On December 10, the Federal Reserve cut interest rates by 25 bps, a decision that was expected. Discussions and analysis abound regarding what impacts macroeconomic factors and policies have on crypto in 2026.

From Bitcoin to altcoins like Solana and Binance Coin, increased liquidity is good news. As a consequence, the rate cut makes the BNB price prediction a bit more optimistic.

For DeepSnitch AI, however, next year seems to be opening a clear path to explosive 100x returns. The project is developing an impressive AI tool, with a massive market, that is likely to change crypto investing in both good and bad times.

What you'll learn 👉

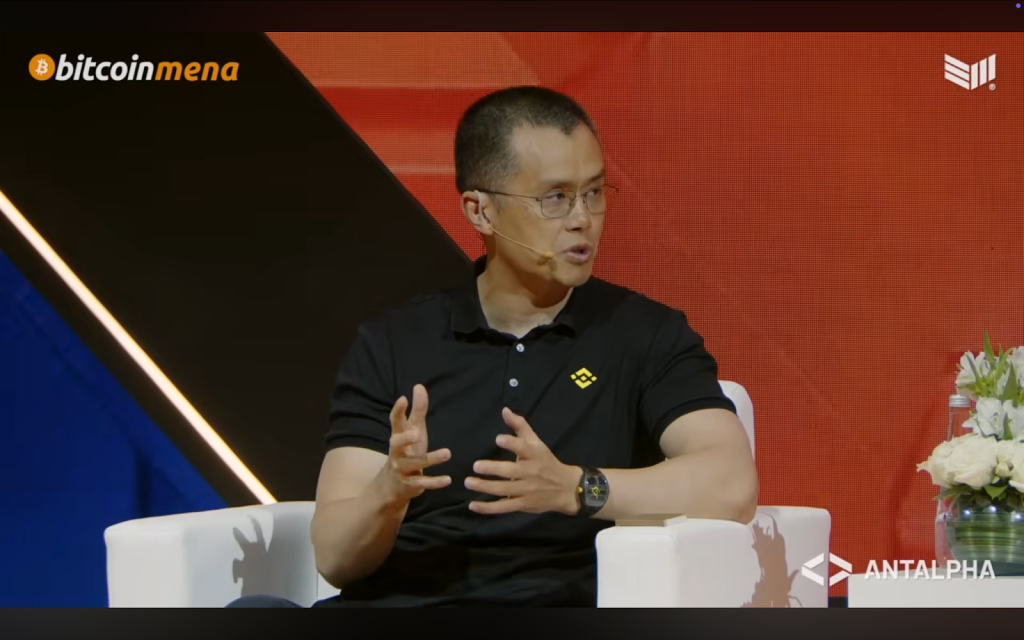

Binance’s CZ: Bitcoin may enter a “super cycle”

The annual Bitcoin MENA conference took place recently in Abu Dhabi, UAE. One of the key speakers was Binance’s co-founder Changpeng Zhao, better known as “CZ”.

In his fireside chat, CZ shared his opinion that Bitcoin has already completed a 4-year cycle, and is now entering an unprecedented “super cycle”, where macroeconomic factors (like increased liquidity coming from Fed’s monetary easing) and institutional investment will play a much larger role than in the past.

Binance’s co-founder Changpeng Zhao (“CZ”) at the Bitcoin MENA 2025 conference in Abu Dhabi, on December 9. (© Bitcoin MENA).

The impact of these factors is likely to go beyond Bitcoin and also affect BNB price predictions and crypto as a whole.

In the next section, this impact is analysed in relation to three altcoins, including a BNB token outlook.

Coins that would benefit from lower interest rates

- DeepSnitch AI (DSNT)

For DeepSnitch AI, additional liquidity coming from lower interest rates would be beneficial, but there’s some nuance here.

Added liquidity lifts crypto markets, helping bullish trends. This makes investors take more risks and look for higher returns. Tighter monetary policies, in contrast, help bearish markets, making investors more defensive. The nuance with DeepSnitch AI is that its tool will be very much in demand in both scenarios.

DeepSnitch AI has developed an AI-powered system that transforms crypto data into market intelligence. This will include actionable insights that include diverse issues like new opportunities, defensive strategies, or even estimating BNB’s price prediction.

In other words, DeepSnitch AI can help hundreds of millions of crypto holders worldwide to make good investment decisions, regardless of where the momentum is going.

The project’s huge growth potential is being realised by more and more investors, and that is why its presale is going at an extremely fast pace. In just the 3rd stage, more than $770,000 has been raised.

The entry price is only $0.02735, which gives a very large upside. In addition, bonuses of 50% and 100% are given for DSNT’s purchases of at least $2,000 and $5,000, respectively.

But only those who take part now in the presale will be among those enjoying explosive returns next year.

- Binance Coin (BNB)

BNB price prediction for 2026 depends more on Binance’s ecosystem growth than on monetary policy factors, though they also count. In this regard, the recent licensing of three separate entities in Abu Dhabi (controlled by Binance), which will carry out exchange, custodial, and brokerage activities, shows an expansion of Binance’s scope of services.

If Binance keeps gaining ground as an institutional player, a BNB long-term projection that sees its coin climbing as high as $1,500 in 2027 or even end of 2026 is realistic. At any event, a baseline BNB’s current price prediction would be for the coin to regain the key $1,000 mark before the second half of next year.

- Beldex (BDX)

Apart from top altcoins like BNB, a monetary easing policy from the Fed would help mid-tier coins like Beldex. Added liquidity would likely mean greater transaction volumes, including for privacy coins like BDX.

The trend for BDX in the last month has been one of a slight increase. From a low of $0.0785 on November 23, BDX has risen to $0.0877 on December 11. If this trend continues, Beldex could regain the $0.10 mark before the end of the year; a performance that would make its 2026 prospects more bullish than most BNB price predictions.

Conclusion

BNB price prediction for 2026 is more optimistic than that of other altcoins, with some exceptions. For DeepSnitch AI, however, all projections and forecasts see a likely crypto explosion.

The project has developed an impressive tool with a huge market appeal. Growth in excess of 100x is not only possible, but likely. But only those who buy now in the presale and take advantage of the 50% (Code: DSNTVIP50) and 100% (Code: DSNTVIP100) bonuses (which will expire on January 1) will enjoy exponential returns.

Visit the official website to buy into the DeepSnitch AI presale now, and visit X and Telegram for the latest community updates.

FAQs

In a bullish scenario, when could BNB reclaim the $1,000 mark?

An optimistic BNB price prediction projects that this could happen as early as January.

When was the last time that Beldex traded above $0.10?

During the crypto bubble of 2021. Since then, the coin has traded below that mark, but it is showing signs of a more sustained long-term trend.

What makes DeepSnitch AI a potential 100x coin?

Its unique combination of a sophisticated AI tool that addresses a concrete problem, and a massive market that experiences it.

DISCLAIMER: CAPTAINALTCOIN DOES NOT ENDORSE INVESTING IN ANY PROJECT MENTIONED IN SPONSORED ARTICLES. EXERCISE CAUTION AND DO THOROUGH RESEARCH BEFORE INVESTING YOUR MONEY. CaptainAltcoin takes no responsibility for its accuracy or quality. This content was not written by CaptainAltcoin’s team. We strongly advise readers to do their own thorough research before interacting with any featured companies. The information provided is not financial or legal advice. Neither CaptainAltcoin nor any third party recommends buying or selling any financial products. Investing in crypto assets is high-risk; consider the potential for loss. Any investment decisions made based on this content are at the sole risk of the readCaptainAltcoin is not liable for any damages or losses from using or relying on this content.