The cryptocurrency market continues to captivate investors and traders alike and Bitcoin (BTC) is once again the center of attention. According to recent on-chain data and analysis from prominent figures in the industry, there are several notable developments surrounding the world’s largest cryptocurrency.

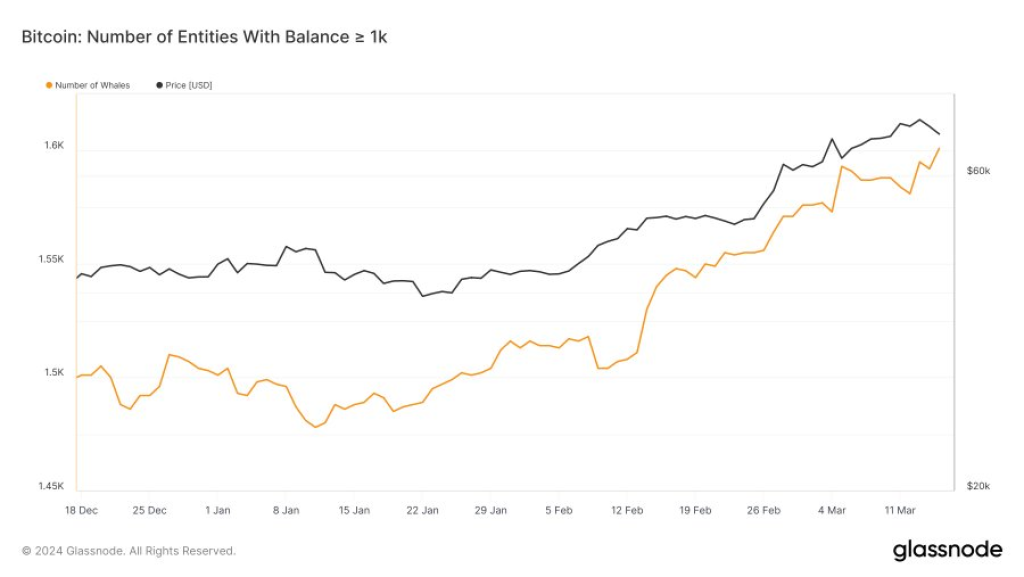

Firstly, as highlighted by Ali, a popular crypto analyst, a significant amount of Bitcoin has been withdrawn from exchanges over the past week. Specifically, 21,401 BTC have been moved off crypto exchanges, indicating an increasing demand from whales – investors holding large amounts of Bitcoin. Furthermore, the Bitcoin network has welcomed 13 new whales, each holding over 1,000 BTC, suggesting a growing interest among institutional and high-net-worth individuals.

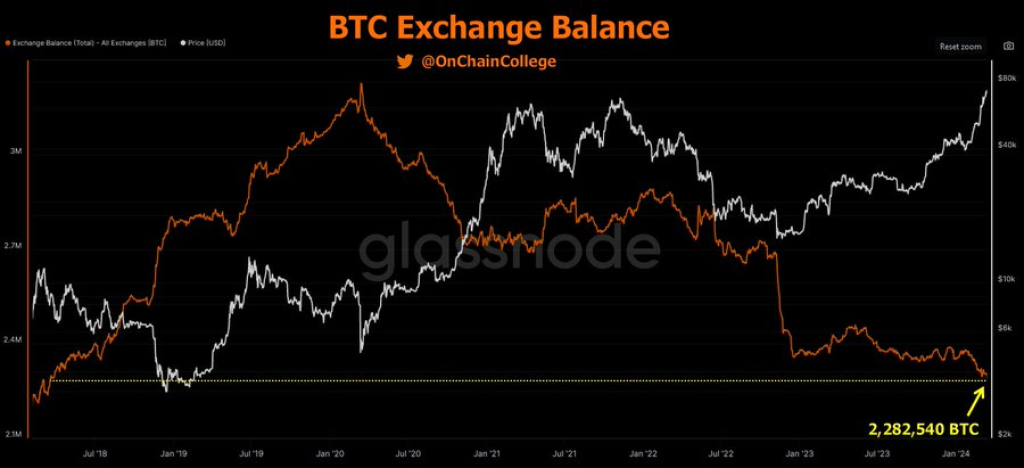

This trend is further corroborated by the data shared by On-Chain College, which reveals that the Bitcoin balance on exchanges is just over 2.28 million BTC, the lowest level since March 2018. A decreasing exchange balance is often seen as a bullish signal, as it implies that investors are withdrawing their holdings from exchanges, potentially to hold them for the long term or to participate in activities like staking or lending.

On-Chain College also notes that the demand for Bitcoin ETFs (Exchange-Traded Funds) is on the rise, contributing to the decreasing exchange balances. Additionally, the upcoming Bitcoin halving event, which will reduce the daily issuance of new Bitcoin by half, is expected to further impact the supply dynamics of the cryptocurrency.

While these developments paint a bullish picture for Bitcoin, another prominent analyst, Johnny Woo, emphasizes the importance of a specific price level for the continuation of the bullish trend. According to Woo, the $60,000 mark is crucial for Bitcoin, as the Relative Strength Index (RSI) can easily reset on the way up without a deep correction, as seen recently on the weekly time frame.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +

It’s important to note that at the time of writing, Bitcoin is trading at around $65,000, well above the $60,000 level highlighted by Woo. However, the analyst’s perspective underscores the significance of key technical levels in determining the strength and potential continuation of a bullish trend.

The convergence of on-chain data, whale activity, and technical analysis provides valuable insights for traders and investors alike. While bullish signals abound, it remains crucial to exercise caution and conduct thorough research before making any investment decisions.

You may also be interested in:

- Grayscale Prepares for a Bitcoin Sell-Off, But Should This Worry Us?

- Ripple’s XRP Could Soon Soar to $1 According to This Analyst’s Charts

- Worldwide Crypto Magnetism Intensifies as Avalanche (AVAX) & Tether (USDT) Adopt Raffle Coin (RAFF) Presale for Anticipated 100X Upswing

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.