Bitcoin has made history once again, briefly touching a price of $88,000 before settling around $87,600 at the time of writing. But behind this milestone lies an an interesting interplay between whales, market sentiment, and the forces driving the price higher.

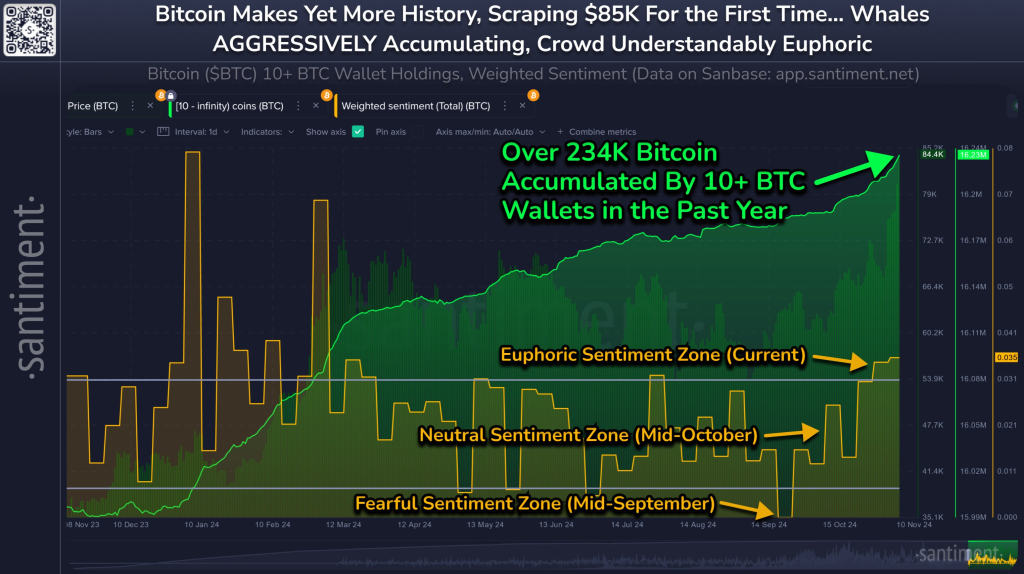

The Santiment chart provides a window into the current state of the Bitcoin market. The green line tracks Bitcoin’s price, showing the steady climb that has led to this new all-time high. However, the chart reveals something even more compelling – the accumulation by large Bitcoin holders, often referred to as “whales.”

According to the data, wallets holding 10 or more BTC have collectively amassed over 234,000 BTC in the past year. This buying spree from whales has undoubtedly contributed to the upward pressure on Bitcoin’s price, as these large players continue to scoop up available supply.

Sentiment, represented by the yellow line, offers additional context. The chart outlines distinct sentiment zones, ranging from fearful to euphoric. During the mid-September period, the market sentiment was firmly in the “Fearful Sentiment Zone,” indicating a high level of uncertainty and pessimism among investors. However, as Bitcoin’s price climbed, the sentiment transitioned to a “Neutral Sentiment Zone” around mid-October and eventually reached the “Euphoric Sentiment Zone” in the current market environment.

The interplay between whale behavior and market sentiment is particularly intriguing. While the retail crowd tends to exhibit emotional responses, buying during euphoria and selling during fear, the whales have demonstrated a contrarian approach. These large holders have been accumulating Bitcoin, even during periods of fear and uncertainty in the broader market. This buying has likely served to support and propel Bitcoin’s price higher, even as the general sentiment fluctuated.

Read also: MicroStrategy’s Massive Bitcoin Purchase, Again! BTC Price Above $80k

The Cyclical Nature of Sentiment and Its Impact on Prices

The chart’s insights also shed light on the cyclical nature of market sentiment and its potential influence on future price movements. Historically, periods of euphoria have often aligned with market tops, while fear and capitulation have accompanied price bottoms. This pattern indicates that understanding the current sentiment landscape can provide valuable clues about the potential direction of Bitcoin’s price.

As the market navigates this euphoric phase, it will be crucial to monitor the behavior of both whales and the broader retail sentiment. If the whales maintain their accumulation strategy, it could further fuel Bitcoin’s upward trajectory. Conversely, a shift in sentiment towards fear or neutrality may signal a potential cooling-off period or correction in the market.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.