close watch on. Traders may want to use various indicators to consider what is expected of the price in the short and long term.

Read Also: Why Cardano (ADA) Price Is Struggling Amid Declining Transactions

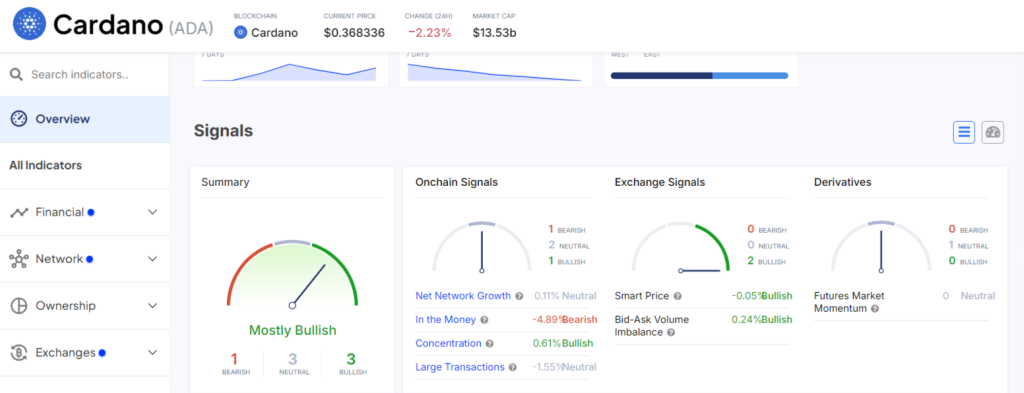

On-chain metrics from IntoTheBlock show that despite the predominant bearish price action, the numbers for Cardano are still bullish.

However, AltFINS price analysis still suggests a bearish price action in the short-medium and long term. However, the firm hints at an RSI divergence which could mean the bulls are gearing to take over.

Source: altFINS – Start using it today

One of the key factors for a bullish move, according to their analysis, is a break above the resistance at around $0.42. This could trigger a move to $0.5 where the next resistance is.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.