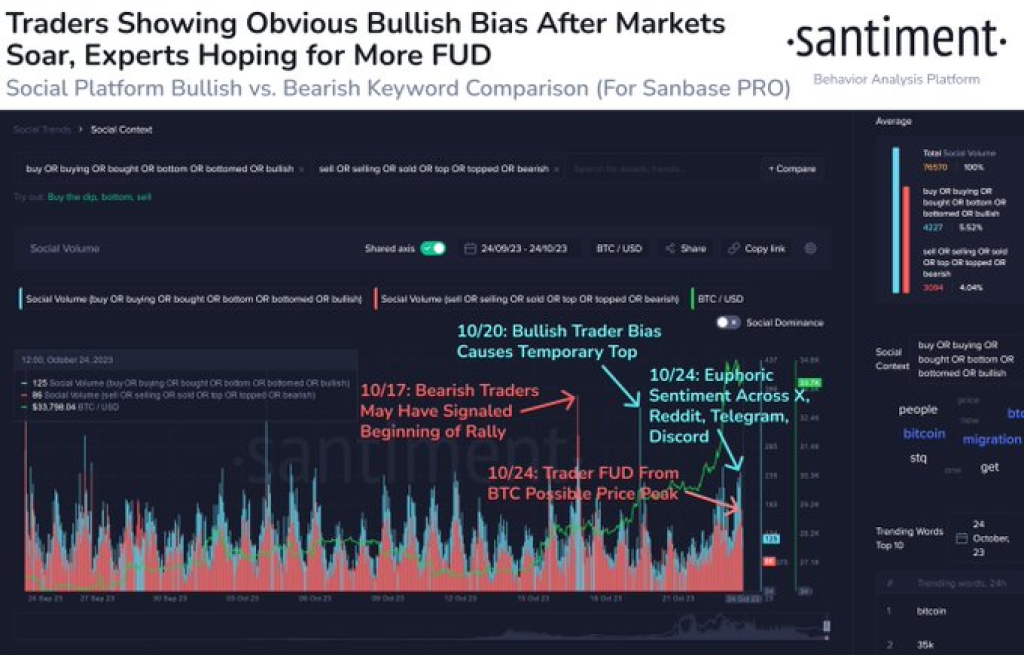

Bitcoin’s dramatic 19% price surge this past week has triggered a wave of greed and FOMO (fear of missing out) among crypto traders according to blockchain analytics firm Santiment.

In a tweet, Santiment reported detecting high usage of greed-indicating keywords as Bitcoin broke out above $30,000 resistance. The leading cryptocurrency hitting its highest level since June has reignited euphoria in the market.

Source: Santiment – Start using it today

However, Santiment cautions that excessive optimism often precedes market tops as rallies become overextended. For further gains, some skepticism and fear is needed to flush out leveraged long positions.

Historically, crypto markets tend to climb when negative sentiment prevails and traders least expect upside. The latest jump caught many off guard after months of bearish momentum.

Still, others contend Bitcoin’s move was fueled by rational excitement over a potential spot Bitcoin ETF approval, rather than simple greed. An ETF could significantly expand Bitcoin access and inflows from public stock markets.

But Santiment’s data indicates surging crypto market caps and rapid price spikes typically correlate with heightened greed and risk appetite. The market intelligence firm often monitors emotional sentiment to gauge when rallies may be overheating. Their findings suggest traders are getting far too optimistic, increasing chances of a short-term pullback.

While fear and pessimism tend to signal buying opportunities, unchecked greed risks unsustainable bubbles. Santiment’s data implies traders may need to cool their jets before significant new highs materialize.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.