Bitcoin’s solid returns across October and November point to December continuing that momentum based on historical trends identified by crypto trader Ali. As BTC navigates key resistance and support, a year-end rally could materialize.

Ali notes Bitcoin has posted strong back-to-back months leading into December for the past four years. In nearly every case, that strength foreshadowed an even more emphatic surge in December to close out the year on a high note.

If that tendency repeats, Bitcoin development through the next month may accelerate and confirm the nascent recovery from this year’s brutal drawdowns. Even absent a specific catalyst, the calendar itself appears prone to stoking the buying appetite as investors chase risk-on positioning.

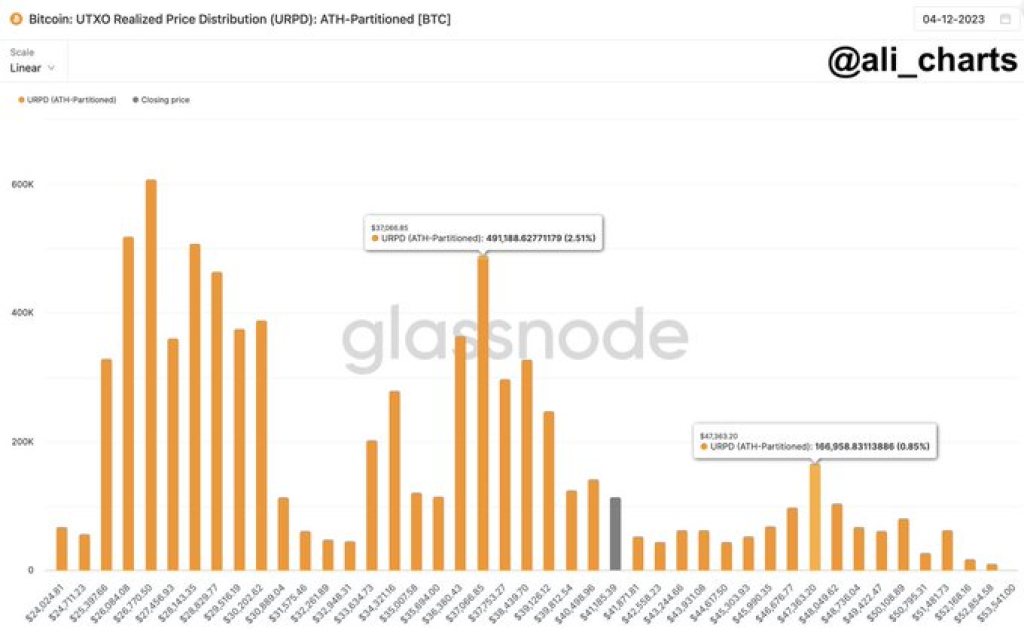

Crucial for Bitcoin will be how it handles critical resistance around $47,360, where the 200-week moving average hovers alongside the topside of its recent range. That barrier has denied progress since September, but Ali spots dependable support established at around $37,000.

Read also:

- Kaspa Set to Explode, Analyst Says KAS Showing Strength at This Point is an Indication of Strong Momentum

- Cardano Sees Surge in ADA Transactions Over $100,000: Analyst Says This Surge Could Be a Precursor to a Noteworthy Phenomenon

- Investors Hurry to Hoard Bitcoin Minetrix As Market Perks Up – Can $BTCMTX Realize the 10X Predictions?

Maintaining that higher low while tackling tough overhead hurdles would pave the way for bullish continuation as hedge funds and systematic traders chase year-end gains. In crypto’s history, November doldrums snapped by December joyrides prove fairly consistent.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.