The short-term outlook for Bitcoin’s price has turned decidedly bearish recently according to analysis from seasoned crypto traders Captain Faibik and Ali. With BTC hitting resistance levels and momentum indicators pointing down, they argue now is the time for caution.

What you'll learn 👉

Ripe for Correction After 40% Pump

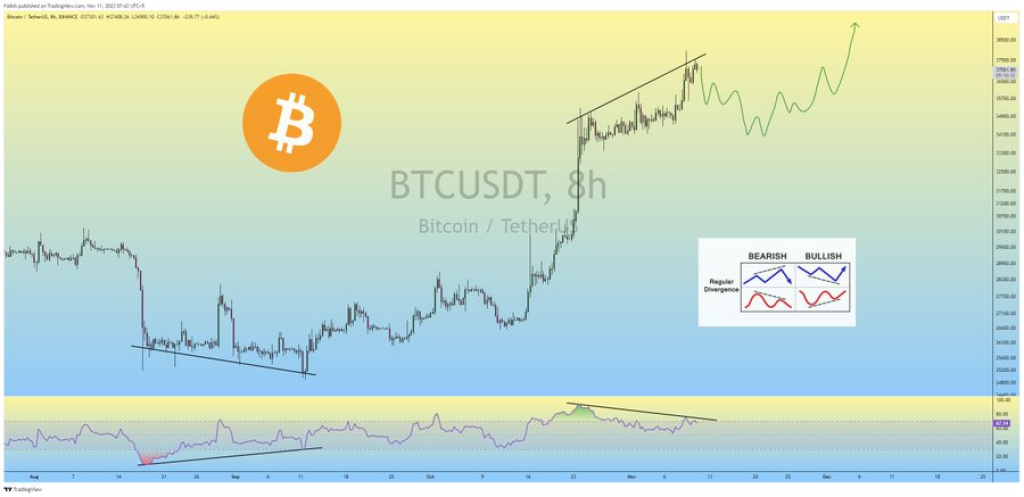

As Captain Faibik notes, Bitcoin has already experienced a major 40% price pump from mid-October until now. This big move upward means Bitcoin is likely due for at least a minor correction soon before it can continue significantly higher.

The key resistance level between $38,000-$39,000 has so far halted further upside. At the same time, bearish divergence is forming just under this resistance zone. This suggests the rally is losing steam and the chances of a bull trap catching late buyers are increasing.

TD Sequential Flashing Sell Signals

Ali also highlights how the TD Sequential indicator is now flashing sell signals on both the weekly and 3-day Bitcoin price charts. Given the TD Sequential’s strong track record at identifying trend reversals, this is a worrying technical development. The last time it showed simultaneous buy signals on the weekly and 3-day charts was in early September, marking the start of the recent bull run.

Read also:

- Are Meme Coin Kings Dogecoin (DOGE) and Shiba Inu (SHIB) ‘Late for the Party’?

- Why Solana (SOL) Will Continue to be One of the Biggest Movers During This Bull Market

- Here are Two Tokens Set To Skyrocket in Price In The Upcoming Months

Consider Taking Profits or Short Positions

In summary, the confluence of overbought conditions, strong resistance, bearish momentum divergences, and sell signals from a reliable indicator all point to Bitcoin being prone to a downward move in the near future. Traders like Captain Faibik and Ali suggest either taking profits if you bought BTC around $20,000, or considering short positions to capitalize on the emerging downside setup.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.