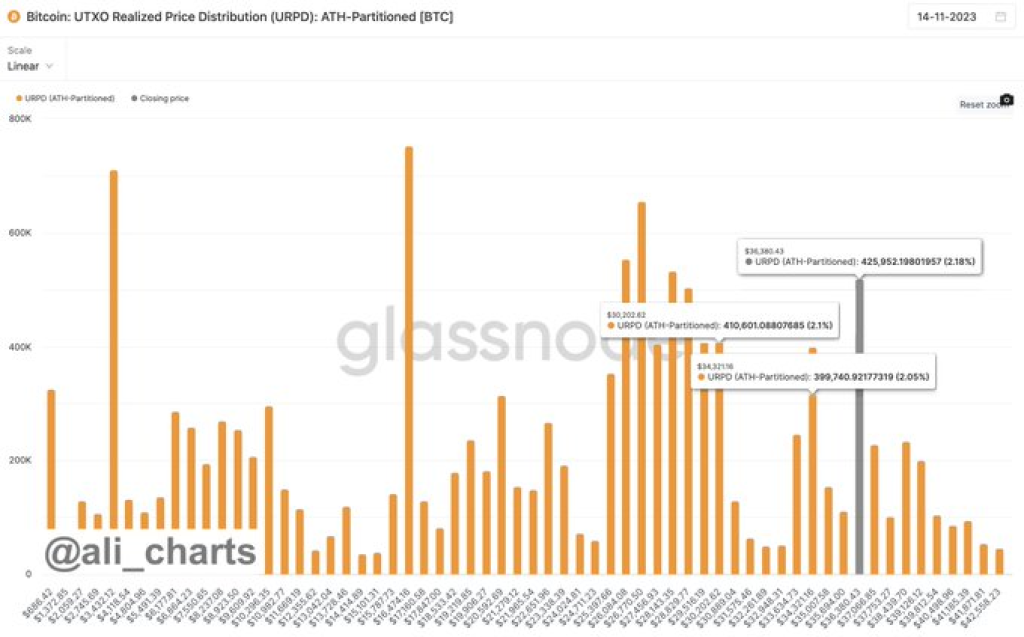

The past week has seen the Bitcoin price pull back from its recent highs above $40,000 as short-term momentum stalls. According to respected analyst Ali, BTC found initial support around $36,400, but the next key levels traders are watching lie at $34,300 and $30,200.

Ali notes that these demand zones could come into play if the $36,400 area gives way and selling pressure accelerates. Other analysts, like Seth, also highlight how current price action rhymes with previous cyclical bottoms.

In a detailed thread, Seth broke down how his proprietary Bitcoin model, relying heavily on monthly RSI data, accurately called the 2022 bottom. By comparing momentum oscillators across cycles, the model pinpointed when BTC was oversold on a macro level—a powerful contrarian signal.

Timing also played a key role in identifying where BTC was within its market cycle phases based on historical patterns. The confluence of momentum and cyclical analysis gave Seth high conviction on capitulating during panic as Bitcoin found its lows.

Of course, even in bull markets, corrections are inevitable. With BTC up over 70% in 2023 already, a pullback to refresh overheated conditions would be healthy. But Seth notes his model will continue evolving to decipher when dips may present buying opportunities vs. the start of a larger drawdown.

In the near term, the critical support levels highlighted by Ali and other experts are likely to attract buyers as long as the 2023 bull market remains intact. But prudent risk management and macro perspective will be key as usual to navigating volatility.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.