Bitcoin’s market performance in October has turned heads as the crypto trades above previous resistance levels. Analyst Zen shared a detailed outlook on Bitcoin’s trajectory, predicting the potential for a new all-time high (ATH) soon.

However, Zen cautions that a price dip might precede this anticipated surge, spotlighting specific price ranges and chart patterns as potential indicators.

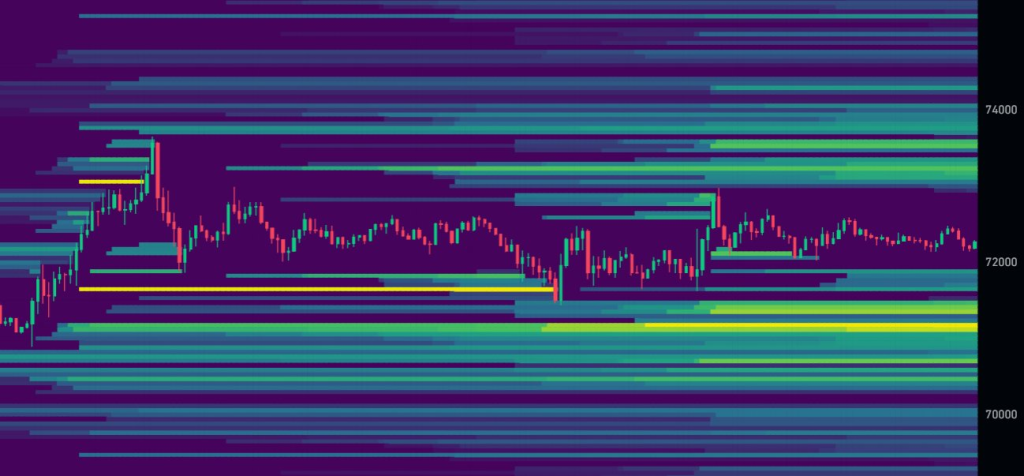

Zen’s analysis highlights the monthly chart, where Bitcoin’s October candle stands strong above March’s closing level of $71,363. This breakout signal indicates substantial bullish momentum, especially if October closes near current levels.

A similar trend was seen in previous bullish cycles, suggesting that a continuation in this price behavior could pave the way for an upward breakout in November. Moreover, supporting this bullish perspective, Bitcoin’s daily chart indicates an upward trajectory with attempts to break higher resistance around $72,890.

What you'll learn 👉

Fibonacci Analysis Reveals Possible Dip Zone

In his tweet, Zen outlined a Fibonacci retracement analysis to identify a potential dip range. By applying this tool from October’s opening to its current price, he marks the 0.618 – 0.786 levels, translating to approximately $67,793 to $70,358.

This range represents a “buy tail” zone where Bitcoin could experience a brief pullback before resuming its climb.

For a more conservative support level, Zen points to the 0.5 Fibonacci retracement around $67,992, although this lower level may not be fully tested if the bullish structure remains intact.

Should Bitcoin retrace to these levels, it could create a strong buy opportunity ahead of an anticipated November breakout.

Support and Resistance Levels: Key Points to Watch

Key support levels, as highlighted in the analysis, include $71,363, representing March’s close, which Zen identifies as a critical level for maintaining a bullish outlook.

Below this, liquidity pools are concentrated around $71,150, $70,444, and $69,300, offering potential buffers against deeper dips. On the resistance side, Bitcoin’s ATH near $73,881 serves as a psychological hurdle, with intermediate liquidity clusters at $73,108 and $73,597

The analyst sees these levels as key markers for Bitcoin’s continued rally. The represent both challenges and opportunities within the current upward trend.

CME Gap and Historical Patterns Add Context to Potential Dip

Adding depth to his analysis, Zen mentions a CME gap between $67,435 and $68,185 on the 1-hour chart, aligning with the 0.5 – 0.618 Fibonacci range.

Although Zen typically disregards lower timeframe gaps, he notes that the correlation with the Fibonacci retracement adds weight to the probability of a pullback to these levels.

Historical performance also lends context; Zen references Bitcoin’s 2019 spring movement when it advanced without a retracement, leaving open the possibility for a similar pattern here.

Yet, the suggestion of a potential buy tail indicates the likelihood of a controlled dip before the anticipated breakout.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Outlook for November: New ATH on the Horizon?

If Bitcoin sustains its current trend above March’s close and closes October in this range, Zen’s analysis suggests that a November breakout could be “inevitable.”

However, traders should remain cautious, as short-term dips within the $67,800 to $70,400 range could present buying opportunities.

By following these support and resistance zones, combined with historical patterns and Fibonacci retracement, investors can potentially navigate Bitcoin’s upcoming moves with better precision.

Follow us on X (Twitter), CoinMarketCap and Binance Square for more daily crypto updates.

Get all our future calls by joining our FREE Telegram group.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.