In the dynamic world of cryptocurrency, Bitcoin continues to be a stable force. Bitcoin has been maintaining a steady course, floating above the $30,000 mark for the past six days. This stability in Bitcoin’s price, amidst the general volatility of the cryptocurrency market, is a noteworthy development and could potentially signal a period of consolidation before the next significant price movement.

As an impartial observer of the market, it’s clear that Bitcoin is currently navigating the choppy waters of its fourth wave, a phase characterized by less exciting price action and potential investor fatigue.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +However, this seeming stagnation could be a harbinger of change. The fourth wave, while often seen as a period of boredom, could be signaling the end of its cycle, paving the way for the much-anticipated fifth wave. This next phase could potentially usher in a period of increased price activity and investment opportunities.

Bitcoin’s recent price trends have respected key resistance parameters, notably the 78.6% retracement level. The cryptocurrency’s inability to break and sustain above the $30,780 level suggests that it remains within its fourth wave. However, should the price go lower and maintain a level above $28,546, this could confirm the commencement of the fifth wave, a phase often associated with significant price movements.

Investors and traders should keep a keen eye on these key price levels. As long as Bitcoin’s price holds above the $26,190 support level, the focus could be on higher prices. However, a drop below this level could necessitate a shift in strategy, with a more bearish scenario coming into play.

It’s crucial to remember that while bearish scenarios are considered, they hold little relevance as long as Bitcoin’s price remains above bullish support levels. As we continue to monitor Bitcoin’s journey through its current wave cycle, the potential for significant price movements and investment opportunities remains high.

While the market may currently seem ‘boring’, this could be the calm before the storm. As Bitcoin potentially nears the end of its fourth wave, the stage could be set for a period of increased price activity and exciting investment opportunities. As always, investors are advised to keep a close eye on key price levels and market trends.

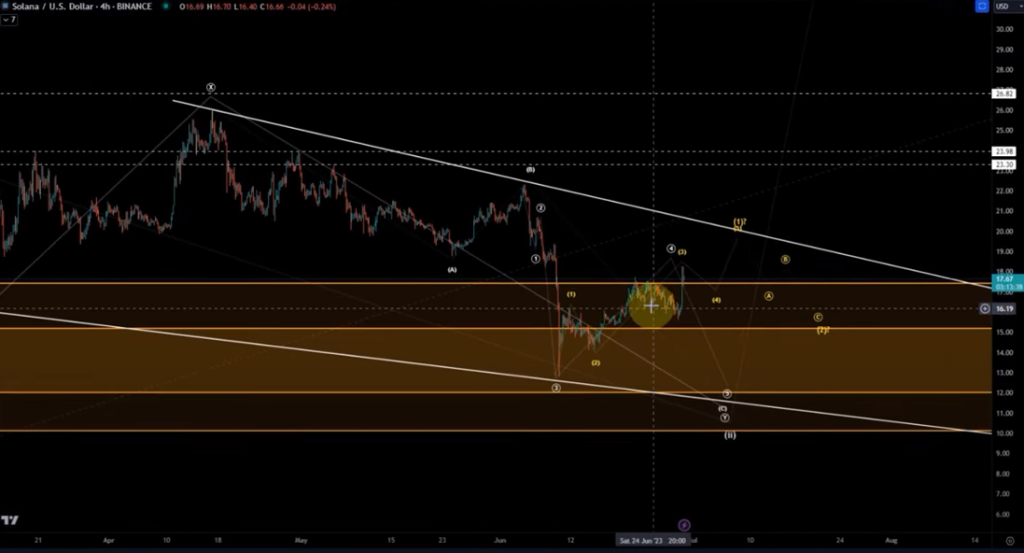

Solana (SOL) on the Rise: An In-Depth Analysis of the Recent Bullish Trend

Volatility is the norm in the world of crypto, and now Solana (SOL) has been making waves. The digital asset has seen an impressive surge of 11% in the last 24 hours, a bullish sign for investors and traders alike.

The recent price action of Solana has been positive, leaving its larger trend reversal area. This suggests that the low price point could already be in, as long as the $12 mark holds. This would mean that the focus can now shift to higher prices, a sentiment that is likely to be welcomed by those who have invested in this digital asset.

However, it’s important to note that the current price action does not give impulsive vibes. For a diagonal structure, another higher low and higher high would be needed. This means that while the price has been moving in a positive direction, there is still some uncertainty about its future trajectory.

One key level to watch is the 78.6% retracement at $14. This is a crucial support level that needs to hold for the bullish momentum to continue. If this level holds, it could pave the way for further gains in the price of Solana.

If the price really takes off, it could be assumed that we’re already in some kind of a third wave rally. However, this would need to be proven as one-two-one-two setups, especially if the second wave one is higher than the first one, are not typically reliable.

In conclusion, while the recent price action of Solana is encouraging, it’s important to approach it with a level of caution. The bullish scenario is being tracked, but the verification on the lower time frames is not yet visible. As always, it’s crucial to keep an eye on the market and make informed decisions based on thorough analysis.