Bitcoin (BTC) is facing challenges in holding above its $95,500 support level as repeated attempts to break higher have failed. Crypto analyst Roman (@Roman_Trading) pointed out that Bitcoin has been unable to establish a higher high (HH), indicating that bullish momentum is weakening.

According to Roman, if Bitcoin loses this local support, it could decline further toward macro support at $90,000. The 4-hour chart analysis suggests that multiple tests of this level have increased the likelihood of a breakdown. Traders are watching $95,500 closely, as a confirmed loss of this level could accelerate further downside movement.

$BTC H4

— Roman (@Roman_Trading) February 13, 2025

Really struggling to catch a solid bounce off our support.

The last one failed to close a HH.

Seems like down to macro support at 90k is inevitable once this local support gives.#bitcoin #cryptocurrency pic.twitter.com/bs9BbThNUa

Bitcoin faces ongoing market challenges although investors adopt both negative and positive perspectives within the wider market. Bitcoin price traded at $96,899.90 during press time, with a 0.97% increase in daily values and a 0.46% decrease measured over 7 days.

The total market capitalization sits at $1.92 trillion and trading activity generated $27.7 billion throughout the past day.

While some analysts anticipate a further decline, others believe a major bullish phase is approaching. Crypto analyst 0xNobler (@CryptoNobler) has predicted that Bitcoin is entering the biggest bull run in history, with a potential rise to $600,000. He also noted that Bitcoin dominance is starting to drop, which has historically led to capital flowing into altcoins.

Read also: Why Is Kaspa Price Up? Short-Term KAS Price Prediction

BTC On-Chain Data Shows Reduced Selling Pressure

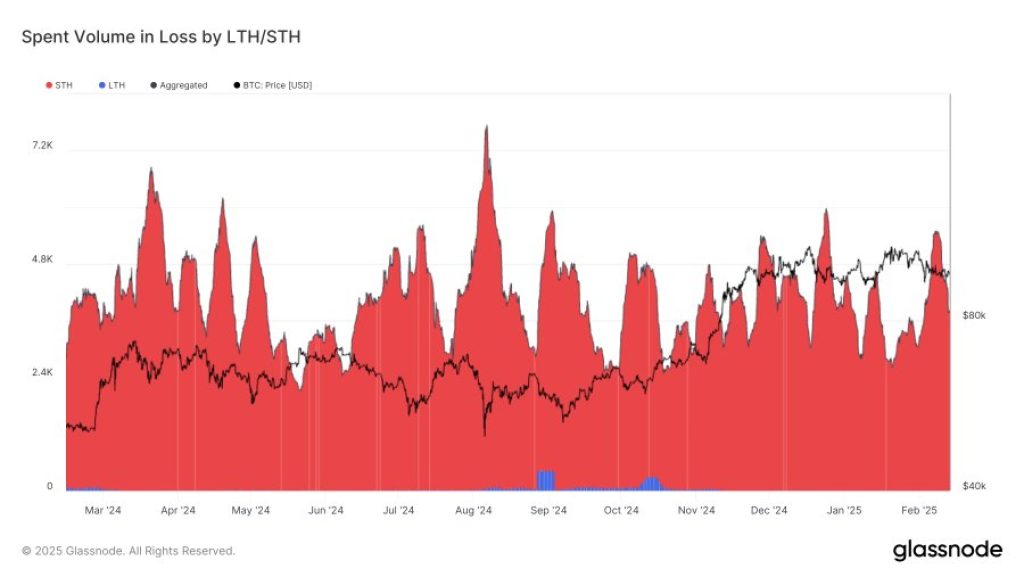

According to Glassnode’s on-chain data, selling pressure from short-term holders (STHs) is lessening. The number of BTC sold at a loss by STHs has decreased from 5.5K BTC in early February to 3.8K BTC, which is approaching the annual average of 3.5K.

Furthermore, long-term holders (LTHs) remain inactive, implying that recent price movements have had little impact on them. This means that panic selling may have faded, lowering the likelihood of additional price cuts. If this trend continues, Bitcoin prices may stabilise at their current levels.

Market analysts have varying perspectives on where Bitcoin is in the market cycle. According to 0xNobler, the market is currently in the Markup phase, which sees retail investors engage and liquidity migrate to lower-cap assets.

He feels that this phase represents an important accumulation opportunity for cryptocurrencies before Bitcoin achieves a euphoric peak.

Bitcoin’s current price position near $96,000 has investors worried about a potential market dip to $90,000 if support contours fail to hold. The next several days will show if Bitcoin maintains stability or if its price will fall.

Follow us on X (Twitter), CoinMarketCap and Binance Square for more daily crypto updates.

Get all our future calls by joining our FREE Telegram group.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.