BlackRock is not just dipping its toes into Bitcoin anymore. It’s fully in. As of mid-June 2025, the world’s largest asset manager holds more than 667,000 BTC, making up 3.18% of Bitcoin’s total supply. That’s one in every 31 bitcoins ever mined – now in the hands of a single TradFi giant. And they did it in just 18 months, starting from the launch of their iShares Bitcoin Trust back in January 2024.

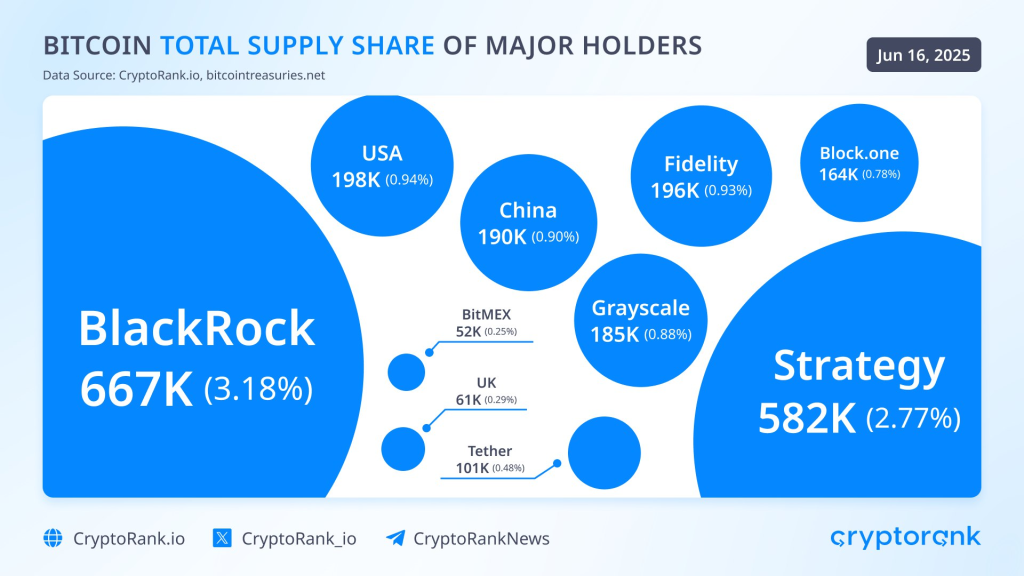

To understand how big this is, consider the other major players in the space. MicroStrategy, the long-time Bitcoin maxi on Wall Street, currently holds about 582,000 BTC. The U.S. government, through seizures and legal actions, controls around 198,000 BTC. Fidelity, another massive institutional player, has 196,000 BTC.

Even Grayscale, whose GBTC product once dominated institutional exposure to Bitcoin, holds less at 185,000 BTC. And then there’s China and the UK, with state-controlled wallets adding up to 190,000 and 61,000 BTC respectively. All of these are now behind BlackRock.

This isn’t about ETF flows anymore. It’s about control. BlackRock’s quiet accumulation strategy reflects more than just a bullish bet on Bitcoin’s price. It’s a calculated move to position itself at the center of the next generation of finance. They’re not just buying bitcoin for exposure – they’re locking up supply, tightening the float, and gaining leverage over an asset that could play a role in global monetary infrastructure.

With over 90% of all bitcoins already mined, and many of those locked away in cold storage or lost forever, the available supply on the open market is shrinking fast. When a firm like BlackRock absorbs 3% of all coins, it creates long-term supply pressure. That doesn’t mean the price will skyrocket overnight, but it does mean there’s a structural floor forming beneath it. As more institutions come in, there will be fewer coins available – and the bidding war begins.

There’s also a symbolic layer to this move. For years, Bitcoin was seen as a protest asset – a decentralized hedge against traditional finance. Now, traditional finance is starting to take ownership of it. That raises important questions. Is Bitcoin still the people’s money if BlackRock owns the largest share? Will ETFs and custodians reshape how access to BTC works in the future?

Whether you see it as a takeover or a sign of mainstream validation, the result is the same: BlackRock’s final move into Bitcoin changes the game. It’s not speculation anymore – it’s strategy. And it’s unfolding in real time, while most of the market is still arguing over price charts.

One thing is clear. The biggest players aren’t waiting for another dip. They’re positioning now. And if BlackRock’s latest Bitcoin grab is any indication, they’re planning to lead – not follow – in the era of institutional crypto.

Read also: Charles Hoskinson’s Bitcoin Move Could Change Cardano Forever

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.