Avalanche price is trading near $25.54, showing only a small move today, but the charts hint that the token could be gearing up for a much larger shift.

Both the daily and 4-hour setups show that AVAX has been consolidating against a key resistance area, with momentum slowly building in the background.

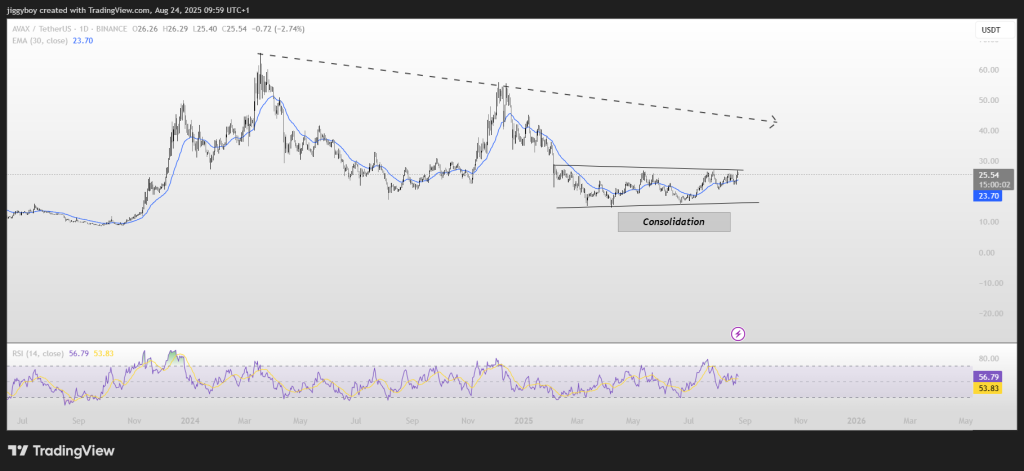

On the daily chart, AVAX price has been stuck inside a wide consolidation zone for months. Price has been capped by a descending trendline from the $60 highs, while support has been forming around $20.

Lately, , the coin has been pressing into the $26–$27 region, which has acted as a stubborn ceiling.

The 30-day EMA at $23.70 remains a support, and the medium-term outlook remains fairly constructive. In the meantime, the RSI is resting just below 57, which is neutral but slightly bullish sloping.

That leaves some leeway for the price to push above without getting overbought. If bulls manage to flip the $26–$27 zone, the next real test would likely be the descending trendline closer to $35–$40. But if support at $23.70 gives way, AVAX price could easily slip back toward $22 or even $20.

Avalanche Price Chart: Break of Structure Signals Momentum

The 4H chart tells a similar story but with more detail on shorter-term momentum. Over the past couple of months, AVAX price has been flashing multiple Break of Structure (BOS) signals, showing that buyers are slowly gaining ground.

Even after the correction that dragged price toward $22, the market bounced back, creating higher lows and pushing once again toward the $25–$26 zone.

Read Also: Kaspa (KAS) Price Prediction for Today, August 24

Momentum looks healthier here, too. The MACD recently flipped bullish, with the signal lines curling upward and the histogram moving green. This matches the idea that AVAX is slowly grinding higher while coiling beneath resistance.

AVAX Price Outlook

Right now, Avalanche is at a crossroads. On one side, bulls are pressing hard against the $26–$27 zone, and a clean breakout could finally clear the way toward $35–$40, which lines up with the longer-term trendline.

On the other side, if momentum fades and price loses its foothold above $23, the structure would quickly tilt bearish again, putting the $20 region back in play.

For now, the charts show a market that’s building pressure. AVAX price has been consolidating for weeks, and the next decisive move looks close. The only real question is whether bulls will finally force a breakout, or if this resistance wall will reject price one more time.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.