According to on-chain analytics provider Lookonchain, an address associated with the Bluzelle company dumped 567,543 BLZ worth $158,000 earlier today as the BLZ price spiked 38%.

The selling wallet “0x9614” has a pattern of distributing BLZ tokens after price rises. It has received a total of 33.5 million BLZ worth $6.5 million from the main Bluzelle company wallet.

So far, 0x9614 has sold 19.6 million BLZ worth $3.63 million of the tokens it received. Currently, it still holds a balance of 13.9 million BLZ, worth around $4 million.

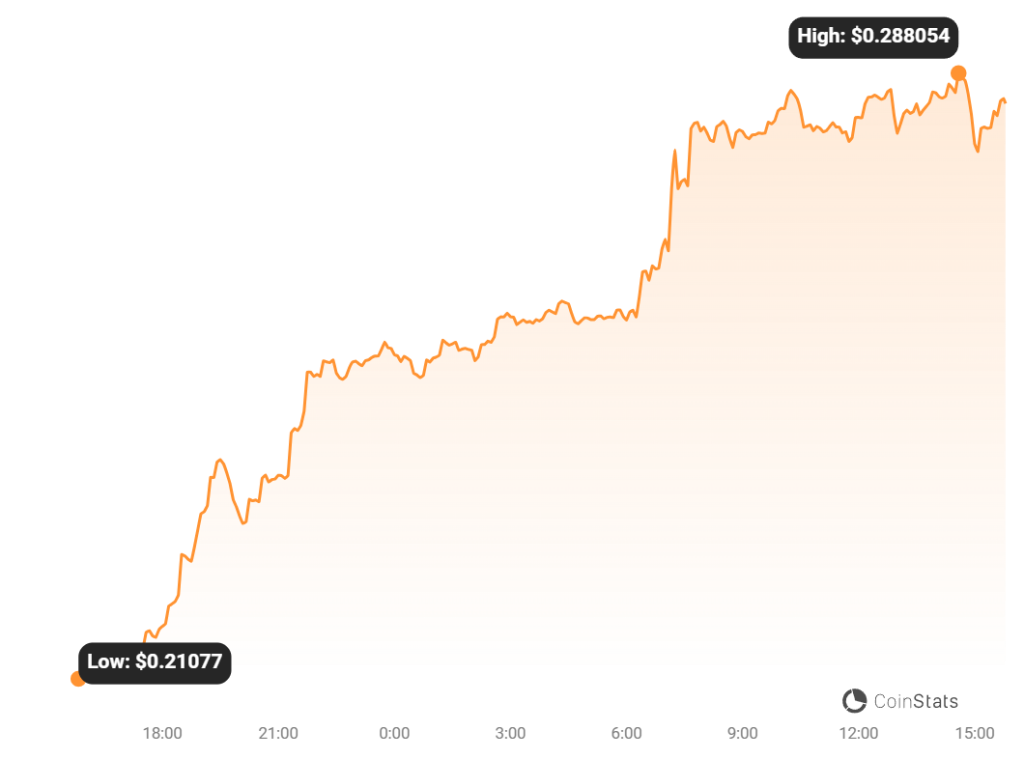

This latest BLZ sale comes right on the heels of a major pump in price earlier today. BLZ surged 38% to $0.32 before pulling back slightly.

Source: CoinStats – Start using it today

The timing indicates the Bluzelle-linked wallet is systematically liquidating portions of its balance into brief spikes in momentum and hype. By selling into high buying demand, the distributions get executed at peak prices.

According to Lookonchain, this wallet (0x9614) has repeatedly sold down its balance after notable BLZ price rises in the past. It follows a pattern of waiting for opportune liquidity events to offload millions of dollars worth of tokens.

Read also:

- Shiba Inu Eyes 500% Gain As SHIB Bulls Take Control

- Dogecoin Faces Resistance at $0.07, but This DOGE Indicator Confirms a ‘Buy Signal’

- October in Focus: Injective, Solana, and InQubeta Emerge as the Biggest Winners

The consistent selling from the Bluzelle-linked wallet after price spikes raises some caution flags for BLZ in the near-term. This on-chain data reveals that major BLZ holders are actively distributing significant portions of their balance into any brief momentum rallies. Such selling pressure could limit upside price potential as insider holdings get unwound.

However, the distributions may also indicate BLZ is overvalued relative to the project’s current fundamentals and growth trajectory. Much depends on the reason behind the selling – if it is simply profit-taking after a pump, that poses less long-term concern than if insiders are losing conviction fundamentally. Either way, traders should incorporate this on-chain activity into their BLZ analyses.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.