According to several prominent crypto analysts, Bitcoin is poised for a monumental breakout that could finally propel the largest cryptocurrency past the coveted $100,000 price level. Market observers are closely watching key technical and fundamental catalysts that may ignite the next explosive BTC rally.

On the technical analysis front, analyst Gert van Lagen has identified Bitcoin’s recent decisive move out of a bullish pennant pattern on the daily chart as a powerful upside signal. After breaking above this continuation pattern, BTC has successfully retested and held the pennant’s upper trendline – suggesting the cryptocurrency is now “ready to send price higher.”

Pennants form when periods of volatility are followed by tighter trading ranges. Their resolution, especially after lengthy consolidation periods like Bitcoin has experienced, often sparks major trending moves in the direction of the preceding momentum. With Bitcoin’s bounce off the pennant resistance, van Lagen believes the stage is set for BTC to “blast through $100k.”

However, the bullish outlook for Bitcoin isn’t solely based on charting patterns. Analyst Vivek is drawing parallels to a similar price catalyst from late 2022: the launch of a U.S. Bitcoin exchange-traded fund (ETF). He notes that in just three months after the first American BTC ETFs began trading, Bitcoin’s price skyrocketed by 80% from $45,000 to nearly $70,000.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

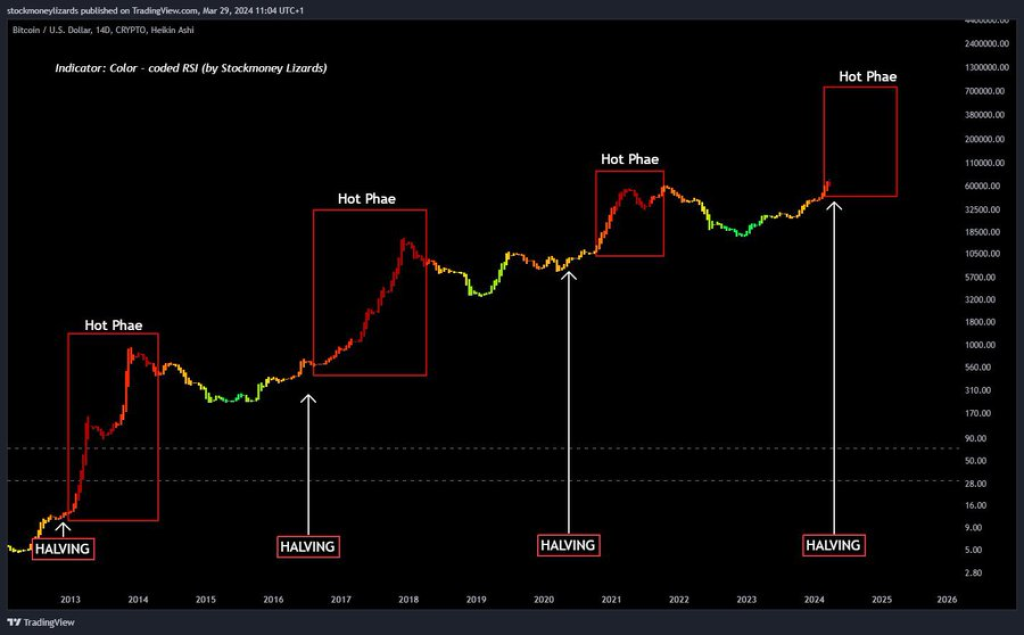

Show more +With multiple Asian countries expected to approve their own Bitcoin ETFs in the coming week, Vivek anticipates an analogous explosive price reaction. When coupled with Bitcoin’s upcoming halving event in 2024, which historically proceeds parabolic price rallies, he posits that $100,000 could rapidly come into view.

Of course, Bitcoin still has a steep hill to climb, with prices currently hovering around $70,000 at the time of writing. But if history remains a guide, traditional investment vehicles like ETFs unlocking Bitcoin exposure to a wider pool of investors could be the catalyst that reignites the crypto king’s upward trajectory.

For crypto traders and hodlers alike, these converging technical and fundamental signals represent compelling reasons to keep a close watch on Bitcoin in the days and weeks ahead. A breach of the $100,000 psychological resistance, while an ambitious target, is now being branded as an imminent possibility by many seasoned analysts.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.