Bitcoin is back below $90,000 and that alone is enough to make many traders uneasy. After failing to hold above the $95,000 area, the mood across the market has clearly shifted. Fear is creeping back in and the calls for deeper pullbacks are getting louder.

Still, not everyone sees this move as the start of something ugly.

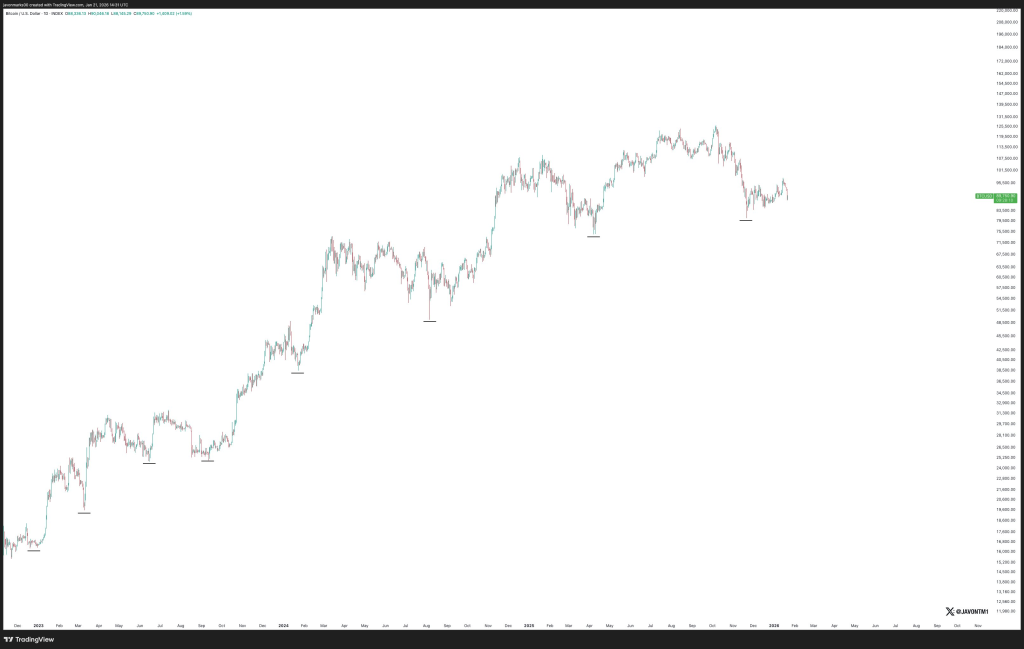

Crypto analyst Javon Marks shared a chart that tells a different story. His point is simple. Bitcoin is still holding a higher low structure on the larger timeframe, and that keeps the broader uptrend alive, even with all the noise around short-term weakness.

Let’s unpack what he means and why this matters.

What you'll learn 👉

What Javon Marks Is Pointing Out

If you zoom out on Bitcoin’s chart, a pattern stands out. Every major pullback over the past cycles has ended higher than the previous one. The market keeps finding support earlier each time it drops.

That is exactly what a higher low looks like.

In his chart, Marks highlights how Bitcoin pulled back from recent highs but never lost the key support zones that define the trend. Instead of collapsing, price stabilized and bounced from levels that are still well above the last major bottom.

That tells a story of buyers stepping in sooner, not later. And when that keeps happening, it usually means large players are still accumulating, not running for the exits.

Marks goes one step further and maps out a potential move back toward the $126,200 area if this structure continues to hold. From current levels, that would mean a rally of roughly 40%.

It sounds aggressive, but the logic behind it is not random. It is built on how Bitcoin has behaved in past cycles when similar patterns formed.

Why the Market Feels Weak Right Now

Even if the structure still looks constructive, it is easy to understand why sentiment has turned negative.

Bitcoin sitting below $90,000 does not inspire confidence, especially after the market spent weeks flirting with higher levels. Many traders expected a clean push to new highs, not another pullback.

But this move is not happening in a vacuum.

At the World Economic Forum in Davos, Citadel CEO Kenneth Griffin warned that U.S. bond yields nearing 5% could become a serious problem for risk assets. When safe yields rise that high, investors start rethinking where they want their money parked.

That kind of environment usually leads to defensive positioning. Less appetite for volatility. Less patience for assets that do not produce yield.

Crypto, by nature, feels that shift fast.

So part of what we are seeing now is not a failure of Bitcoin itself, but capital becoming more cautious across the board.

Read also: Wall Street Just Invaded Solana: Ondo Brings 200+ US Stocks Onchain in a Tokenization Shockwave

Why the Bigger Picture Still Leans Bullish

Here is the key part that often gets lost in the noise.

A market can correct without breaking its trend. That is what seems to be happening now.

Bitcoin is pulling back, but it is not making lower lows on the larger timeframe. As long as that holds, the broader structure still favors continuation rather than collapse.

This is very different from true bear markets, where every bounce gets sold and each low is lower than the last one.

Right now, dips are still being bought. Maybe not aggressively, but consistently.

And that alone keeps the bullish case alive.

What Would Change the Story

For this view to stay valid, Bitcoin needs to defend the current support area. A sharp breakdown that takes price well below recent lows would be a different story and would force a rethink.

On the upside, reclaiming the $95,000 to $100,000 zone would shift momentum back toward the bulls and reopen the conversation about new highs.

Until then, Bitcoin sits in a waiting phase. Not broken. Not flying either.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.