This week, the crypto market encountered selling pressure, leading to a notable decline in Bitcoin’s price. Bitcoin dropped below $59k, marking a loss of 10%.

This dip has reflected broader market trends affecting various cryptos, including Avalanche (AVAX). Besides, HashKey Exchange, situated in Hong Kong, has been given permission to list AVAX and LINK for retail investors.

Only Bitcoin and Ethereum could be traded on the exchange in the past. With AVAX and LINK now part of the Web3, Hong Kong’s Web3 scene is growing, which could lead to further retail investment in these assets.

However, the listing of AVAX and LINK comes at a time when the crypto market is witnessing shifts, yet it highlights the growing interest in diversifying trading options. This move could pave the way for increased adoption and visibility of AVAX and LINK among retail investors in the region.

What you'll learn 👉

AVAX Sees Price Decline Despite Positive Market Signals

At publicates, AVAX trades at $23.80, down 7.19% from the last day’s close. AVAX has demonstrated resilience in spite of this decline, rising in price by 1.73% in the week. $436,755,190 is the daily trading volume, indicating that AVAX is still being sought for despite recent market difficulties.

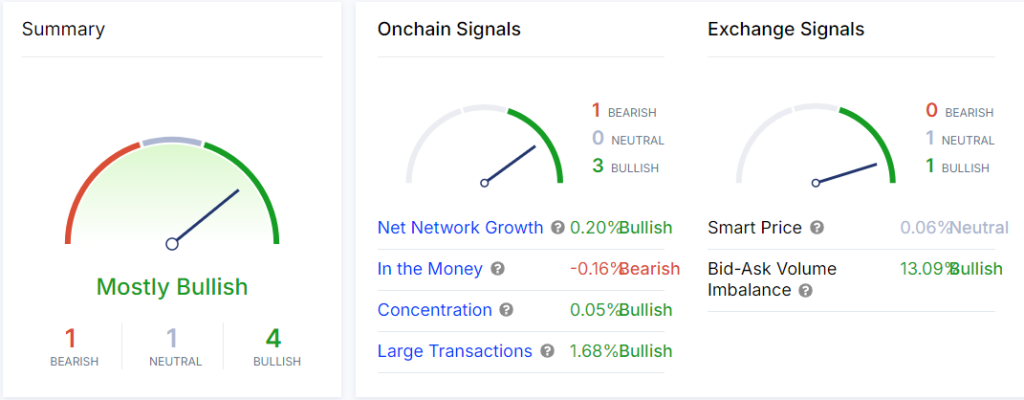

AVAX has a 400 million token supply in circulation and a $9.62 billion market capitalisation. According to IntoTheBlock statistics, the general market signals for AVAX remain mostly optimistic, despite the possible cause for concern given the recent price decrease.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Technical Indicators Show Mixed Signals for AVAX

The AVAX/USDT chart indicates a slight upward movement, with the price testing the middle Bollinger Band. The bands are tightening, which could signal reduced volatility in the near term. The MACD line, slightly above the signal line, suggests a potential bullish crossover, although further confirmation is needed.

At press time, the RSI was currently at 57.86, indicating moderate buying pressure. This level suggests that AVAX is not yet overbought, providing room for potential upward movement.

However, the relatively low trading volume following an earlier spike may indicate a lack of strong support for the recent price increase.

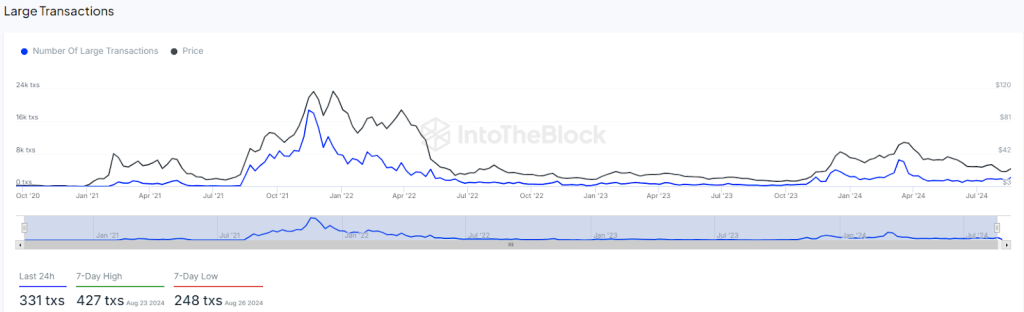

Whale Activity in AVAX Shows Decline from Previous Highs

Large AVAX transactions have declined from their peak in 2021 and the first part of 2022. The number of large transactions in the last day was 331; this is a decrease from the weekly high of 427 transactions that was registered on August 23, 2024.

Although whale activity has diminished, the current level of large transactions remains closer to the 7-day low of 248, indicating that while participation from large holders is subdued, it is still present. This trend may influence AVAX’s price movement as market conditions evolve.

Read also: Trader Warns of Over 65% XRP Price Crash – Here’s Why

Captain just hit his first 100x among a lot 2-5xs. Want to be a part of a profitable community?

Get all our future calls by joining our FREE Telegram group.

DISCLAIMER: CAPTAINALTCOIN DOES NOT ENDORSE INVESTING IN ANY PROJECT MENTIONED IN SPONSORED ARTICLES. EXERCISE CAUTION AND DO THOROUGH RESEARCH BEFORE INVESTING YOUR MONEY. CaptainAltcoin takes no responsibility for its accuracy or quality. This content was not written by CaptainAltcoin’s team. We strongly advise readers to do their own thorough research before interacting with any featured companies. The information provided is not financial or legal advice. Neither CaptainAltcoin nor any third party recommends buying or selling any financial products. Investing in crypto assets is high-risk; consider the potential for loss. Any investment decisions made based on this content are at the sole risk of the readCaptainAltcoin is not liable for any damages or losses from using or relying on this content.