Bitcoin price has come under renewed pressure after a sharp wave of institutional outflows weighed on market confidence. The leading cryptocurrency has struggled to regain upside momentum as large holders reduce exposure.

Despite this setback, the technical structure suggests Bitcoin may still have room to stabilize and recover if conditions improve.

What you'll learn 👉

Bitcoin Institutions Are Skeptical

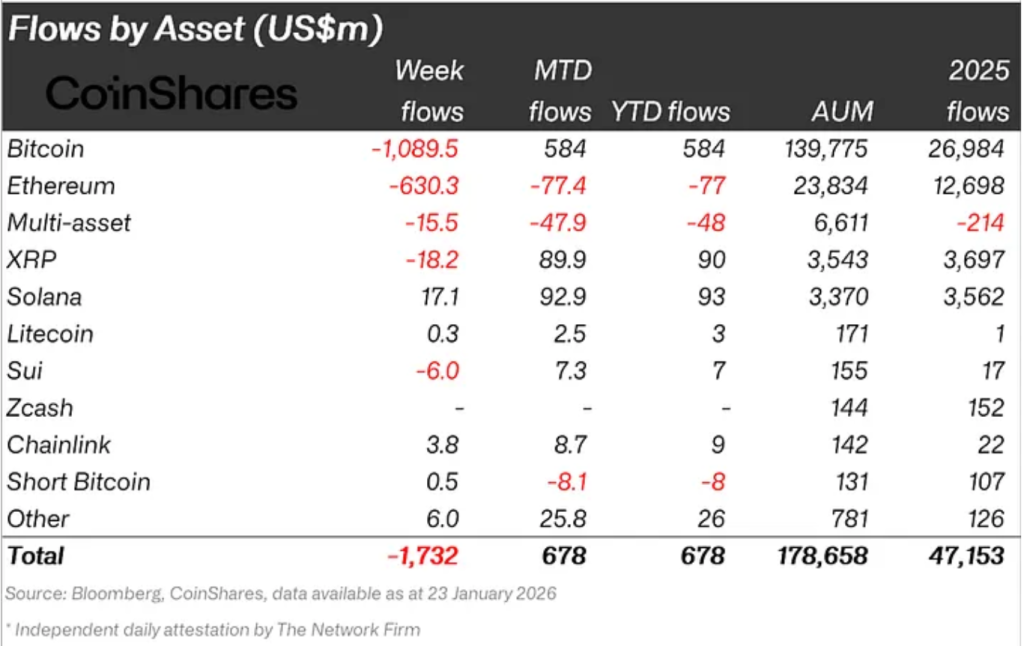

Institutional sentiment toward Bitcoin weakened significantly in the week ending January 23. Data shows institutional holders pulled $1.08 billion from Bitcoin ETPs. This marked one of the largest weekly outflows in recent months, reflecting rising caution among professional holders.

Such withdrawals often signal reduced risk appetite rather than outright rejection of Bitcoin’s long-term value. Institutions typically respond to macro uncertainty, interest rate expectations, and regulatory developments. Their retreat highlights concerns that Bitcoin price recovery could take longer than previously expected.

Bitcoin Institutional Inflow – Source – Coinshares

Institutional holders also hold considerable influence due to capital size and market impact. Sustained outflows can limit upside momentum and dampen sentiment among retail participants. This dynamic increases short-term volatility and complicates the Bitcoin price path toward higher targets.

Bitcoin Profits Drop, But Price Rise Becomes Likely

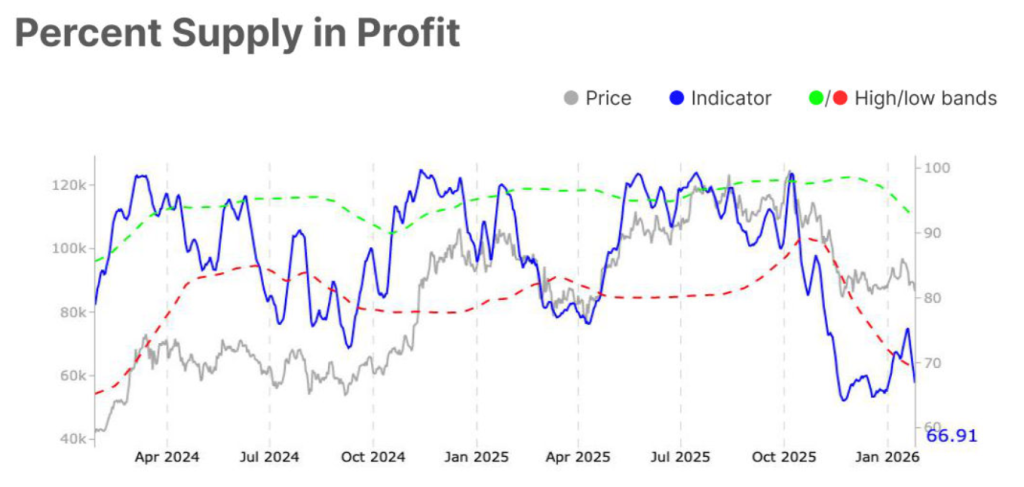

Blockchain data adds further support to this view. Overall profitability across the Bitcoin network has declined sharply, with the portion of supply sitting in gains falling from 75.3% to 66.9%.

This drop pushed the metric below its long-term lower boundary near 69.1%, a level that has often aligned with periods of price stabilization. As more holders move into unrealized loss, the urgency to sell typically fades, reducing near-term supply pressure.

Bitcoin Supply In Profit – Source – Glassnode

In previous cycles, moves beneath this profitability threshold have functioned as a market reset, enabling price to build a foundation before the next upward expansion. While a brief bearish phase recently interrupted this tendency, Bitcoin is now changing hands well below former highs.

That backdrop improves the likelihood that holders view current weakness as an accumulation opportunity rather than a signal to reduce exposure.

Can Bitcoin Price Recover Its Losses?

Bitcoin is currently changing hands just above the 23.6% Fibonacci retracement level, a key technical zone. This level is widely viewed as a bear market support floor. Holding above it suggests Bitcoin still retains underlying strength despite persistent selling pressure.

If institutional sentiment improves and long-term holders shift back to accumulation, the Bitcoin price could regain upside momentum. A move above $90,000 would signal renewed strength and attract sidelined capital. The more critical milestone remains $94,087, which aligns with the 50% Fibonacci retracement level.

Bitcoin Price – Source – TradingView

Reclaiming $94,087 as support would mark a meaningful shift in market structure. It would also suggest that institutional selling pressure is easing. Such a development could restore confidence among longer-term holders.

Once $94,087 is secured, Bitcoin would likely target the $98,000 level next. A break above that zone could open the path toward the psychological $100,000 mark.

How Does Bitcoin Price Rise Help Tokens Like Minotaurus (MTAUR)?

A prolonged uptrend in Bitcoin typically lifts sentiment across the broader crypto market. Once BTC shows signs of stability, capital often flows into smaller digital assets. Projects such as Minotaurus (MTAUR), which tend to move in alignment with Bitcoin’s direction, could see accelerated price momentum in the near term.

However, MTAUR is not driven by Bitcoin alone. The project is supported by a growing community of more than 20,000 participants, providing a strong base of engagement. Changing hands at approximately 0.00012648 USDT, the token remains accessible to a wide range of users. Its appeal extends beyond short-term speculation, focusing instead on practical application.

Minotaurus serves as the core utility token within a blockchain-based maze game where tokens are actively used. This functionality is already live, not merely conceptual. The project’s tokenomics emphasize balance, with just 2% of the supply reserved for the development team. An additional 10% is dedicated to community incentives, reinforcing long-term sustainability.

These factors position emerging projects like Minotaurus (MTAUR) as credible portfolio additions. While Bitcoin’s rally can provide momentum across the altcoin market, long-term performance often favors tokens backed by real utility and sound fundamentals.

DISCLAIMER: CAPTAINALTCOIN DOES NOT ENDORSE INVESTING IN ANY PROJECT MENTIONED IN SPONSORED ARTICLES. EXERCISE CAUTION AND DO THOROUGH RESEARCH BEFORE INVESTING YOUR MONEY. CaptainAltcoin takes no responsibility for its accuracy or quality. This content was not written by CaptainAltcoin’s team. We strongly advise readers to do their own thorough research before interacting with any featured companies. The information provided is not financial or legal advice. Neither CaptainAltcoin nor any third party recommends buying or selling any financial products. Investing in crypto assets is high-risk; consider the potential for loss. Any investment decisions made based on this content are at the sole risk of the readCaptainAltcoin is not liable for any damages or losses from using or relying on this content.