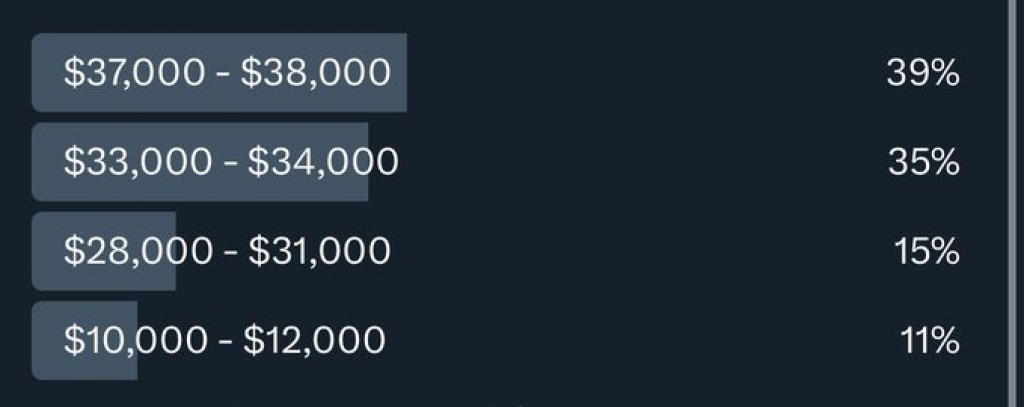

Bitcoin remains under pressure in early 2024, with BTC still struggling to gain traction. However, according to trader Ali, the foremost cryptocurrency faces a significant technical test if $38K fails decisively on a weekly closing basis:

“A close below $38,000 on the weekly chart could signal a downturn for $BTC, targeting the strong support cluster around $33,000.”

Ali highlights the confluence of technical support around $33K, noting that it combines the lower parallel channel boundary, the 0.5 Fibonacci retracement, and the crucial 50-week simple moving average.

However, sentiments remain mixed around whether the current $37K-$38K area will manage to hold. Trader David expects lower levels over the next few months before Bitcoin finds a sustainable bottom.

“To think $37,000 – $38,000 will be the bottom of this overall correction. Well, still 2-3months of the corrective phase left & it won’t be in a straight line, so you’ll have every reason to doubt it.”

David sees concern escalating only below $35K en route to even lower support. This aligns with the typical timing of Bitcoin’s bottoms relative to the halving cycles.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +So in summary, Ali and David provide an insightful technical and macro perspective on Bitcoin’s precarious position. The path of least resistance still seems lower at the moment, but the bull case depends on the zone around $33K managing to hold up as strong support. Bitcoin is currently hovering around $39,000 to $40,000.

You may also be interested in:

- RAY Stays Strong Above $1, Analyst Says Raydium Is ‘Practically the Backbone of Solana Shitcoin Season’

- Bitcoin Crash Continues, But Experienced Crypto Trader Spots Buy Opportunities – Here His Outlook

- Which Crypto Coin Will Pump Next? 7 Trending Altcoins To Watch In 2024

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.