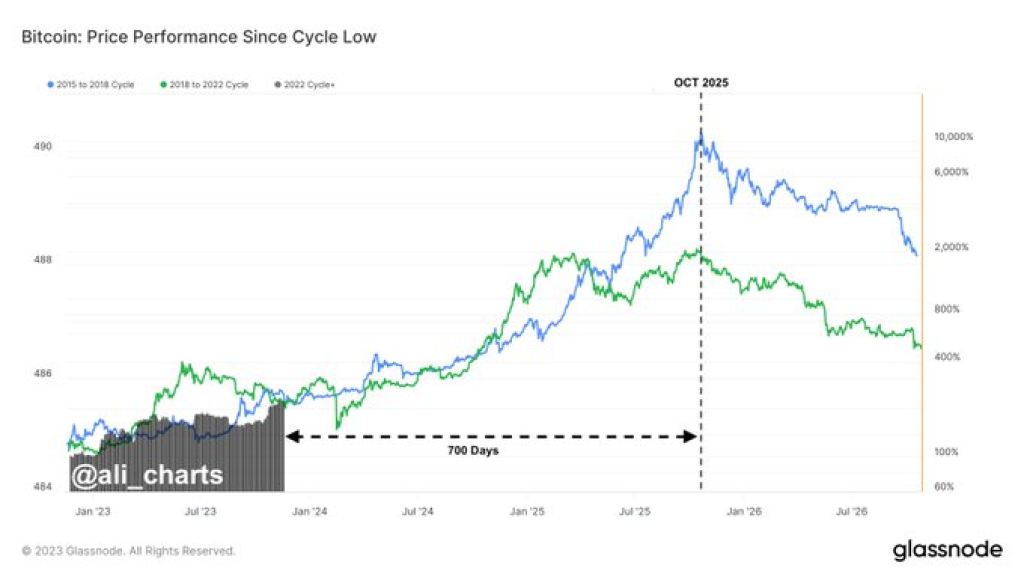

Bitcoin’s current price action closely tracks previous market cycles and suggests the top cryptocurrency still has almost two more years of upside remaining in its bull run, according to crypto trader Ali.

Ali notes that mirroring Bitcoin’s past two major bull markets points to the next peak arriving around October 2025. This projection is based on analyzing the duration and magnitude of gains from respective cycle bottoms.

The 2015–2018 bull run saw Bitcoin surge from under $200 to around $20,000 before topping out. The 2018–2022 cycle then took BTC from roughly $3,100 to $69,000 at its high. Measuring from peak to peak, each advance lasted approximately 1,100 days.

If history repeats itself, Ali calculates that Bitcoin could trend higher for another 700 days from now. This timeline would culminate around October 2025, implying over two more years of potential bullish momentum.

Of course, there is no guarantee that Bitcoin precisely mimics prior cycles. But the striking symmetry of previous advances gives credence to the notion that Bitcoin could see accelerating upside momentum into late 2024 before culminating in blow-off tops in 2025.

Read also:

- Solana Bullish as SOL Reaches $60 First Time Since May, But Initial Retracement to This Level Is Possible

- This BTC Indicator Makes It ‘Incredibly Easy’ to Know if Bitcoin Is in a Bull or Bear Market

- Analyzing Future Prospects: $ROE, XRP, and SOL’s Potential for Market Growth

For now, Bitcoin continues to build upon a 23% recovery from its recent lows. If key support levels hold, history provides a template for Bitcoin to sustain this bull run for an extended period as it revisits its former glory and sets new all-time highs.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.