The analysis was conducted by Rekt Capital, a premier analyst and renowned trader on Twitter, who thoroughly researched Bitcoin’s historical performance in the month of September. According to Rekt Capital, September has generally been a negative month for Bitcoin.

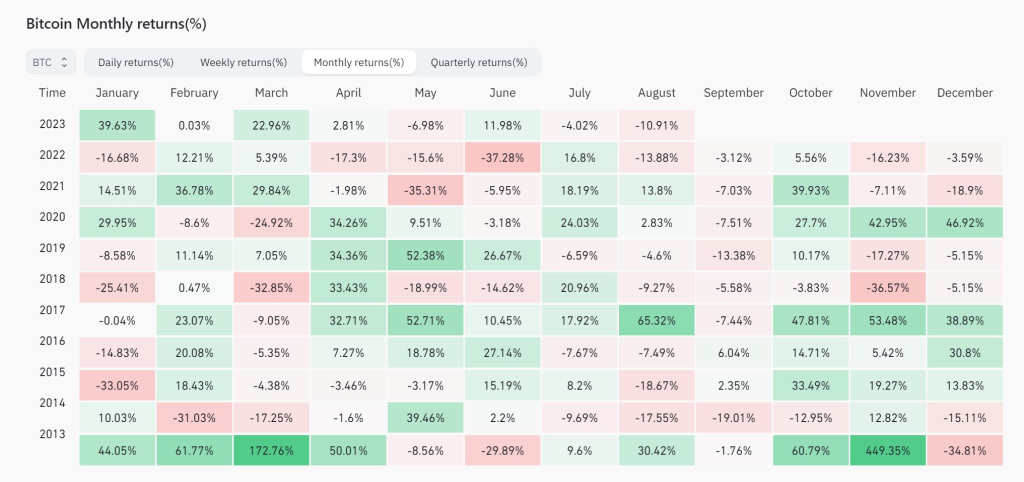

This observation is backed by data showing that 8 out of the past 10 Septembers have experienced downside. Interestingly, only two months, September 2015 and 2016, bucked this trend, recording small, single-digit gains of +2% and +6%, respectively.

When it comes to the most likely retrace we could expect, the recurring theme appears to be a -7% dip throughout the month. This specific percentage of drawdown was observed in the years 2017, 2020, and 2021. Another close figure was a -5% dip in 2018, which aligns closely with the -7% mark.

As for the possibility of a double-digit drawdown, it’s relatively rare but not unprecedented. Bitcoin saw double-digit retracements only in 2014 and 2019, with declines of -19% and -13%, respectively. However, Rekt Capital advises caution when comparing 2014 to 2023, as the former was a Bear Market year, while 2023 is considered a “Bottoming Out” year, making it more comparable to 2019 or even 2015.

Regarding the potential for another crash in September, the analyst points to 2019 as a reference year. In that year, Bitcoin experienced a -13% retrace in September, but it’s important to note that this followed one of Bitcoin’s worst-ever August drawdowns at -16%.

Given this context, Rekt Capital suggests that it’s unlikely for Bitcoin to experience severe back-to-back drawdowns in both August and September.

In his personal thoughts, Rekt Capital speculates that a drawdown of around -7% to -10% could reasonably occur this September, which would see Bitcoin’s price dropping to approximately $24,000 to $23,000. This analysis offers a comprehensive view of what traders might expect for Bitcoin in the coming month, especially when considering historical trends and current market conditions.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.