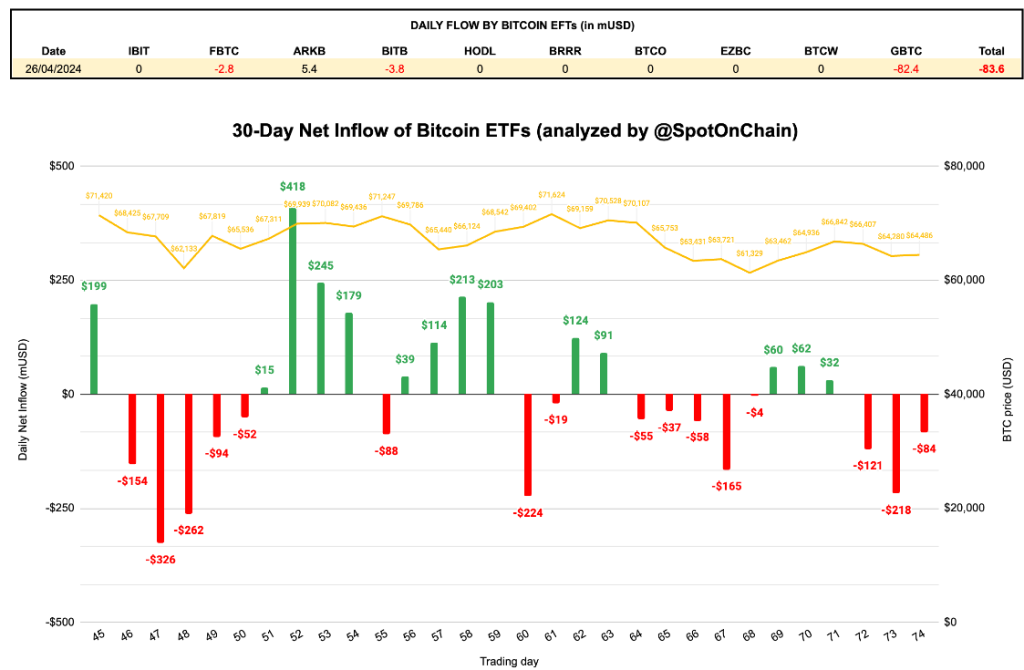

Bitcoin ETFs (Exchange-Traded Funds) are facing a significant outflow for three consecutive trading days. According to data from SpotOnChain, the Bitcoin Spot ETF Net Inflow on April 26, 2024, was recorded at -$84 million.

This substantial outflow is part of a larger trend that has unfolded over the past three days. SpotOnChain reported that the net inflow has been negative for three consecutive trading days, with outflows of -$121 million and -$242 million recorded on the previous two days, respectively.

The cumulative total net inflow after 74 trading days has been further lowered to $11.99, the lowest level in the past 21 trading days. This sustained outflow has had a profound impact on the Bitcoin ETF market, with 6 out of the 10 Bitcoin ETFs experiencing zero flows. Notably, the BlackRock iShares Bitcoin Trust (IBIT) has had zero flow for three consecutive days.

While the single-day outflow of the Grayscale Bitcoin Trust (GBTC) decreased from $139 million to $82.4 million, it still represents a big withdrawal of capital from the Bitcoin ETF market.

The negative sentiment surrounding Bitcoin ETFs has not gone unnoticed by the broader cryptocurrency market, as the price of Bitcoin (BTC) has reacted unfavorably to this. Over the past week, BTC has experienced a 2% decline, currently trading around $63,000. In fact, BTC price is in the consolidation mode, and Bitcoin ETFs net outflows might be one of the reasons for that.

In times of market uncertainty, traders and investors tend to wait, often resulting in a decrease in trading volume. The current situation in the cryptocurrency market reflects this sentiment, as traders and whales alike seem to be adopting a wait-and-see approach, assessing the direction in which the market will move from its current position.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +As a seasoned crypto trader and investor myself, I can attest to the importance of closely monitoring market trends and sentiment. The sustained outflow from Bitcoin ETFs is a concerning development, as it may indicate a lack of confidence among institutional investors and a potential shift in market dynamics.

The current outflow from Bitcoin ETFs may be a temporary setback, or it could be a precursor to more significant market shifts. Only time will tell, and those who can navigate these turbulent waters with patience and prudence are likely to emerge victorious in the long run.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.