This isn’t making headlines yet, but the crypto market may be starting to shift. Trader Huang 皇 shared on X that a small group of long-term Bitcoin whales are accumulating Zcash (ZEC).

These are not active traders chasing short-term moves. They are holders who usually stay in Bitcoin unless they see something clearly mispriced.

That detail matters. Huang says these buyers are not discussing price targets. They are thinking in terms of exposure and optionality. In other words, they want a position before the market fully wakes up to the idea.

At current levels, Huang argues that the ZEC price does not feel speculative. In his view, the asset looks underpriced relative to its role and positioning, especially compared to other privacy-focused coins that have faced increasing regulatory pressure.

Moreover, a move toward much higher prices, in his words, feels easier to justify than most people expect. This is his opinion, not a prediction or advice.

What you'll learn 👉

What the ZEC Chart Is Showing

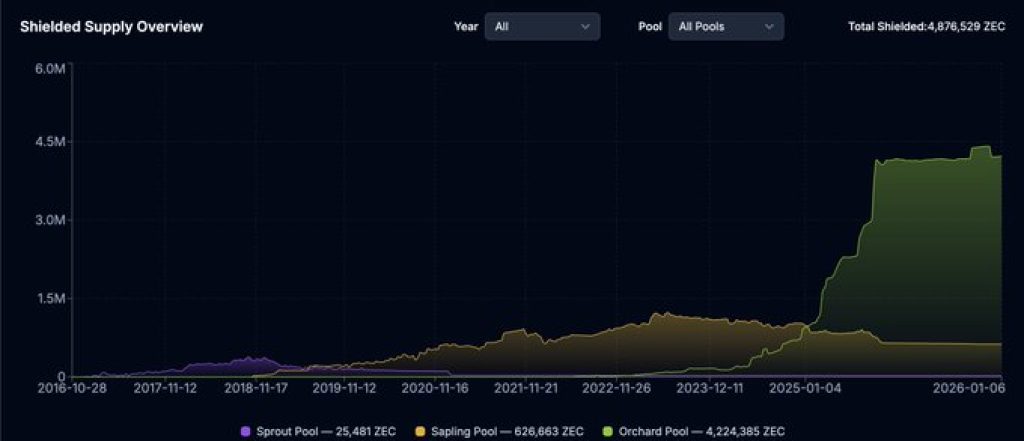

The chart Huang shared adds context to his thinking. It tracks Zcash’s shielded supply over time. One thing stands out clearly: shielded ZEC has been rising sharply, especially over the past year.

That matters because shielded supply reflects how much Zcash (ZEC) is being moved into privacy-protected addresses. When this number grows, it often signals long-term holding behavior rather than short-term trading. Coins moved into shielded pools are less likely to be flipped quickly.

The recent jump in shielded supply suggests that more ZEC is being held with intention. It aligns with the idea that some buyers are positioning early, before broader demand shows up.

Why Privacy Is Back in the Discussion

Zcash is a bit in its own class among all the privacy coins. Unlike all the other coins, having mandatory privacy, it allows optional privacy. That distinction has become more important as regulators tighten rules around fully opaque networks.

Institutional players tend to avoid assets that could trigger compliance issues. Zcash’s design gives it more flexibility, which may explain why it is still being considered while others are being pushed aside.

This does not mean institutions are rushing in today. That implies the reopening of the conversation and that in itself can alter the way long-term investors consider exposure.

Read Also: How Much Could 11,400 Stellar (XLM) Tokens Be Worth in 2026?

Is this A Quiet Accumulation Phase For Zcash Price?

What makes this situation interesting is how quiet it is. There is no major hype cycle, no viral headlines, and no aggressive promotion. Instead, there are signs of steady accumulation, rising shielded balances, and interest from investors who usually move slowly and carefully.

That does not guarantee anything about price. Markets can stay mispriced longer than expected. But it does explain why some Bitcoin-focused investors are starting to pay attention.

For now, the ZEC price seems to be in such a phase where positioning factors more than excitement. Yet, it remains to be seen whether the broader market catches up.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.