According to CryptoCon, Bitcoin is setting up for what he calls a “mega expansion” phase, one that could lead to faster and more dramatic price increases heading into the end of 2025.

After carefully mapping out BTC price action throughout Cycle 4, CryptoCon suggests that most of this cycle has been about slow, sideways movement, but the real fireworks might just be starting.

What you'll learn 👉

Bitcoin Has Spent Most of Its Time Ranging

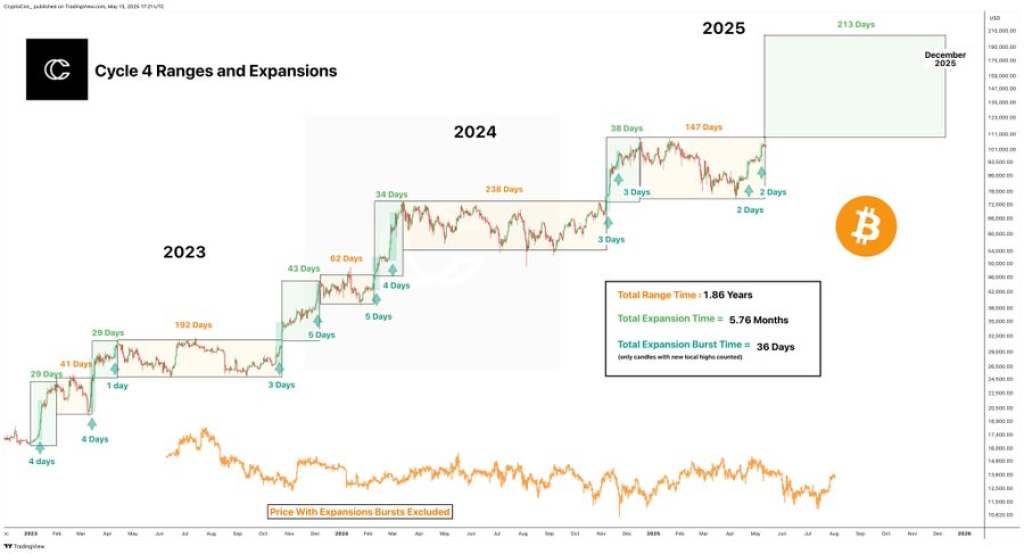

CryptoCon breaks down Bitcoin’s performance since the start of 2023 into two main phases: ranging and expanding. The data shows BTC has spent a total of 1.86 years in sideways price ranges. These periods, like the long 192-day range in late 2023 and the 238-day stretch into mid-2024, have dominated the current cycle. They’re marked by tight consolidation where Bitcoin price makes little meaningful upward movement.

While these long phases might feel dull to many traders, they seem to set the stage for brief but powerful expansion bursts. CryptoCon tracks these bursts and finds they’ve only added up to 5.76 months in total—yet they’re the moments when Bitcoin actually moves.

CryptoCon / X

The real kicker is in the sharp expansions that follow the long waits. Most of Bitcoin’s meaningful gains have happened in just 36 total days across the entire cycle, where price action hit new local highs. Four of those days came recently, which CryptoCon highlights as a possible early signal that the next big wave is just getting started.

A Mega Expansion May Be Right Around the Corner

CryptoCon believes we’re on the edge of another breakout. After observing a small 2-day expansion in early 2025, he’s projecting that the next move could be the largest one yet—what he calls a “mega expansion” phase. His chart forecasts this run could last up to 213 days, potentially taking Bitcoin price into six-figure territory by December 2025.

Read More: Cardano (ADA) Now Looks Ready for Its Next Leg Up: Analyst Reveals Price Target

This part of the cycle is when CryptoCon expects the classic bull market parabola to kick in. In his words, “Once we reach more new ATHs, the genie is out of the bottle.” That suggests once BTC clears certain resistance levels and sets new all-time highs, the move could accelerate quickly and catch many off guard.

The idea behind this chart is simple but powerful. Most of Bitcoin’s time has been spent going nowhere. But when it moves, it really moves, and we might be just days or weeks away from the kind of run that defines an entire cycle. CryptoCon’s data-driven look at Cycle 4 provides a compelling reason to watch BTC closely through the second half of 2025.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.