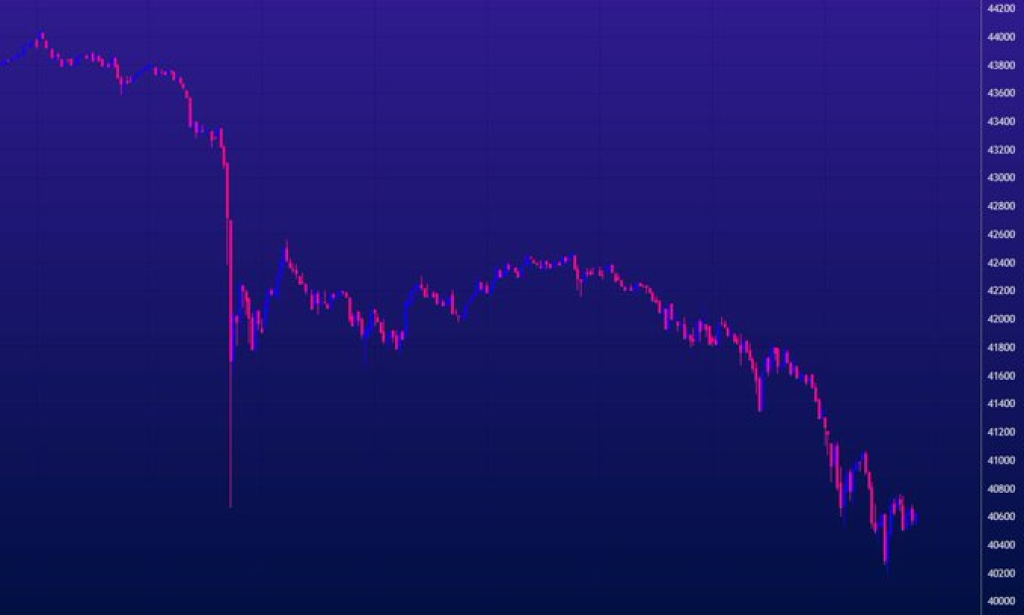

Amidst the euphoria over Bitcoin’s rally back above $45k, contrarian analyst WhaleWire cautions that the top crypto remains stuck in a broader bear trend that has further to run.

WhaleWire argues the last few months’ rebound represents a “manipulated rally designed at luring retail suckers for exit liquidity.”

With overwhelming bullish sentiment expecting new all-time highs ahead, the reality may be quite the opposite, according to the analyst.

On the way up, almost every analyst cited the network’s strong on-chain fundamentals, like growing hashrate, as justification for calling the bottom.

Contrary to the prevailing sentiment that Bitcoin is poised to reach new all-time highs, WhaleWire suggests that the short-term targets for Bitcoin involve a potential dip below $40,000 and even further to $30,000. Looking into the medium term, the prediction extends to levels below $20,000 and $10,000.

This contrarian viewpoint challenges the overwhelmingly bullish narrative that has dominated the crypto community, cautioning against unwarranted optimism fueled by sensationalist predictions from various sources.

Read also:

- Polygon (MATIC) Whales Make Mystery Moves Amid Price Plunge

- Chainlink (LINK) Signals Breakout with Eyes Set on This Key Resistance

- Battle for Attention: New Cryptocurrency’s Presale Versus Dogecoin’s Anticipated Surge

It may not be a popular opinion, but WhaleWire’s warnings about excessive optimism seem to warrant consideration. Betting the entire farm on a straight-line recovery here could leave bulls burned once again if bearish technical and macro forces reassert control.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.