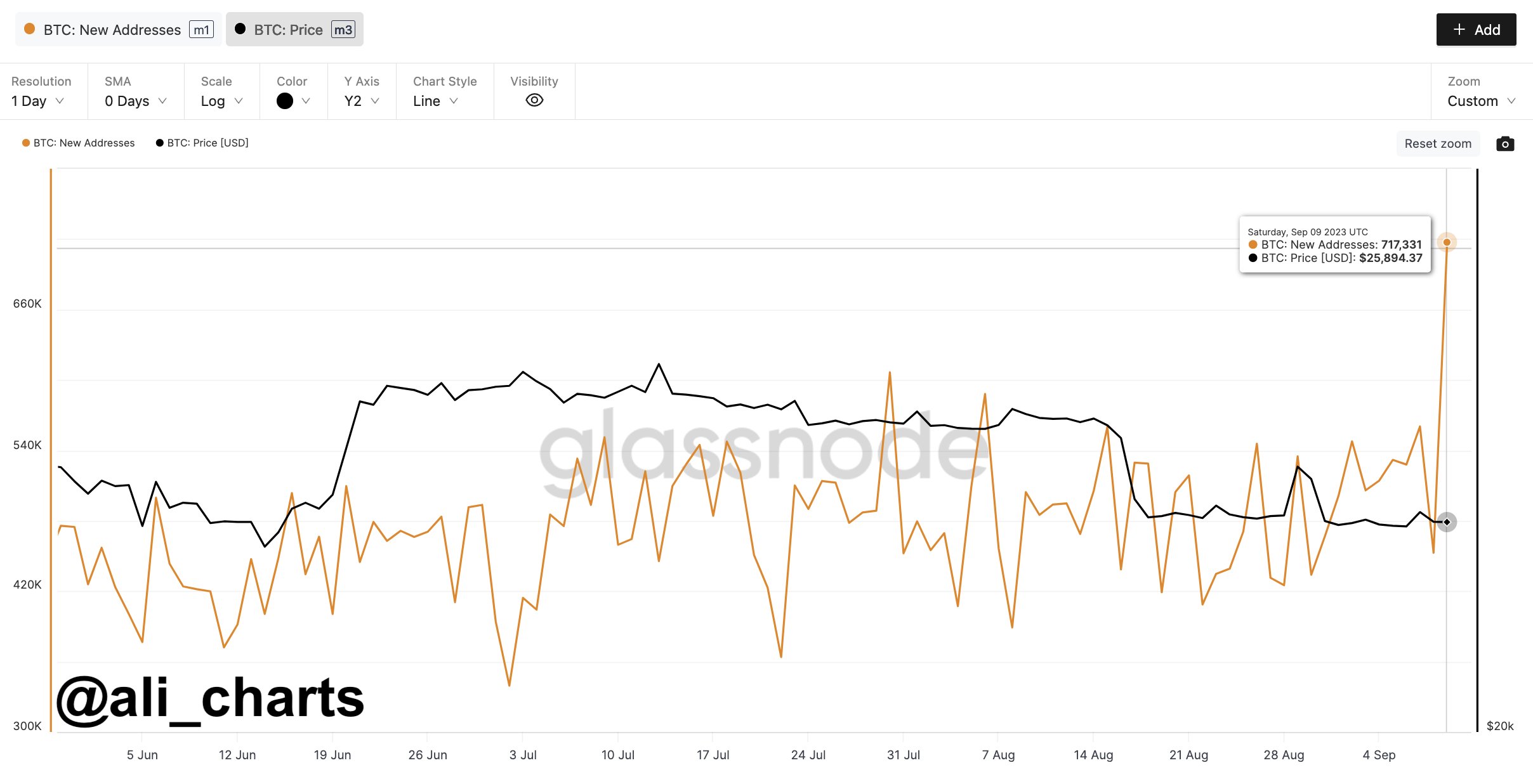

On September 9, 2023, the Bitcoin network witnessed a staggering increase in user adoption, with 717,331 new Bitcoin addresses being created. This marks the highest surge in new addresses in the last five years. The only other time such a significant uptick occurred was on December 14, 2017, when 800,180 new Bitcoin addresses were generated. This recent event has left both experts and enthusiasts pondering its implications.

What you'll learn 👉

Contextualizing the Surge

The 2017 Boom

The previous record set on December 14, 2017, was during the infamous Bitcoin bull run, when the cryptocurrency’s price soared to nearly $20,000. The surge in new addresses at that time was largely driven by retail investors flocking to get a piece of the action.

The Current Landscape

The current surge is particularly noteworthy because it comes at a time when Bitcoin has already established itself as a more mature asset, with increased institutional interest and regulatory clarity compared to 2017.

Sustained Hope in Bitcoin Despite Its Unfavorable Price Action

The uptick in new Bitcoin addresses suggests a growing interest in the cryptocurrency, even amidst its current stagnant trading performance. This could be interpreted as a bullish indicator of Bitcoin’s long-term prospects. The expanding user participation serves as a testament to enduring confidence and trust in the network.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Implications of the Surge

Market/Price Impact

The surge in new addresses could potentially lead to increased liquidity and trading volume, which in turn could impact Bitcoin’s price positively.

Regulatory Attention

The sheer scale of new user adoption could attract more regulatory scrutiny, as governments may look to implement stricter controls on cryptocurrency transactions.

The recent surge in Bitcoin addresses is a historic event that could signify a pivotal moment for the cryptocurrency. Whether driven by technological advancements, mainstream adoption, or economic uncertainty, this phenomenon warrants close attention from both market participants and regulators alike.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.