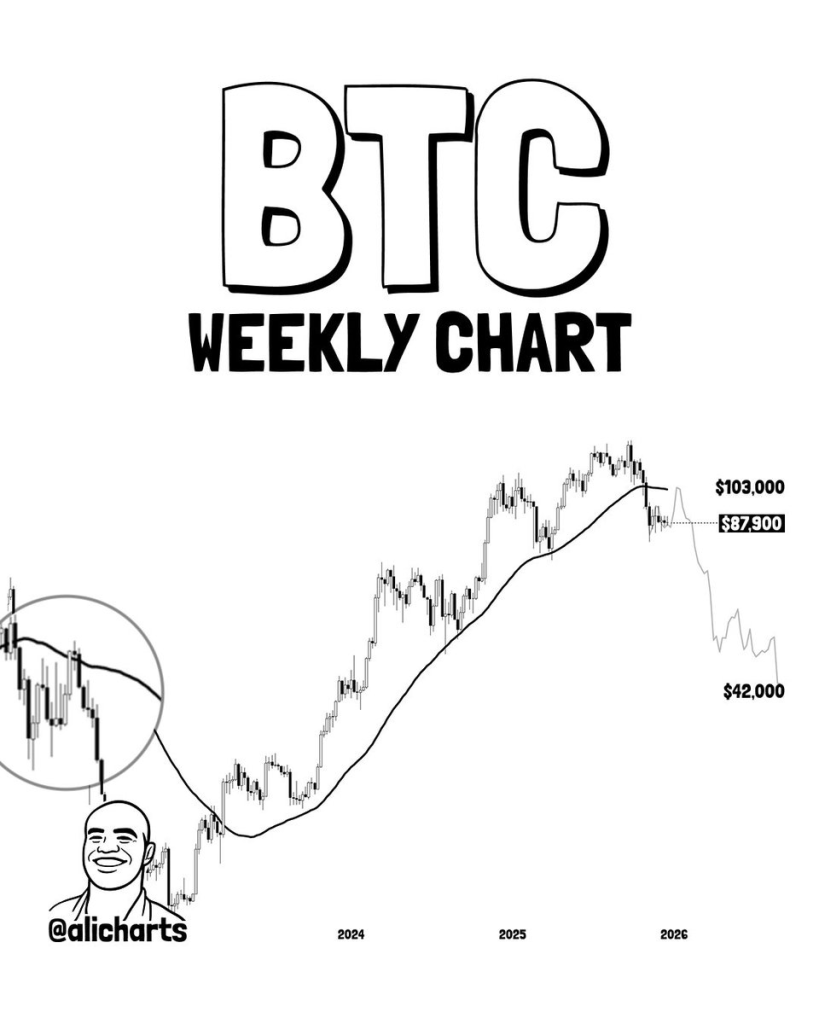

Prominent market analyst Ali Martinez has again highlighted the possibility of the Bitcoin price capitulating from the current levels despite the recent recovery.

He noted that the short-term rebound does not invalidate Bitcoin’s bearish structure on the higher timeframe. The market analyst insisted that this could be a brief rebound before a 56% capsize to $42,000.

What you'll learn 👉

Bearish Structure Remains

Bitcoin bounced to $97,900 earlier in the week, reaching a level last seen on December 4, 2025. The rally spread renewed bullishness around the crypto space, but has not changed Martinez’s stance.

In a tweet, he explained that short-term rebounds before a bearish continuation are common for Bitcoin, especially when it falls below the 50-week simple moving average. For context, Bitcoin lost the 50W SMA in early 2022 but quickly rebounded to retest the resistance. It again didn’t hold the trendline, continuing its bearish trend to the bear market lows of $15,000.

Martinez sees this repeating even as Bitcoin holds critical levels. His earlier analysis identified the 50W MA at around $103,000. This implies that the coin might trend higher, but remains bearish overall in higher timeframes.

Bitcoin Both Bearish and Bullish

Martinez went further to explain that analysts can be both bearish and bullish. Because analyses are not predictions, they depend on the timeframe and the specifics of what the chart is saying at that time.

Again, he emphasized that an asset can be both bearish and bullish at the same time. In Bitcoin’s case, it is bullish within its macro-structure, yet remains bearish on higher timeframes.

As a result, he sees BTC ultimately targeting the $42,000 region, representing a 56% drop from the current market price. Notably, this builds on his conviction that the crypto is still maintaining its four-year cycle and that Bitcoin has peaked at its October 2025 high of $126,200. It also closely aligns with Bloomberg strategist Mike McGlone’s prediction that Bitcoin would drop to $50,000.

This Hidden Gem Eyes Breakout Despite Bitcoin Uncertainty

While uncertainties remain for Bitcoin, Minotaurus (MTAUR) has remained bullish, eyeing a breakout to higher prices. Whales are beginning to pay attention to this hidden gem following this show of strength, diversifying their funds considerably into the token.

Minotaurus has emerged as a real contender for top performer this cycle, with both adoption and momentum on its side. For the uninitiated, MTAUR is the native token of Minotaurus, a blockchain-based game in which players explore intricate mazes, battle enemies, and collect treasures. By combining engaging gameplay with blockchain technology, the project has caught the attention of crypto fans and enthusiasts of the projected $29 billion casual gaming sector.

Meanwhile, with an entry price of just 0.00012636 USDT, Minotaurus is an affordable option for those looking to acquire the potential next big thing. Furthermore, MTAUR token holders enjoy exclusive perks, including referral bonuses, vesting incentives, and the opportunity to participate in a 100,000 USDT giveaway.

With Bitcoin tipped to correct considerably, Minotaurus offers a real opportunity to diversify into bullish assets with massive use cases and upside potential. Leverage this opportunity now and buy MTAUR while prices are still affordable.

DISCLAIMER: CAPTAINALTCOIN DOES NOT ENDORSE INVESTING IN ANY PROJECT MENTIONED IN SPONSORED ARTICLES. EXERCISE CAUTION AND DO THOROUGH RESEARCH BEFORE INVESTING YOUR MONEY. CaptainAltcoin takes no responsibility for its accuracy or quality. This content was not written by CaptainAltcoin’s team. We strongly advise readers to do their own thorough research before interacting with any featured companies. The information provided is not financial or legal advice. Neither CaptainAltcoin nor any third party recommends buying or selling any financial products. Investing in crypto assets is high-risk; consider the potential for loss. Any investment decisions made based on this content are at the sole risk of the readCaptainAltcoin is not liable for any damages or losses from using or relying on this content.