According to Bitcoin analyst Willy Woo, Bitcoin has likely established a long-term price floor above $30,000 based on an insightful supply pattern that has held true for 8 years.

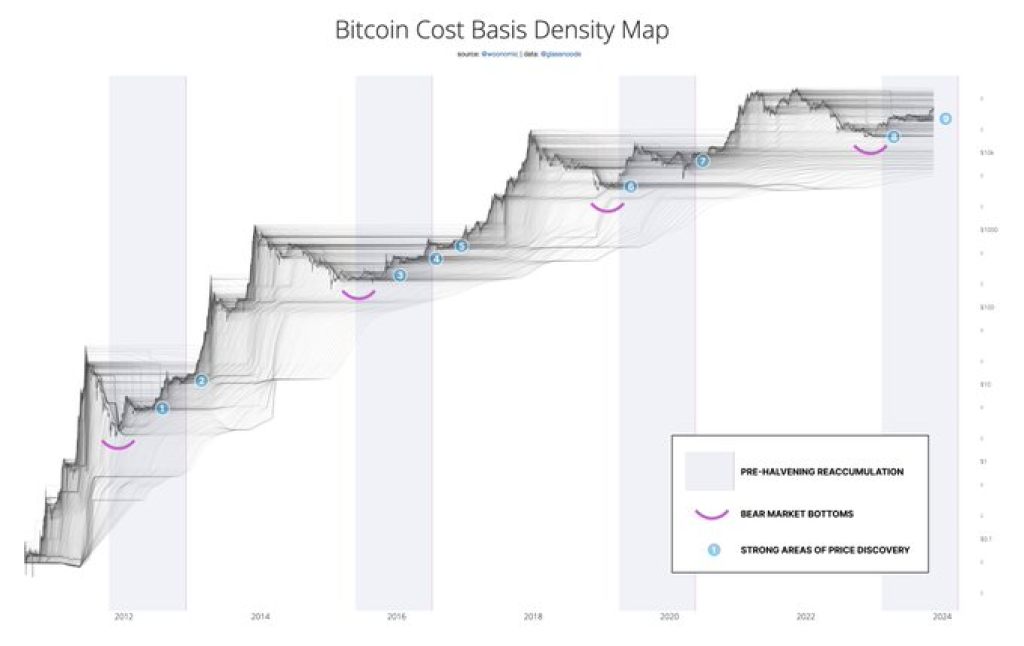

In a recent tweet thread, Woo shared a Bitcoin contour map visualizing the distribution of the BTC supply by price. The map illustrates dense horizontal bands representing price levels where large portions of Bitcoin’s supply moved between investors, reflecting a strong agreed value.

Woo highlights that whenever Bitcoin had:

- Strong bands of agreed value

- Coming out of a bear market

- Approaching the next halving

…its price has never revisited these support bands again.

So far, this pattern is 8 for 8 in predicting higher Bitcoin price floors after each bear cycle. If it continues, Bitcoin will likely just put in its final retest of the $30,000 to $40,000 value zone in this current market cycle.

Woo explains that unlike traditional commodities, Bitcoin adoption is still rapidly expanding as a decentralized store of value technology. Growing adoption leads to less supply availability and higher prices over the long term.

Read also:

- Litecoin Whale Activity Could Foreshadow Next Bull Run While Solana Flashes Sell Signal

- Shiba Inu Magazine Highlights Welly’s Commitment to Shibarium Blockchain

- Benjamin Cowen Predicts Bitcoin’s Rise to $100K by 2025; InQubeta Celebrates $5M Presale Triumph

With over 300 million Bitcoin users today compared to only 10,000 in 2010, Woo believes Bitcoin is still extremely early in its maturity cycle. Further adoption drivers, like a spot Bitcoin ETF approval, could accelerate this user growth even faster going forward.

In summary, Willy Woo presents a compelling case using on-chain supply dynamics that Bitcoin’s latest dip below $30k may turn out to be its last. If past patterns persist, significantly higher value bands are likely to await Bitcoin’s next adoption phase, leading into the 2024 halving and beyond.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.