Analysts spot signs that an impending move could materialize soon for Bitcoin, with the upside favored. Veteran trader Crypto Rover notes that Bitcoin’s trading volume has declined notably.

As many seasoned investors know, extended periods of narrow price action coupled with shrinking volume tend to precede violent breakouts.

“Bitcoin Volume is dropping! Indicating that a gigantic move is imminent…” Rover commented. This coiling price behavior reflects tension building in the market until ultimately triggering a cathartic resolution.

What you'll learn 👉

Key Support Holds To Maintain Uptrend Intact

Adding credence to bulls’ hopes, Bitcoin successfully defended crucial price floors on its recent retest – preserving market structure intact.

Jelle points out that despite revisiting the key support area, bears could not overwhelm demand around these levels. The swift dip-buying response signals that most investors remain undeterred, with eyes set firmly on recovery.

“Bitcoin successfully retested the key support area over the weekend! The uptrend remains strong — I’ve got my eyes on $60,000 next,” Jelle tweeted.

With its technical posture still favoring the bulls, Jelle forecasts a march back toward Bitcoin’s former all-time highs once the consolidation resolves favorably.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Time to Re-Evaluate Market Sentiment and Outlook

For contrarian investors, moments like the current uncertainty offer ideal moments for recalibrating one’s thinking against the crowd.

Veteran Mags reminds followers of Bitcoin’s sensational transformation from under $20,000 to over $50,000 at a time when macro gloom pervaded analyst commentary.

Where consensus impressions see only risk, the investor spots opportunity. Now, with sentiment still muted but fundamentals strengthening, the stage looks set for Bitcoin’s next parabolic ascent.

New Higher Price Range Emerging

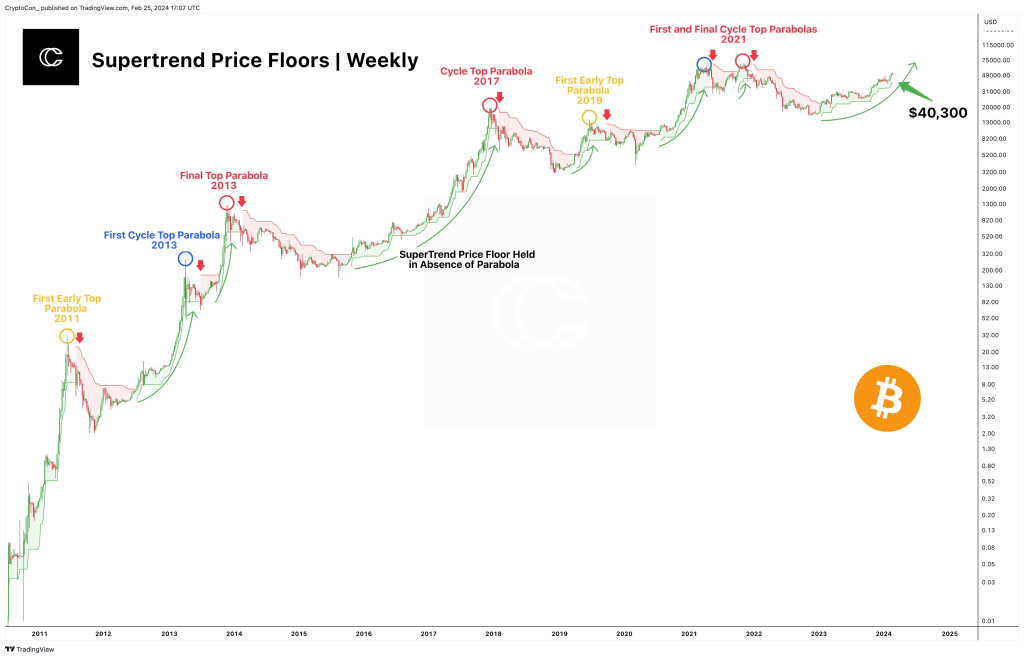

Tying this together, analytics resource CryptoCon examines Bitcoin’s technical patterns and finds evidence of marginally higher support forming. Specifically, CryptoCon suggests $40,300 now marks the lower boundary of Bitcoin’s trading range based on the Supertrend.

With metrics aligning to support a breakout, informed traders have begun positioning for increased volatility and potential upside acceleration if Bitcoin awakens from its slumber. While short-term choppiness persists, bracing for a larger move edges closer to fruition.

You may also be interested in:

- JasmyCoin (JASMY) Bull Flag Breakout Finally Complete; Price Must Now Break These Levels for Bullish Continuation

- Kaspa Analyst Reveals What KAS Will Be Worth by April 2024

- Why Binance Coin (BNB) Influences Ethereum (ETH) and How Does DeeStream (DST) Make 20X in Just Months?

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.