Decrypting opportunities in Bitcoin’s market cycles is crucial to capitalizing on emerging trends early. In a constructive development, top analysts spot both technical and fundamental signals turning favorable for a continued BTC price surge.

What you'll learn 👉

Repeating Historic Roadmap

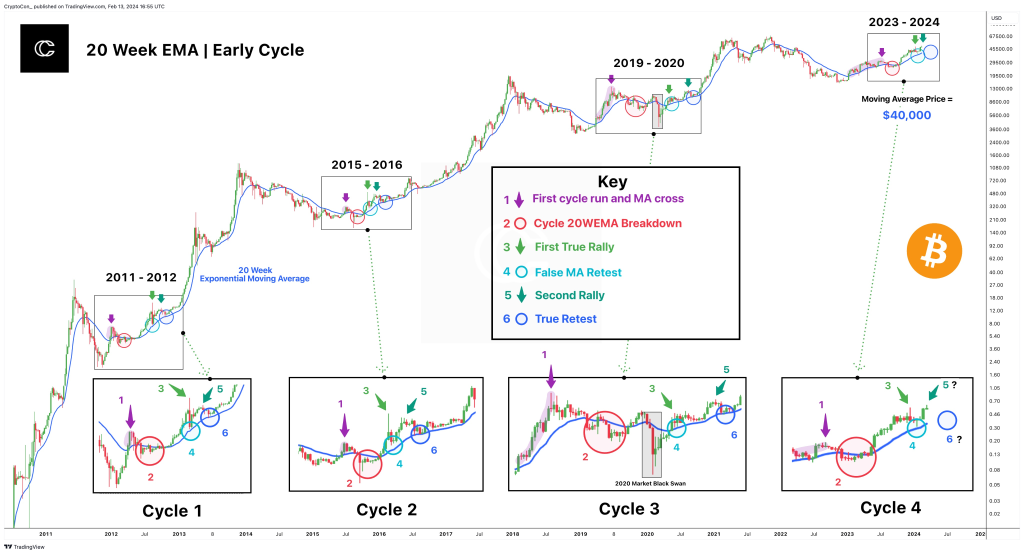

As independent market observer Cryptocon notes, Bitcoin has traded eerily in line with the 20-week exponential moving average (EMA) during each cycle throughout history. After breaking above and then back below this dynamic support, BTC tackles it once more in a larger rally.

Zooming in, a false breakdown forms where Bitcoin narrowly avoids officially retesting average support. Veteran investors will recall this exact pattern from previous secular bull runs.

Cryptocon believes since the latest pullback bounced neatly off the 20-week EMA, another false retest might be in progress, signaling sparse remaining downside. The next milestone per the roadmap is initiating Bitcoin’s second leg higher, targeting fresh record highs.

Bullish Structure Builds

Analyzing high-timeframe charts, popular analyst BitQuant concurs that Bitcoin’s existing market structure points firmly higher. The lack of major daily pullbacks amidst an inclining series of higher price peaks highlights an extremely limited appetite for the downside. BitQuant mentioned that Bitcoin below $50k is done.

BitQuant notes that trading counter to such a robust primary trend comes packed with peril even for experienced short-term operators. With fundamentals like network security and community momentum strengthening as well, the risks of fighting the rally outweigh any stretched technical readings.

He forecasts this rally ultimately pushing Bitcoin towards $74,000 if key milestones keep getting achieved ahead.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Institutions Tip-Toe In

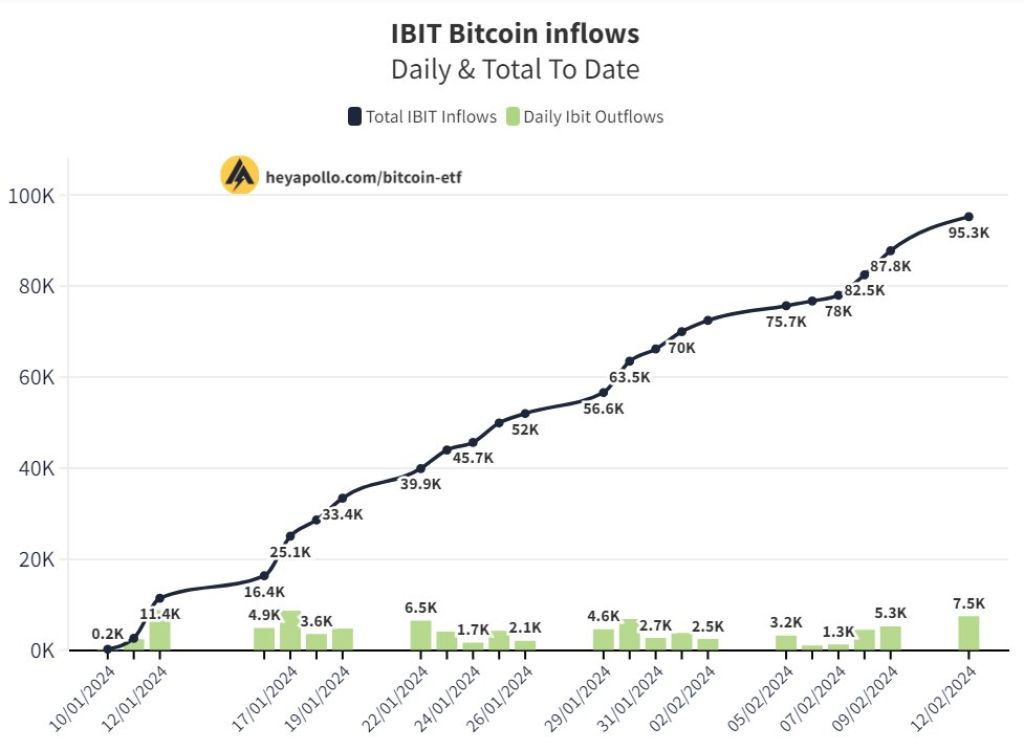

Adding legitimacy, Apollo Sats co-founder Thomas stated that fresh institutional participation became apparent via Blackrock’s high-profile Bitcoin ETF, which accumulated almost 95,000 BTC worth over $4 billion in its debut month.

Despite some analysts questioning whether such inflows prove sustainable, history shows higher prices begetting more demand, especially from bigger participants.

So with technical, on-chain, and sentiment indicators aligning, Bitcoin appears on the cusp of a renewed surge. Cautiously tracking critical supports is essential, but the path of maximum probability trends upwards by most measures.

Bitcoin has surpassed the $51,000 level and regained the $1 trillion market cap, according to the latest data. BTC is also up by 3% in the last 24 hours.

You may also be interested in:

- When Will Kaspa (KAS) Hit $1?

- Bitcoin Pre-Halving Rally ‘Has Begun,’ but Ethereum and Altcoins Will Follow BTC – Here’s Why

- Best Altcoins to Collect Before the Bitcoin Halving: Which of These Altcoins Could Surge in 2024?

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.