According to technical analyst Rekt Capital, Bitcoin’s latest move to $45,000 suggests the top cryptocurrency could soon start to pull back from its recent highs. In a December 31 Twitter post, Rekt Capital noted that Bitcoin had reached an important resistance level around $45,000.

“**Bitcoin reached $45,000. History suggests this trendline resistance could reject price into a moderate Pre-Halving retrace,**” Rekt Capital stated.

What you'll learn 👉

Projected Price Retracement Level

For some additional context, Rekt Capital has projected that the coming retracement could take Bitcoin’s price back down to the $40,000 level before the upcoming halving event expected in April 2024. As he suggested in his tweet, “**From Rekt Capital’s price analysis, the retracement could take BTC back to around 40k for his projected pre-halving retrace.**”

So in Rekt Capital’s view, Bitcoin hitting resistance around $45,000 could lead to a pullback toward $40,000 over the next few months. With Bitcoin’s closely-watched halving just months away, some volatility in BTC’s price action would not be surprising during this period.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Upcoming Bitcoin Halving Event

For those unfamiliar, the Bitcoin halving refers to the periodic reduction in the cryptocurrency’s production rewards that occurs roughly every four years. Specifically, the amount of new Bitcoin created and awarded to miners gets cut in half at each halving – thus reducing the inflation rate of new coin supply over time.

The next Bitcoin halving is scheduled for April 2024. This widely-anticipated event has preceded major bull rallies in past market cycles. However, **CryptoCon** offered an interesting historical comparison between the current cycle and previous ones.

Historical Cycle Comparison

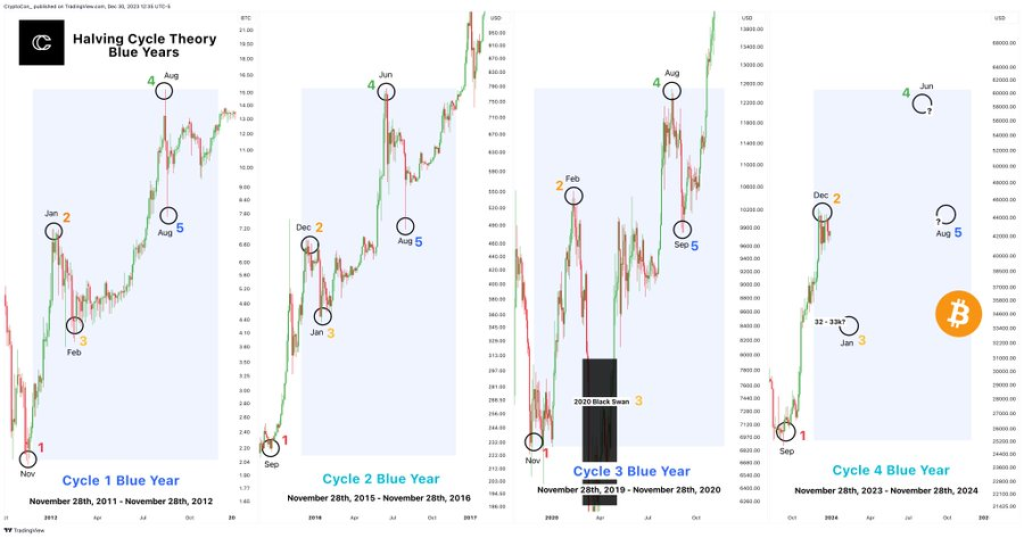

In a separate December 31 analysis, **CryptoCon** took a close look at Bitcoin’s four-year boom and bust cycles tied to each halving event. As CryptoCon explained, “**Even more similar, are the comparisons to alternating cycles. Cycles 1 and 3 rallied strongly at the beginning of Blue Year in November, while this cycle and cycle 2 started in September.**”

Therefore, CryptoCon believes the timing of Bitcoin’s peak this cycle aligns more closely with the second cycle’s December top rather than the November tops of other cycles. “**Like cycle 2, I believe Bitcoin topped in December,**” CryptoCon concluded.

In terms of what’s next for Bitcoin, CryptoCon acknowledged there is still much uncertainty around the crypto market’s direction in the new year. While some speculate around the potential approval of a Bitcoin exchange-traded fund (ETF) in 2022, CryptoCon cautions that “**no one knows what will occur with ETFs, and everything we have seen is speculation.**”

So in summary, analysts seem to suggest Bitcoin could be primed for a period of consolidation or retracement after its volatile 2021 run. Yet historical data also indicates the cryptocurrency could still have room left to run in 2022 if past market cycles repeat. For now, traders appear focused on Bitcoin maintaining support near $40,000 as the next halving approaches.

You may also be interested in:

- Kaspa (KAS) Secures New Exchange Listing Again Despite Unencouraging Price Action

- Why Is Creditcoin (CTC) Pumping? There Is Even Room for Further Price Increase

- Why Is Internet Computer (ICP) Price Surging: Analyst Anticipates 30% More Price Rise From Here

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.