In today’s market update, the crypto market has entered a tense phase as the Bitcoin price continues its recent downtrend, testing investor patience near key support zones. Amid this cooling momentum, a familiar figure has resurfaced — the same Bitcoin whale who famously turned a major BTC price crash into a $200 million gain within 24 hours.

Rather than attempting to catch short-term BTC price rebounds, sources close to early investment desks reveal that the Bitcoin whale is strategically positioning ahead of a potential liquidity rotation — this time, into a rising contender: Paydax Protocol (PDP). While Bitcoin (BTC) consolidates beneath critical resistance levels, the whale’s renewed movement appears to signal a calculated pivot.

What you'll learn 👉

The Bitcoin Whale’s Return Sparks Institutional Repositioning

The re-emergence of the Bitcoin whale who correctly forecasted the last BTC price crash and earned a $200 million profit within 24 hours has renewed interest among institutional observers. His activity, verified through on-chain flows, shows a notable divergence from conventional accumulation patterns.

Instead of re-entering the Bitcoin (BTC) market directly, capital movements suggest a decisive shift toward Paydax (PDP). Beyond the bearish sentiment surrounding BTC due to ongoing global events, this developing DeFi project is drawing attention for its liquidity efficiency and cross-chain adaptability.

Analysts view this transition as a strategic hedge rather than a speculative move. While the BTC price market dominance remains firmly intact, its limited mobility has prompted some high-value investors to explore complementary assets capable of sustaining yield and transactional velocity.

Paydax fits these parameters well, offering liquidity patterns that institutions can model and integrate into broader cross-market strategies. The renewed positioning of the Bitcoin whale underscores a subtle shift: the search for scalable liquidity pathways beyond the traditional BTC price cycle.

Why Bitcoin’s Liquidity Model No Longer Works

For all its dominance, Bitcoin (BTC) carries a structural flaw that most traders overlook. Its liquidity doesn’t circulate; it concentrates. Each rally tends to lock capital into dormant wallets, draining energy from the broader market. Thus, rising BTC prices cause the ecosystem around it to often stall, waiting for liquidity to trickle back down.

Source: Paydax Protocol

That bottleneck is the reason even the most seasoned Bitcoin whales are diversifying beyond pure BTC price exposure. Having seen the same pattern play out across multiple cycles — rising prices followed by shrinking mobility and fading returns — the more brilliant move now is toward systems that don’t just hold liquidity but make it work.

That’s where Paydax (PDP) is setting itself apart from traditional assets. Instead of static storage, Paydax’s liquidity model operates as a living circuit. Every transaction moves capital through cross-chain pools, staking modules, and collateralized lending layers, allowing liquidity to circulate rather than remain trapped. It is the same financial foundation that built Bitcoin (BTC), refined for a yield-driven market.

Liquidity Moves Beyond Bitcoin (BTC)

Institutional interest in Paydax (PDP) is also gaining momentum as its unique market behavior captures attention across trading desks. While many DeFi tokens depend on short-lived speculative surges, Paydax’s growth is driven by sustained on-chain accumulation and steady wallet engagement. For investors like the Bitcoin whales who correctly timed previous market shifts, Paydax represents a promising opportunity beyond Bitcoin’s current price stagnation.

Moreover, what sets Paydax (PDP) apart — and why major funds are watching closely — is its integration of real-world assets (RWA) into its DeFi framework. By allowing the tokenization and collateralization of physical assets such as art, luxury goods, and other tangible holdings, Paydax can bridge the gap between on-chain liquidity and off-chain value. This hybrid approach boosts utility and stabilizes yield potential.

Source: Paydax Protocol

In this sense, Paydax complements traditional crypto positions like Bitcoin by offering a productive yield ecosystem rather than a purely speculative model. As institutional portfolios diversify into yield-bearing assets, Paydax’s RWA-driven model could become a key instrument in balancing liquidity exposure with sustainable returns.

Paydax Protocol Will Emerge As Bitcoin’s Liquidity Alternative

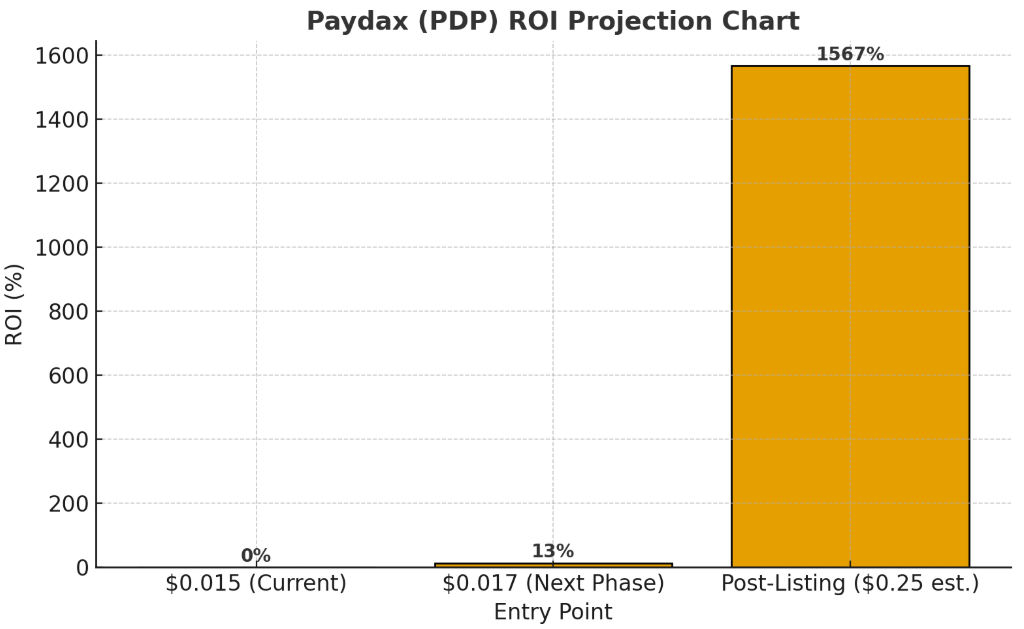

The Paydax native token presale, PDP, is gaining strong momentum after renewed attention from the Bitcoin whale who once made $200 million in a single day. With $1,129,148 raised in less than a few weeks, demand is intensifying ahead of the next price jump from $0.015 to $0.017.

Source: Paydax Protocol

Early buyers are positioning ahead of a 13.3% price increase, with expectations of exponentially higher gains post-listing. The project’s Assure DeFi audit has strengthened investor confidence, confirming its contract security and transparency. As the BTC price consolidates beneath key resistance levels, traders are transitioning into assets that make liquidity more productive.

If Bitcoin’s liquidity remains locked and Paydax (PDP) continues to circulate capital efficiently, this presale upside could be exponential, especially with its 25% bonus, claimable using the PD25BONUS code. With institutional attention building and the next phase rapidly approaching, this presale window may close faster than most expect.

Join The Paydax Protocol (PDP) presale and community:

Website | Telegram | X (Twitter) | Whitepaper

DISCLAIMER: CAPTAINALTCOIN DOES NOT ENDORSE INVESTING IN ANY PROJECT MENTIONED IN SPONSORED ARTICLES. EXERCISE CAUTION AND DO THOROUGH RESEARCH BEFORE INVESTING YOUR MONEY. CaptainAltcoin takes no responsibility for its accuracy or quality. This content was not written by CaptainAltcoin’s team. We strongly advise readers to do their own thorough research before interacting with any featured companies. The information provided is not financial or legal advice. Neither CaptainAltcoin nor any third party recommends buying or selling any financial products. Investing in crypto assets is high-risk; consider the potential for loss. Any investment decisions made based on this content are at the sole risk of the readCaptainAltcoin is not liable for any damages or losses from using or relying on this content.