Bitcoin enthusiasts have shown excitement as the crypto surpassed the $60K mark. However, Zero Ika, a prominent crypto analyst advises caution. Zero Ika tweeted, “Brother, is the weekly closure bullish? We smashed the 60K!” Despite the recent surge, several factors must align for a sustained bullish trend.

What you'll learn 👉

Bitcoin (BTC) Price Analysis

Bitcoin’s performance includes four consecutive daily gains, signaling a positive short-term trend. Nonetheless, Zero Ika emphasizes that Bitcoin has yet to reverse its mid-term bearish structure.

He highlights the importance of surpassing the high (SH) at $63,826. Only a high time frame (HTF) closure above this level would alter his bearish outlook.

Moreover, Zero Ika points out the rise in Open Interest, reaching the 180K danger zone. This suggests aggressive long positions, especially as Bitcoin nears a crucial level.

Additionally, an increase in funding rates adds to this sentiment. The current market scenario requires careful monitoring to avoid potential pitfalls.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Spot CVD and Liquidation Heatmap Insights

Interestingly, the spot cumulative volume delta (CVD) reveals significant buy pressure from Coinbase, driving the recent move.

In contrast, Binance shows a flat trend, indicating a lack of participation from its users. This divergence between major exchanges could influence Bitcoin’s price dynamics.

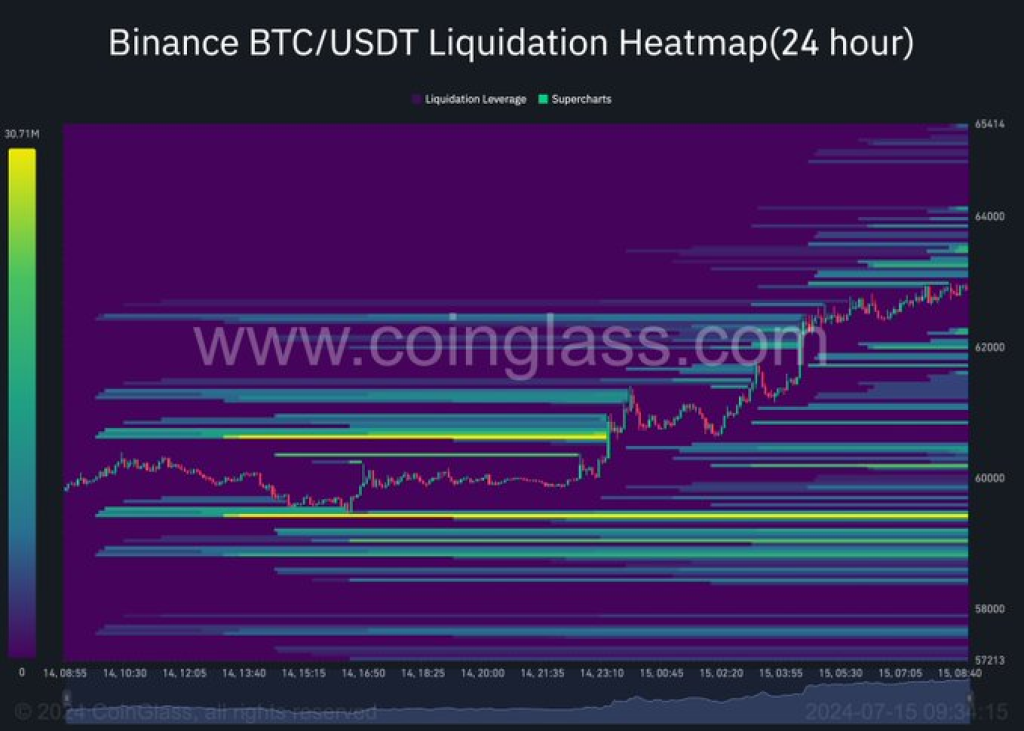

Furthermore, Zero Ika examines the liquidation heatmap, identifying a cluster near the SH at $63,800. This cluster suggests that Bitcoin might face resistance at this level, potentially halting the bullish impulse if not reclaimed on an HTF basis.

Read also: Mysterious Whale Massively Accumulates Chainlink – Will LINK Price Pump?

USDT Dominance Observations

Another critical factor is the USDT dominance, which recently reversed near the 5.80% to 6.00% order block (OB) zone. Although it has not closed below key levels, this reversal warrants attention as it may impact Bitcoin’s momentum.

while Bitcoin’s recent performance is promising, Zero Ika urges caution. Surpassing the $63,826 mark on an HTF closure is essential for a sustained bullish trend.

Market participants should monitor Open Interest, funding rates, spot CVD, and the liquidation heatmap to navigate the crypto space. The interplay between these factors will determine Bitcoin’s trajectory in the coming weeks.

Captain just hit his first 100x among a lot 2-5xs. Want to be a part of a profitable community?

Get all our future calls by joining our FREE Telegram group.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.