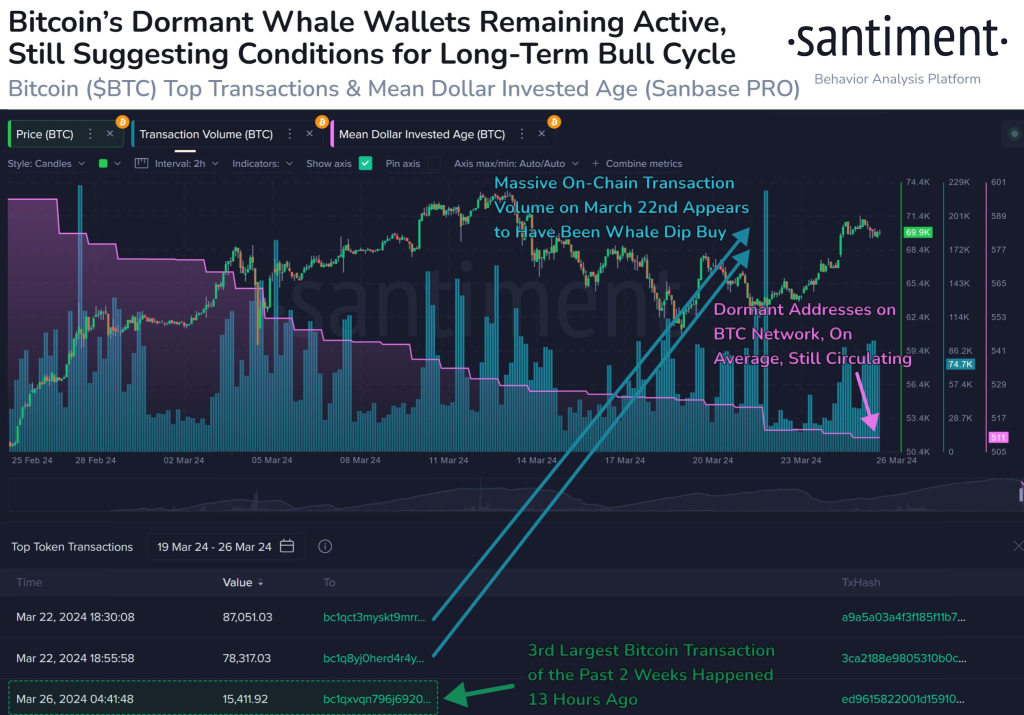

Bitcoin has recently experienced significant on-chain activity, with the third-largest transaction in the past two weeks occurring just 13 hours ago. The transaction, which involved 15,411.92 BTC, pales in comparison to the pair of massive transactions that took place on March 22nd, totaling 87,051.03 BTC and 78,317.03 BTC, respectively. These substantial movements coincided with Bitcoin’s price dip to $63,000, sparking interest among analysts and investors alike.

What you'll learn 👉

Spike in On-Chain Transaction Volume Indicates Dip Buying

According to data provided by Santiment, a leading blockchain analytics platform, the on-chain transaction volume spiked significantly on March 22nd, suggesting that key stakeholders may have engaged in dip buying, ultimately aiding in the asset’s recovery. Although identifying the wallets involved in these transactions can be difficult, the activity seems consistent with the increased accumulation of wallets since the previous weekend.

This accumulation by key players during price dips is often seen as a bullish signal, as it demonstrates confidence in the asset’s long-term potential and can help establish strong support levels.

Mean Dollar Invested Age Indicator Hints at Bull Market Conditions

Santiment also highlights the importance of monitoring the Mean Dollar Invested Age indicator, which is currently trending downward. This indicator implies that the average age of investments is decreasing as stagnant wallets bring older coins back into circulation. Historically, this phenomenon has been one of the primary ingredients of cryptocurrency market bull runs throughout the industry’s 15+ year existence.

As more dormant coins re-enter the market, it suggests that long-term holders are becoming more active, either by selling or redistributing their holdings. This increased activity can contribute to greater market liquidity and price volatility, which are characteristic of bull market conditions.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Historical Patterns Suggest Potential for Parabolic Rally

Analyst Moustache has drawn attention to a compelling pattern in Bitcoin’s price action following its all-time highs (ATHs) in previous years. In 2017, after Bitcoin reached its ATH, the correction lasted 21 days before the asset experienced a parabolic rally. Similarly, in 2020, Bitcoin’s correction after reaching its ATH lasted 21 days, followed by another parabolic rally.

This historical pattern has led some analysts to speculate whether the same scenario could unfold in 2024. If Bitcoin’s price action continues to mirror its behavior in previous post-ATH corrections, the market could be poised for a significant upswing in the coming weeks or months.

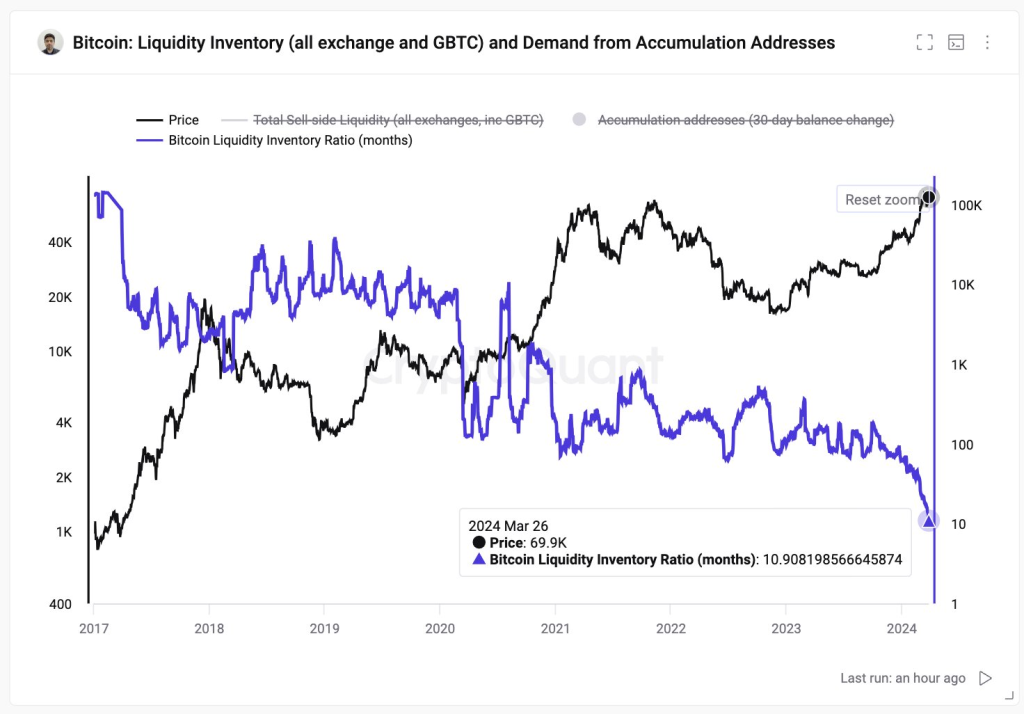

Liquid Inventory Ratio Reaches All-Time Low

Ki Young Ju, the founder of Cryptoquant, has pointed out that Bitcoin’s liquid inventory ratio has reached an all-time low. This indicator suggests that sell-side liquidity is currently much lower than historical levels relative to demand.

A low liquid inventory ratio is generally considered a bullish signal, as it indicates that there is less available supply in the market, which can lead to increased buying pressure and, consequently, higher prices. This observation further supports the notion that Bitcoin may be gearing up for a significant price move in the near future.

Recent on-chain activity, in conjunction with historical patterns and key indicators, presents a potentially bullish outlook for Bitcoin. The accumulation by key stakeholders during price dips, the decreasing average age of investments, and the low liquid inventory ratio all suggest that the market may be setting the stage for a significant upswing.

However, as with any analysis of the cryptocurrency market, it is essential to approach these observations with caution. The market remains highly volatile and subject to various external factors that can influence price action.

You may also be interested in:

- Top 13 Real Estate Tokens Poised for 100x Growth as Blackrock and Coinbase Dive into RWA

- Ripple Analyst Says XRP Holders Can Earn 50X To 100X In this Bull Run

- DOGE, BONK, and NUGX: The Meme Coin Trio Defying Market Expectations

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.