Bitcoin started 2025 trading around $91,000 and later pushed to a new all-time high slightly above $126,000 before dipping back to $90,000 at the time of writing. For many market participants the move felt muted. Expectations were far higher because 2025 was widely believed to be the peak of the post-halving bull cycle. Instead of a sharp vertical run, Bitcoin spent long stretches moving sideways while the broader crypto market struggled to follow through.

That gap between expectations and reality has led to a growing reassessment of the cycle itself. Rather than asking why the bull market failed, some analysts are now asking whether 2025 was simply the wrong year to expect one.

What you'll learn 👉

Bitcoin Price Action in 2025 Lacked the Classic Signs of a True Bull Market

Bitcoin reached new highs in 2025, yet the structure beneath the move looked unusual. According to Ran Neune non X, the behavior of the market did not match what has historically marked the start of a real bull cycle.

Bitcoin stalled after setting new highs. Ethereum failed to sustain momentum. Solana experienced a sharp drawdown instead of continuation. Altcoins as a group struggled to attract consistent capital despite strong narratives circulating across the market. Those patterns raised concerns that something fundamental was missing.

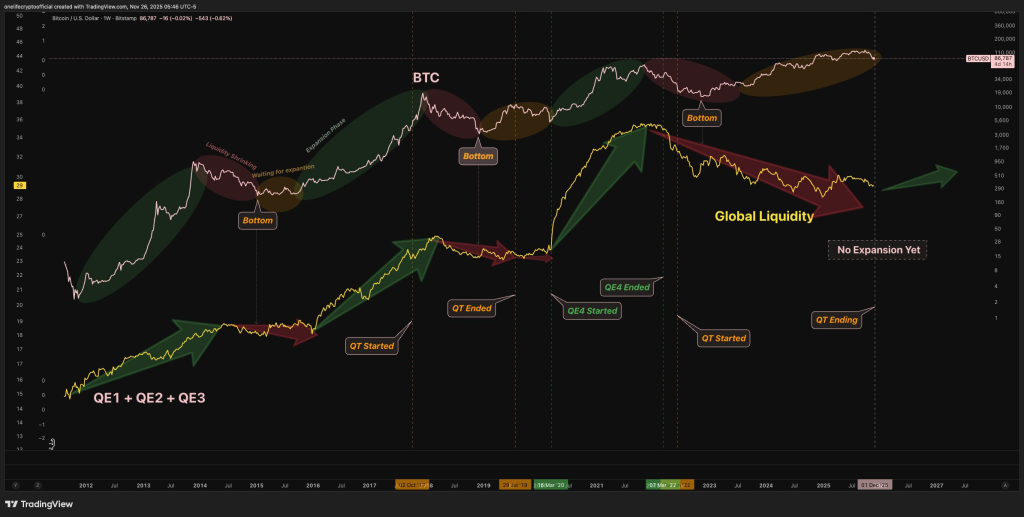

Ran Neuner pointed directly to global net liquidity. His chart focuses on liquidity that actually reaches financial markets rather than headline money supply figures. Throughout most of 2025, net liquidity continued to fall. Quantitative tightening remained active. Purchasing managers data stayed in contraction. Economic expansion never clearly began.

Without liquidity expansion, price increases tend to lack follow through. That dynamic helps explain why Bitcoin moved higher while altcoins remained weak and why the year felt confusing rather than euphoric.

How Global Liquidity Trends Shaped Bitcoin and Altcoins in 2025

The global liquidity chart shared by Ran Neuner shows a repeating pattern across multiple cycles. When liquidity expands, Bitcoin trends strongly. When liquidity contracts, rallies stall or fade. The 2025 section stands out because liquidity never turned decisively upward.

Quantitative tightening continued draining capital even as optimism around ETFs, regulation, and institutional adoption grew louder. That imbalance created a market driven by narratives without fuel. Bitcoin managed to hold strength, but altcoins suffered more, which is consistent with past cycles where liquidity tightens.

Historically, Bitcoin has never entered a bear market while liquidity is rising. The problem in 2025 was not bearish price action, but the absence of conditions that normally ignite a full cycle expansion.

Why the Macro Backdrop Looks Different Heading Into 2026

The same liquidity models now suggest a potential shift heading into 2026. Ran Neuner highlighted several changes that have historically preceded major bull markets. Quantitative tightening has ended. Rate expectations are moving lower. Treasury General Account pressure has eased. Net liquidity appears to be bottoming instead of falling.

Purchasing managers data is beginning to turn upward, which often signals early economic expansion. Institutional behavior is also changing, with preparation for a second wave of capital rather than reactive positioning.

These shifts matter because liquidity tends to lead price. If liquidity expands in 2026, the macro environment would look very different from what defined most of 2025.

Altcoin Dominance Signals a Potential Altseason Window in 2026

Bull Theory, known as BullTheoryio, approached the discussion from the altcoin side using the OTHERS dominance chart. This chart tracks the share of the crypto market held by assets outside the largest names and has historically been useful for identifying altseason timing.

The chart shows OTHERS dominance sitting near the same base zone where it bottomed before major altcoin expansions in previous cycles. Similar setups appeared in 2017 before the first major altcoin run and again in 2020 before the 2021 altseason. Momentum indicators like MACD and RSI are also near historical lows that previously preceded multi year expansions.

This context explains why altcoins have underperformed even as Bitcoin recovered strongly from its lows. Liquidity drain always impacts altcoins more than Bitcoin. According to Bull Theory, that phase is now beginning to change.

The Federal Reserve has resumed T-bill purchases at roughly $40B per month. While this is not full quantitative easing, it represents a clear shift away from aggressive tightening. Markets tend to price future liquidity rather than current conditions, which helps explain why expectations are shifting toward 2026.

Why Altseason May Align With Liquidity Expansion Rather Than the Halving Cycle

Bull Theory also pointed to broader market signals that often lead crypto cycles. The Russell 2000 index recently made new highs, a move that historically suggests improving liquidity expectations. Small-cap assets often move first when conditions begin to loosen, with altcoins frequently following.

If OTHERS dominance returns to the 12% to 13% range, history suggests a strong altseason. A move toward 18% to 20% would indicate an unusually powerful expansion. In such environments, altcoins often outperform Bitcoin and experience smaller drawdowns during pullbacks because liquidity is improving rather than shrinking.

This perspective reframes the past few years. Bitcoin strength without altcoin follow-through was not a contradiction. It was a reflection of liquidity conditions.

Read Also: SUI Price Tests a Key Level as Traders Watch for a Fakeout

The frustration surrounding 2025 likely came from misplaced timing rather than a broken cycle. Strong narratives existed, but the macro fuel never arrived. Liquidity conditions did not support the type of expansion many expected.

Looking at the data now, both Ran Neuner and Bull Theory arrive at similar conclusions through different lenses. 2025 showed movement, but not expansion. The structural ingredients that typically launch bull markets appear more aligned with 2026.

If liquidity continues to turn positive, the next phase for Bitcoin, altcoins, and altseason could look very different from the slow grind of 2025. The charts suggest the story is still unfolding, and the most important chapter may not have started yet.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.