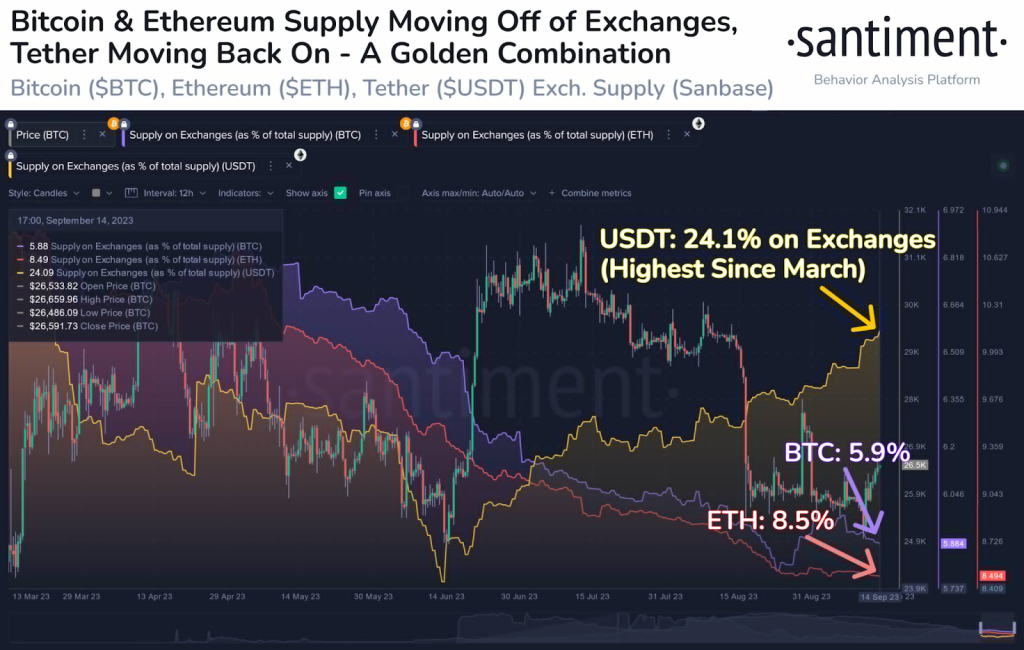

Bitcoin and Ethereum have shown remarkable stability thanks to the community’s unwavering faith in these digital assets. Recent data by Santiment, a market intelligence platform, suggests that the exchange supply of Bitcoin and Ethereum has declined.

This trend indicates that traders are less inclined to sell their holdings, opting instead to hold onto their digital assets for the long term. While some argue that this could lead to liquidity issues, others see it as a strong sign of confidence in the market’s future.

What you'll learn 👉

Tether Makes a Comeback

Tether, the stablecoin that often serves as a barometer for the cryptocurrency market, has also been making headlines. After a period of reduced activity, Tether is now moving back onto exchanges at an accelerated pace. This is noteworthy because the stablecoin’s presence on exchanges is now at its highest since March.

Source: Santiment – Start using it today

This is a positive indicator for part of the community, suggesting increased buying interest in the market. Tether’s return to prominence could be a precursor to a more active and bullish market, as traders often use the stablecoin as a haven to park their assets before making future investments.

What Does This Mean for the Future?

The implications of these trends are manifold. On one hand, the declining exchange supply of Bitcoin and Ethereum suggests that long-term investors are bullish on these cryptocurrencies. This could drive up demand and, subsequently, the price of these digital assets. On the other hand, Tether’s resurgence on exchanges indicates that traders are gearing up for more buying activity. This could be a sign that the market is preparing for a new wave of investments.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +The cryptocurrency market is showing promising signs that could bode well for both long-term investors and short-term traders. While it’s too early to make definitive predictions, the current trends in Bitcoin, Ethereum, and Tether supply on exchanges are worth watching.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.