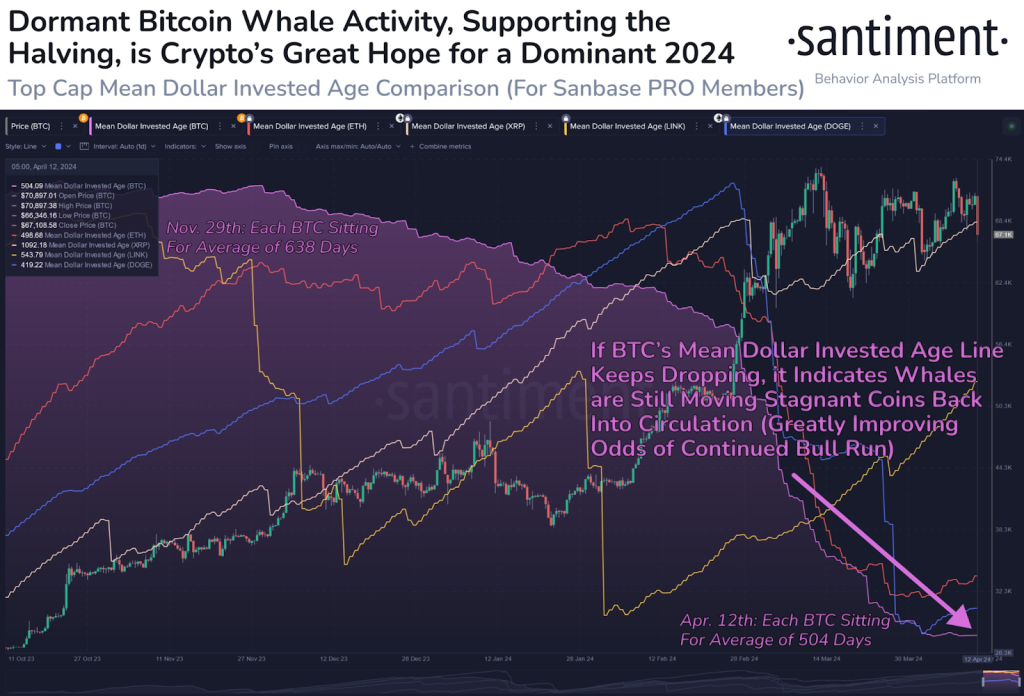

As the crypto market eagerly awaits the resumption of a bullish momentum following a month of price volatility, analysts at Santiment, a leading on-chain data analytics platform, have identified a crucial metric to watch: Mean Dollar Invested Age. This metric tracks the average age of investments in an asset that have remained in the same wallet, providing insights into the activity level of a blockchain network.

What you'll learn 👉

Understanding Mean Dollar Invested Age

According to Santiment’s @santimentfeed, a rising line for Mean Dollar Invested Age indicates that investments are becoming more stagnant, with older coins remaining in their respective wallets, implying a decrease in activity on the blockchain network. Conversely, a falling line suggests that investments are moving back into regular circulation, signaling an increase in activity on the network.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Historic Bull Cycles and Bitcoin’s Performance

Historically, during bull cycles, Santiment has observed a falling Mean Dollar Invested Age line for Bitcoin, the world’s largest cryptocurrency by market capitalization. From late October until the end of March, this pattern was evident as Bitcoin’s market value surged by an impressive 133%.

However, in the past couple of weeks, despite the anticipation surrounding the upcoming Bitcoin halving event, the Mean Dollar Invested Age line for Bitcoin has stagnated. Furthermore, Santiment emphasizes that for a continued price rise, it is essential to observe top key stakeholders moving coins back into circulation, leading to a downward trend in the Mean Dollar Invested Age line.

The Importance of On-Chain Analytics

Santiment’s analysis underscores the significance of on-chain analytics in understanding the underlying dynamics of crypto markets. By monitoring metrics like Mean Dollar Invested Age, traders and investors can gain valuable insights into the activity levels of blockchain networks and potential market movements.

Hence, as the crypto community anticipates the next bull run, Santiment’s insights provide a valuable perspective on the key signals to watch, highlighting the importance of on-chain data analysis in navigating the crypto space.

Hunting for a small cap coin that could explode 10x? We’ve unveiled a few last week alone.

Get all our future calls by joining our FREE Telegram community.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.