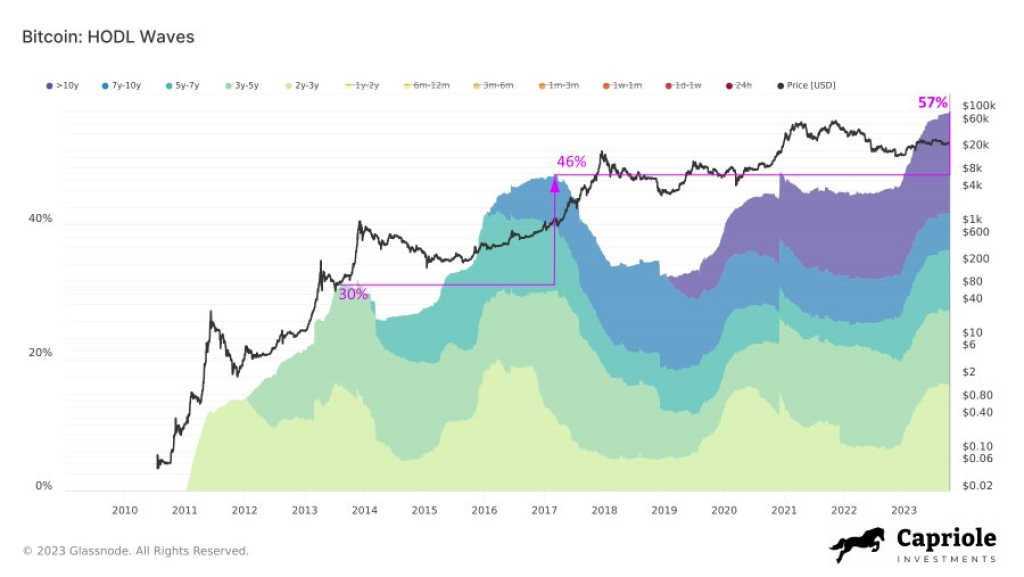

According to recent data, the growth of long-term Bitcoin holders has surged to levels comparable only to 2016, marking a significant development in the cryptocurrency landscape. This massive expansion of Bitcoin’s “Hodl Waves” could potentially have major implications for the upcoming 2024 cycle.

What you'll learn 👉

Key Takeaways:

- Long-term BTC Holder Growth: The growth of long-term Bitcoin holders has experienced a remarkable surge, reaching levels akin to the growth observed in 2016. This surge is a notable departure from the 2017-2020 cycle when hodler growth was more subdued.

- Increased Hodler Base: The increasing number of hodlers in the Bitcoin community suggests a stronger holding sentiment among investors. This is a significant factor as it reduces the selling pressure on the market.

- Comparing Cycles: It’s worth noting that the 2017 bull run resulted in 10x price gains, while the 2020 bull run saw 3x gains. The surge in hodler growth hints that the 2024 cycle may bear more resemblance to the 2017 bull run in terms of price performance.

- Potential for Larger Gains: With the substantial increase in hodlers, the current cycle could potentially see even larger gains than the previous one. The growing commitment of long-term holders may contribute to stronger price appreciation.

Looking Ahead to 2024:

The rapid expansion of Bitcoin’s Hodl Waves indicates a growing pool of long-term holders who are less inclined to sell their holdings. As more coins are locked away in wallets for extended periods, future bull runs could exhibit sharper and more sustained price appreciation.

This data paints an optimistic picture for Bitcoin’s prospects in 2024, as belief in its narrative as digital gold continues to gain traction. With investors extending their time horizons and maintaining their faith in Bitcoin’s potential, bullish momentum has ample room to build. The stage appears to be set for substantial growth in the cryptocurrency market in the coming years.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.