Stockmoney Lizards (@StockmoneyL), a renowned Bitcoin analyst, has shared insights into Bitcoin’s price movements following its rejection at $69,300 and subsequent drop to $66,400. In a detailed analysis, the expert presented “7 Facts and 1 Conclusion” to help determine if the world’s largest cryptocurrency is headed for a deeper correction.

Fact 1: Short-term Correction Mode

According to the analyst, Bitcoin remains in a correction mode in the short term. The open interest (OI) and funding data on the 1-hour timeframe suggest that the futures market has undergone some long and short liquidations, with negative premiums and low funding rates.

Fact 2: Futures Market Reset

The analyst notes that the futures market appears to have been “cleaned up,” a necessary condition for an uptrend. New long liquidation levels have emerged below $65,000, while the region above $69,300 is dense with short positions, indicating that a breakout above $72,000 could trigger a massive short squeeze.

Fact 3: Potential Liquidity

Flush If the $66,000 support level breaks, the analyst believes Bitcoin could see a liquidity flush towards the $64,000 to $65,000 range.

Fact 4: Bullish Consolidation Pattern

The current chart pattern resembles a “running flat correction,” which is considered a bullish consolidation pattern. This could suggest that Bitcoin has seen its local bottom and may soon experience an uptrend with the potential for a new all-time high.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

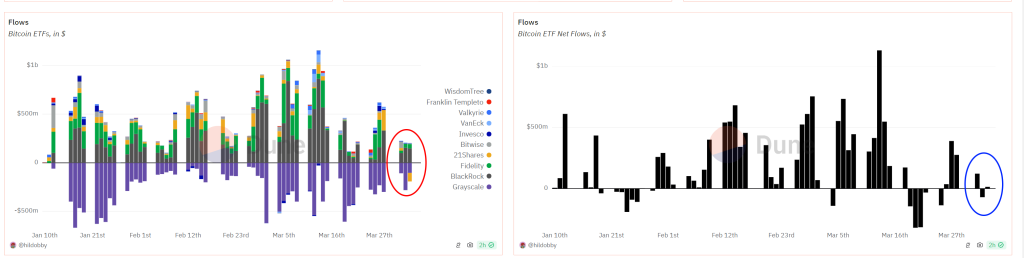

Show more +Fact 5: Institutional Buying Pause

The analyst notes that institutional buying through exchange-traded funds (ETFs) has slowed down this week. This pause in buying activity is expected and fits the current correction narrative, with renewed interest potentially marking the end of the correction.

Fact 6: Bearish Short-term Technicals

Short-term technical indicators, such as the pending bearish MACD cross and bearish signal line crossing of the RSI on the 2-hour timeframe, point towards a potential retest of the previous trading range between $65,000 and $66,000.

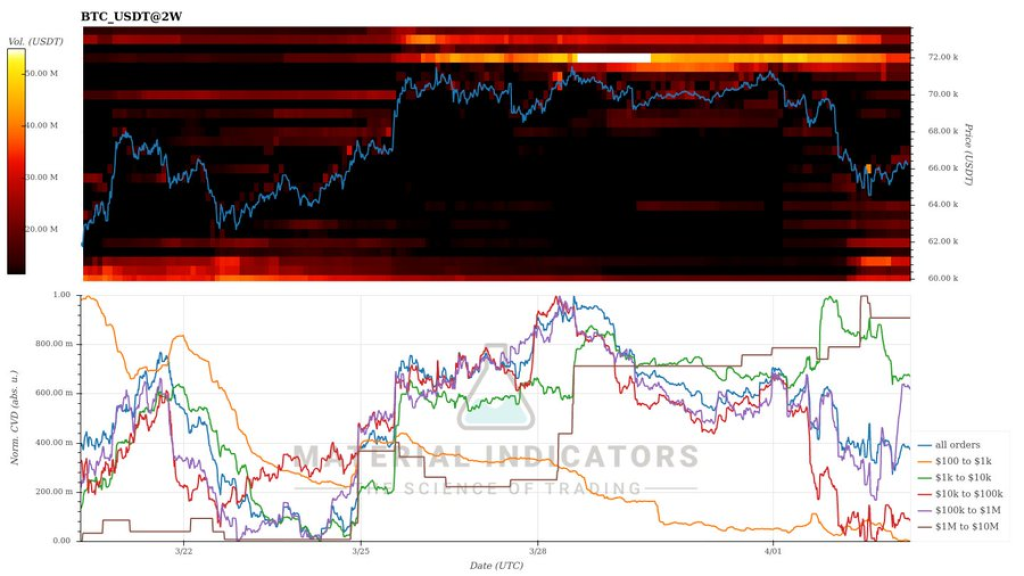

Fact 7: Whale Accumulation

The analyst highlights that “smart money,” or large addresses often associated with whales, continues to accumulate Bitcoin during the dips, as indicated by the Cumulative Volume Delta (CVD) according to order size.

Conclusion: The analyst concludes that the bearish factors include the rejection at the 50-period Simple Moving Average (SMA) on the 4-hour chart and the bearish short-term technicals, suggesting a likely sideways correction between $65,000 and $68,000 for a couple of days. However, the bullish factors, such as the reset in OI and funding/premium, whale accumulation, and the running flat correction pattern, point towards a potential short squeeze in the near future.

The outlook for the next 1-2 days is sideways, while the 1-2 week outlook remains bullish. The $65,000 level is identified as an important support, with a break potentially leading to a short flush towards the $62,000 to $63,000 region.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.