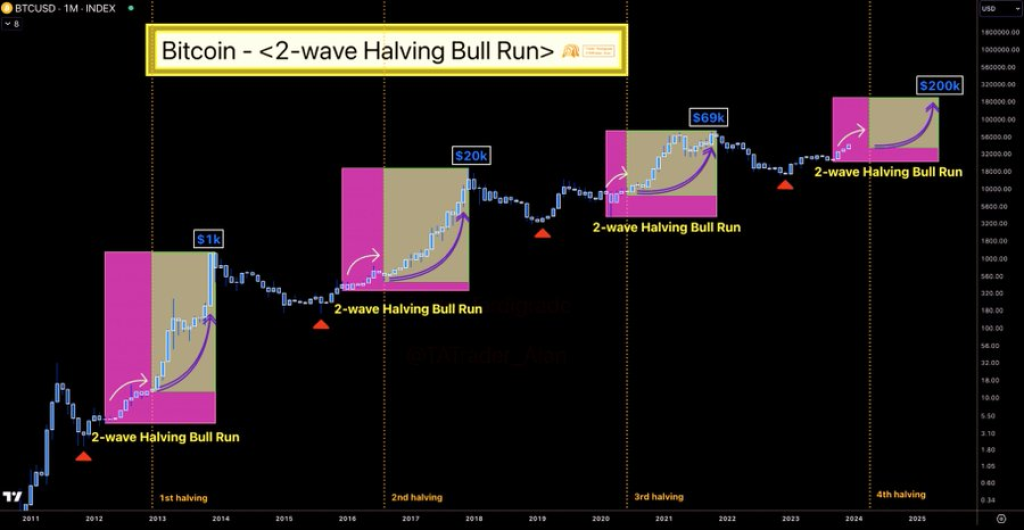

Trader Tardigrade, known as @TATrader_Alan on Twitter, recently posted an analysis of Bitcoin’s “halving” cycles and how they have impacted price. According to Tardigrade, Bitcoin has now undergone four “2-wave Halving Bull Runs,” each triggered by the periodic halving of Bitcoin’s block reward.

Tardigrade explains that Bitcoin is currently in the first wave of the fourth post-halving bull run, which started in 2020 after the previous halving. Based on his chart analysis, he states: “This pattern has never failed!! #Bitcoin has undergone the 4th “2-wave Halving BULL RUN”. $BTC is just at the middle of the first wave. $200k is estimated at the end of this 2-wave Halving Bull Run in the mid of 2025.”

Examining Previous Cycles

In further detail, Tardigrade points out that the first halving cycle took Bitcoin’s price to around $1,000, the second halving cycle peaked around $20,000, and the third halving cycle topped out around $69,000. Each of these major price increases aligned with the second wave of their respective halving cycles.

Now in the second wave of the fourth halving cycle, Tardigrade estimates Bitcoin could reach $200,000 “around mid 2025” based on the consistent pattern across all previous halving eras.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Reliable Indicator

While anything can happen in the volatile cryptocurrency markets, Bitcoin’s built-in halving events have proven to be a remarkably reliable indicator for major bull runs over its history.

As Tardigrade notes, this consistent cycle of supply shocks and subsequent price rises is a pattern “that has never failed.” If the established trend repeats again this halving era, Bitcoin’s price still has substantial room to run in the second wave over the next 2-3 years based on the $200k target.

Time will tell whether this projection based on previous halving cycles continues to remain accurate. But for investors pondering if and when Bitcoin may rise toward its all-time high again, the insight from analysts like Tardigrade shows there are quantitative models suggesting more upside is still ahead in Bitcoin’s fourth halving paradigm.

You may also be interested in:

- Will Solana (SOL) Flip ‘Dead’ Ethereum?

- Why Being Bearish on Kaspa (KAS) For Now Is a Wrong Move

- Exploring Fresh Crypto Options: $NUGX’s Promising Presale Picks Up Steam Among PEPE and DOGE Enthusiasts

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.