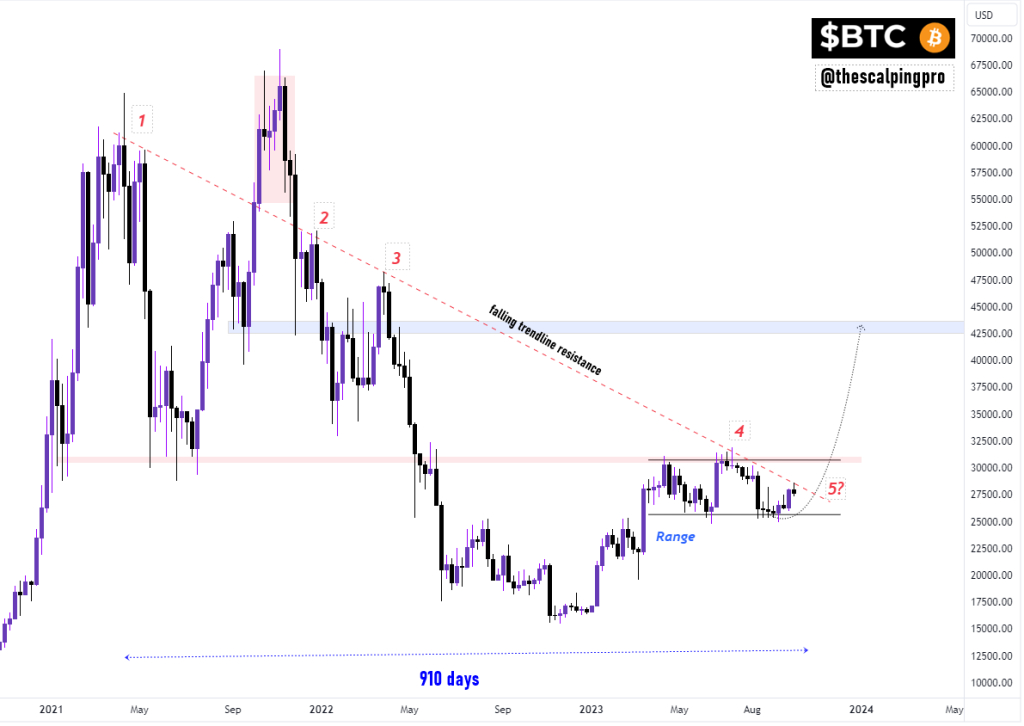

Bitcoin currently tests critical overhead resistance for the fifth time following its all-time high according to one trader’s analysis. Crypto analyst Mags points to a key falling trendline that has capped upside since the peak. Conquering this barrier could signal a major bullish breakout.

According to the tweet, Bitcoin has faced rejection at the sloping trendline resistance for over 910 days since hitting its apex. But a decisive weekly close above that level would convey incredibly positive momentum.

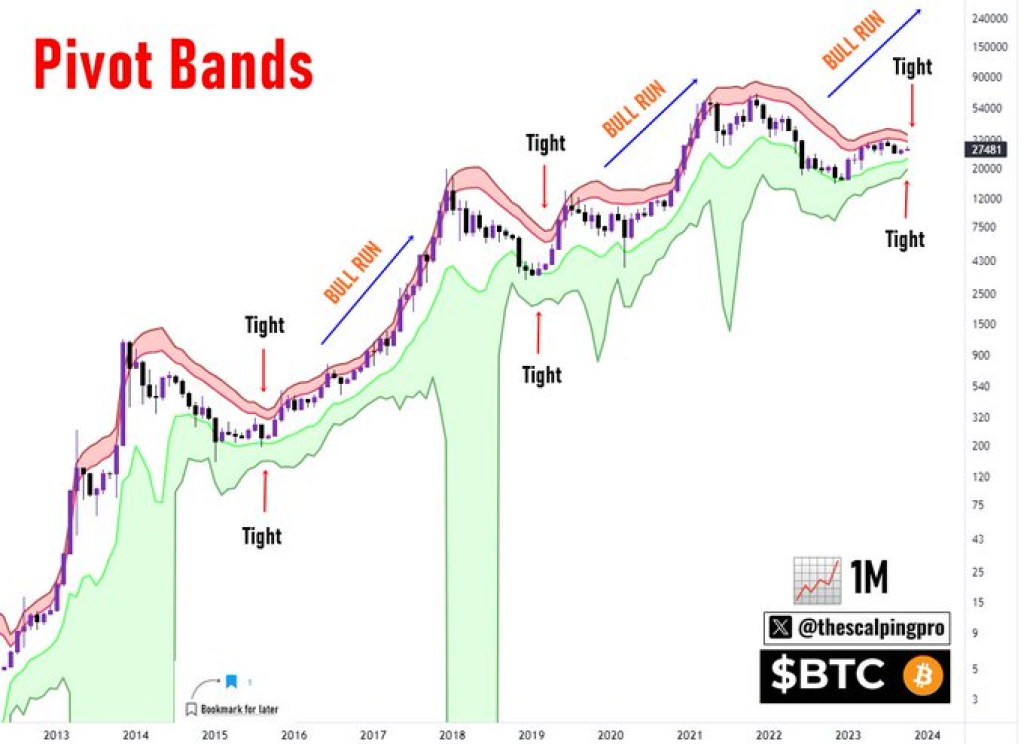

Mags also highlights that Bitcoin’s pivot bands have tightened to an unprecedented extreme, similar to past accumulation phases. Back in 2016, squeezed pivot bands preceded an 8,300% bull run from $235 to around $20,000 over the ensuing years.

In 2019, another period of tightening pivot bands combined with a price around $4,400 preceded a 1,600% historic rally, topping out at $69,000. With bands now tightest ever as Bitcoin trades around $27,000, a comparable massive surge could manifest if history repeats.

The confluence of pivotal technical indicators has some analysts anticipating fireworks ahead. A break above stubborn long-term resistance as conditions mirror the dawn of past epic bull runs could be the perfect storm for liftoff.

Of course, unprecedented macro forces weigh on Bitcoin’s outlook, absent in past cycles. And overeager bulls have misread signals throughout the brutal bear market. But the potential narratives align for a cycle-bottom reversal.

Traders eye the crucial weekly close as the first step toward confirmation. Though nothing is guaranteed, the momentum implications of reclaiming resistance after prolonged consolidation raise the feasibility of an impending trend change.

With data suggesting accumulation is underway, the door seems open to testing upside conviction. Savvy investors may position early for a high-reward reentry while managing downside risks. But eventually, Bitcoin’s fate depends on transitioning potential to undeniable technical evidence. For now, analysts are watching a pivotal make-or-break moment years in the making.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.