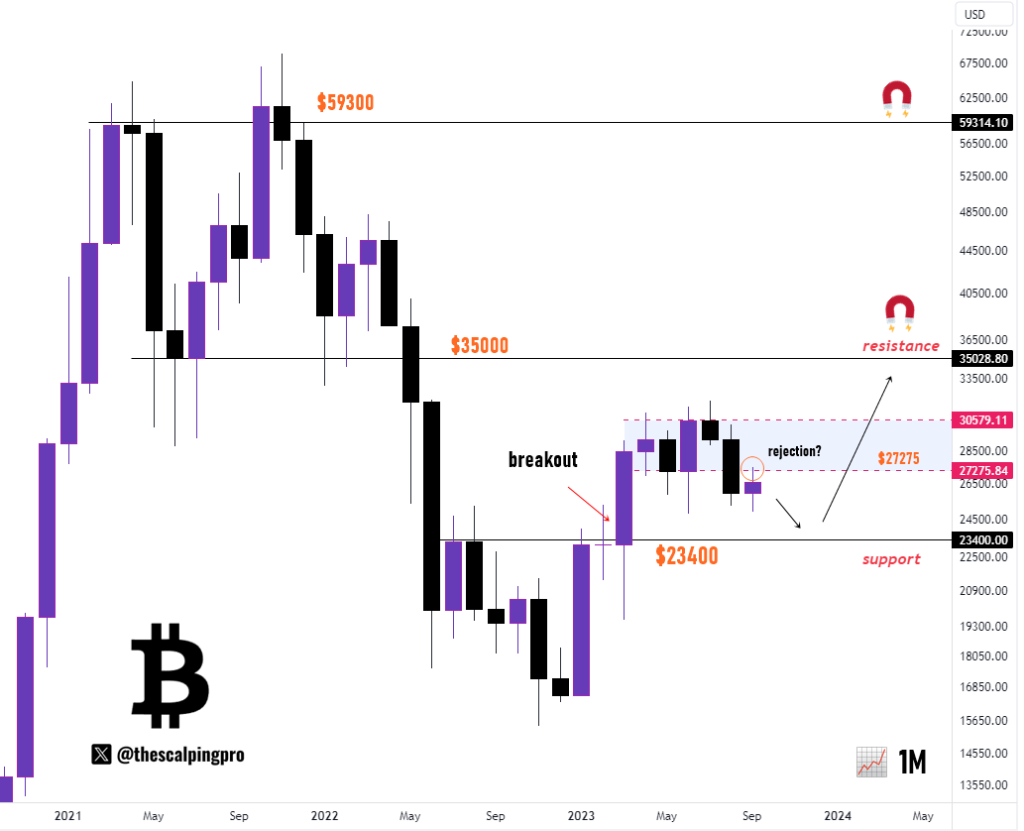

The price of Bitcoin has seen significant volatility over the past few months, trading in a range between support at $23,400 and resistance around $31,000. According to market analysts by Mags, Bitcoin now faces a crucial test that could determine if a major breakout is on the horizon.

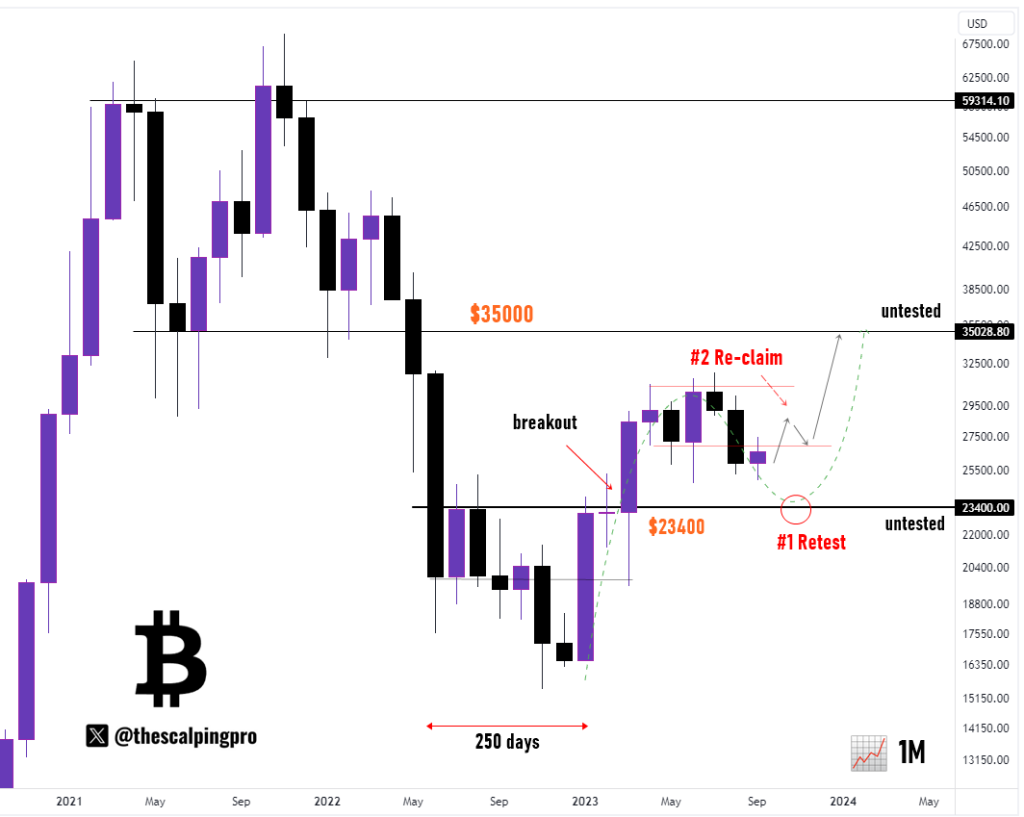

After breaking out above the $23,400 level in March following 250 days of trading below it, Bitcoin was rejected around the $31,000 area which is considered a key daily resistance level. For the past few months, Bitcoin has been oscillating between these two critical monthly levels at $35,000 and $23,400 without a clear direction.

Currently, Bitcoin is facing rejection once again from the local resistance at $27,275. Market experts have laid out two potential scenarios for Bitcoin’s price action over the upcoming weeks.

The first scenario sees Bitcoin continuing its downward trajectory, leading to another monthly red or black candle close and a retest of the $23,400 support level. This would be followed by a strong bounce in October as Bitcoin starts the new monthly candle.

The alternative scenario is for Bitcoin to reclaim the $27,275 level before the close of September, holding above the $23,400 support. This could lead to a bullish breakout above the current range in the October monthly candle close.

According to historical data, some analysts believe now is the perfect time to accumulate Bitcoin before the next major bull run. Bitcoin has typically moved in a choppy and sideways manner below its long-term trendline resistance. However, once the trendline is broken decisively, Bitcoin has entered prolonged bull markets in the past.

If history repeats itself, the current consolidation below resistance could represent one of the best buying opportunities ahead of the next run-up in price. As October approaches, analysts will be watching closely to see if Bitcoin can break out above its long-term trendline and confirm the start of a new bull market.

With Bitcoin facing a make-or-break moment ahead of a potential trend defining move, traders and investors will be paying close attention to price action at these key levels. The coming weeks could provide critical insights into where Bitcoin is headed next and how high it may run during the next bull cycle.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.