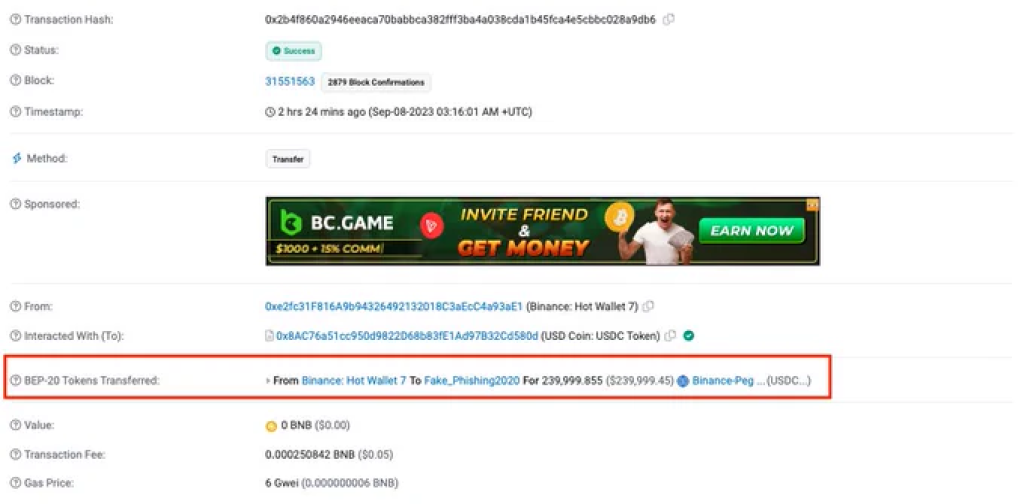

A recent transaction captured on Etherscan and spotlighted by blockchain security firm PeckShield has set the crypto community abuzz.

Binance’s official “Hot Wallet 7” transferred a $240,000 in USDC to an address ominously labeled as “Fake_Phishing.” At first glance, the optics are far from flattering. But before we jump on the scandal bandwagon, it’s crucial to dissect the situation.

What you'll learn 👉

The Likely Explanation: Less Sensational Than It Appears

The most probable explanation for this transaction is far less sensational than the headlines would have you believe. The owner of the “Fake_Phishing” address likely initiated a standard withdrawal from their Binance account. In this context, Binance isn’t a co-conspirator with a scammer but merely a facilitator of a user’s transaction request.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +What adds a layer of intrigue to this story is Binance’s regulatory compliance. As a regulated exchange, Binance adheres to stringent Know Your Customer (KYC) protocols. This means that the exchange could possess vital information that could help identify the owner of this mysterious address.

If the address is indeed linked to illicit activities, Binance could become a key player in unmasking the individual behind it. The exchange also has the authority to limit or even freeze the user’s activities, making it a perilous game for any would-be scammer.

Even if Binance is merely an innocent intermediary in this transaction, the incident serves as a glaring reminder for everyone involved in the crypto space. In a world where phishing scams are as ubiquitous as memes about “going to the moon,” this event underscores the need for constant vigilance. It’s a wake-up call for all of us to double-check addresses, scrutinize links, and maintain a high level of digital security.

The Bigger Picture: Fueling a Necessary Conversation

While the initial shock of the headline might lead you to think that Binance has committed an egregious error, the reality is likely much more prosaic. However, the incident does pave the way for broader discussions about security protocols, the role of exchanges in monitoring transactions, and the ever-present need for caution in the volatile landscape of cryptocurrency.

In conclusion, Binance may not have fueled a scam, but it has certainly ignited a conversation that is both timely and necessary for the evolving crypto ecosystem.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.