The price of Banana Gun (BANANA) has been up by more than 50% in the last 2 days. The token’s rise has gotten the attention of some analysts and investors who are seeking ways to exploit this opportunity.

A tweet from GLC Capital explains why BANANA is an undervalued and compelling opportunity making buying it a no-brainer. Along with RLB, BANANA has emerged as one of the projects in which analysts are most confident.

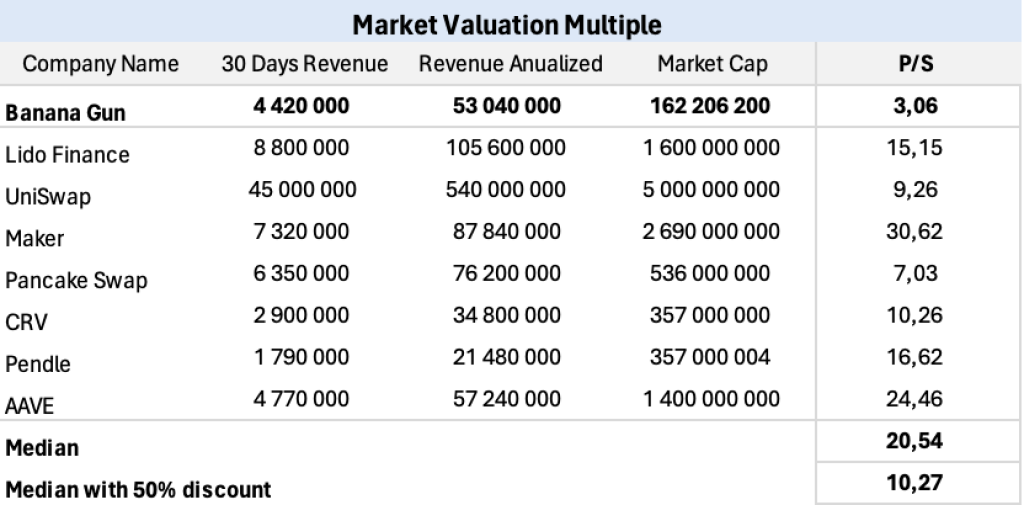

The analyst stated that a more comprehensive analysis of BANANA would be done, but the recent post only addressed the revenue aspect, which sets BANANA apart from other projects. The direct materialization of their value proposition into revenue is ultimately the most crucial metric for measuring a project’s attractiveness.

BANANA’s ability to generate substantial revenue indicates a direct demand for its offering. The project is pulling in an impressive $50M annualized, placing it directly in line with the top revenue-generating projects in the ecosystem.

Read Also: Bitcoin Price to Retest $60k Level Again – Will BTC Finally Break Out?

A closer examination of the price-to-sales (P/S) ratios reveals that BANANA is currently undervalued relative to the market median. While the median P/S ratio is around 20, BANANA’s stands at just 3.

GLC Capital has applied a 50% discount to this median to account for the future unlocks of BANANA (September 2025) and the competitive nature of its market.

Using the industry average as a benchmark, analysts arrive at a fair value price for BANANA of $160, suggesting an upside potential of over 230%. This valuation considers current market conditions and does not factor in the potential value BANANA could reach in the coming months or years.

What you'll learn 👉

BANANA Price Analysis

BANANA price action shows the lower zone (~$45) acted as a support zone where the price found a bottom after a significant downtrend. The upper zone (~$58) is a resistance zone where the price is currently struggling.

The chart displays a strong bullish reversal from the support zone ($45), pushing the price upward toward the resistance zone ($58).

Read Also: PEPE Meme Coin Risks Major Decline if Price Closes Below Key Support This Week: Here’s the Outlook

There has been a significant bullish candle breaking through previous resistance levels, indicating strong buying momentum. The price is approaching or testing the resistance zone (~$58), which might lead to a consolidation or a pullback if the zone holds.

Relative Strength Index (RSI) Divergence

The RSI is currently around 61, which suggests bullish momentum but not yet overbought.

There is a divergence visible, as indicated by the yellow line, where RSI made a higher low while the price was making lower lows. This divergence often signals a potential bullish reversal, which seems to be occurring.

Possible Scenarios for Next Price Direction

- Bullish Continuation:

If the price breaks above the $58 resistance level with strong volume, it could trigger further upside momentum. The next target might be around $64-$66, considering the prior price levels.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +- Pullback/Consolidation:

If the resistance zone holds, the price could face a pullback towards the $52-$54 area before attempting another move upward. This consolidation would help reset indicators like the RSI and gather more buying power.

- Rejection:

If there’s a strong rejection from the resistance zone, the price might revisit the lower support zone near $45. However, given the recent bullish strength, a deep retracement is less likely unless broader market conditions turn bearish.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.