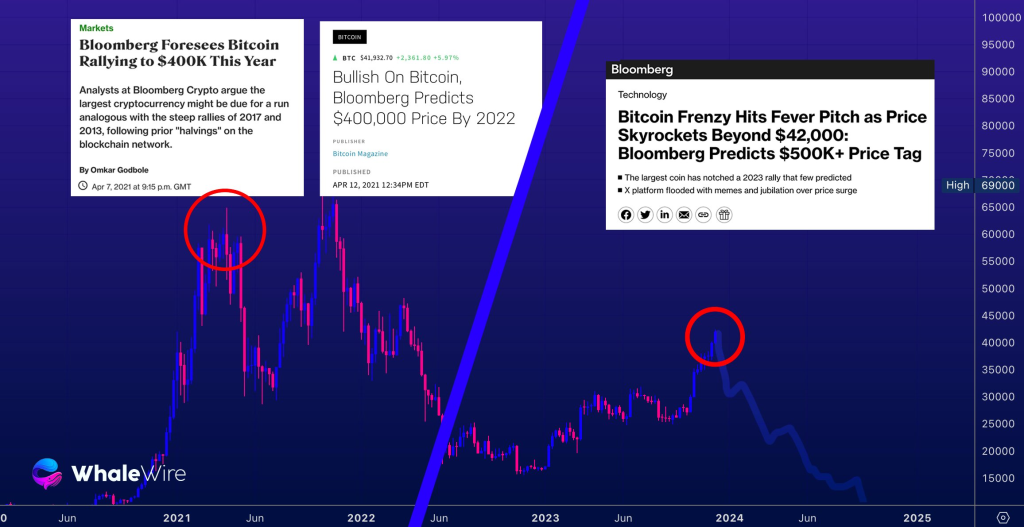

Popular crypto analyst WhaleWire recently posted a warning about the bitcoin market, claiming an inevitable crash is coming after the media has lured greedy investors with predictions of $500,000 bitcoin. However, these confident assertions deserve close scrutiny.

Back in April 2021, Bloomberg did make an aggressive prediction that bitcoin could surge above $400,000 by the end of the year. That prediction clearly did not materialize as bitcoin entered a prolonged bear market instead, tumbling under $16,000 at its lowest point.

Now, as bitcoin trades around $41,800 at time of writing, WhaleWire argues the current market action is just a “short-term bull trap” before the next major crash. Additionally, WhaleWire claims the mainstream media predicting $500,000 bitcoin is just bait to lure in “exit liquidity” before that inevitable crash.

However, while caution in crypto investing is certainly wise, making overly confident predictions of an inevitable crash goes too far. No one can predict the future bitcoin price action with certainty.

First, claiming this is a bull trap is debatable. There are reasonable arguments this could mark the beginning of a new bull market instead. No one knows for sure yet.

Second, ascribing malicious intent to mainstream media predictions seems speculative. Media can legitimately be bullish on bitcoin’s long-term potential without ulterior motives.

Read also:

- Kaspa Set to Explode, Analyst Says KAS Showing Strength at This Point is an Indication of Strong Momentum

- Cardano Sees Surge in ADA Transactions Over $100,000: Analyst Says This Surge Could Be a Precursor to a Noteworthy Phenomenon

- Investors Hurry to Hoard Bitcoin Minetrix As Market Perks Up – Can $BTCMTX Realize the 10X Predictions?

Finally, shaming other investors blinded by greed and doomed to repeat mistakes comes across as judgmental. Investors have diverse logical reasons for their market actions.

In the end, while bitcoin investors should approach hot market predictions carefully, conclusively dismissing the possibility of a continued price recovery seems premature. The future holds inherent uncertainty. Rather than making absolute assertions, we should continue discussing multiple market perspectives respectfully.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.