Both Avalanche (AVAX) and Polkadot (DOT) tokens have rebounded strongly after retesting previous resistance levels as new support. According to analyst Rekt Capital, these key tests pave the way for new bullish momentum.

What you'll learn 👉

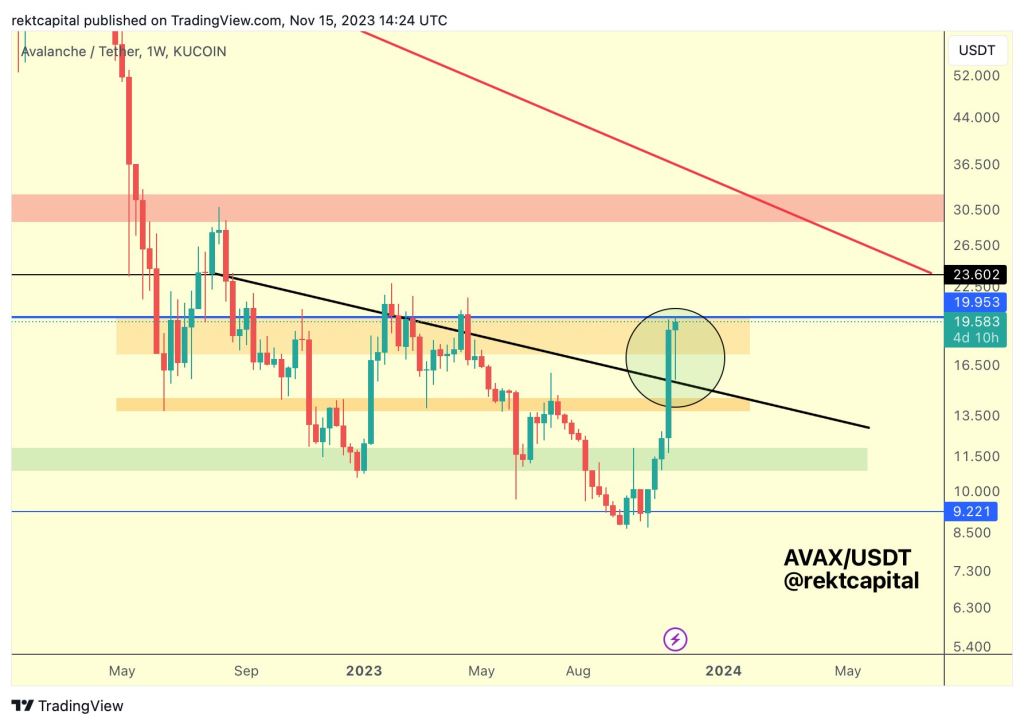

Avalanche Breaks Downtrend

Avalanche broke out above its descending trendline resistance last week. After some consolidation, it retested the former downtrend as support around $15 and bounced higher.

With a successful retest of this critical level, Avalanche appears poised for more upside. The first target is the minor resistance around $19. Breaking above that would turn the focus toward $23, a major hurdle for AVAX. Beyond that, the next key resistance level sits around $30.

Polkadot Holds Support

Similarly, Polkadot recently broke its downtrend before retesting around $5. This area also held as support, confirming the trend change.

Now, Polkadot is aiming for overhead resistance in the $6.50 to $7 zone. Pushing above that would be very bullish and likely lead to a test of the key $10 level further up.

Bulls Take Control

Rekt Capital points out that both Avalanche and Polkadot holding their previous descending resistance trends as new support is a very constructive price development. It signals that buyers have wrested back control and that uptrends are likely getting underway.

With their downtrend retests passed, AVAX and DOT appear poised to climb higher. Their chart patterns point toward further upside that could see them recapture key resistance levels and ignite renewed bull runs if those are broken. The successful support tests have given their bull cases a boost over the short to medium term.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.